In a significant move capturing investor attention, Sindoh (029530) has announced a substantial KRW 10 billion Sindoh share buyback program. This decision comes at a pivotal moment, as the company navigates a period of financial underperformance against a backdrop of global economic uncertainty. For investors, the key question is clear: Is this stock repurchase a strategic masterstroke to unlock shareholder value and signal a confident future, or is it a short-term measure to placate the market? This comprehensive investment analysis will dissect the buyback’s context, potential impacts, and crucial considerations for anyone monitoring Sindoh 029530.

The Announcement: A KRW 10 Billion Commitment to Shareholders

On September 30, 2025, Sindoh, a stalwart in the office equipment sector, formally disclosed its plan to acquire its own shares through a trust agreement. The company has allocated KRW 10 billion for this purpose, contracting with Samsung Securities to execute the buyback. The program is set to run for six months, from September 30, 2025, to March 31, 2026. This move is explicitly aimed at enhancing shareholder value and stabilizing the stock price. You can view the complete filing in the Official Disclosure (DART).

Analyzing the ‘Why’: Strategy Amidst a Downturn

Confronting Recent Financial Headwinds

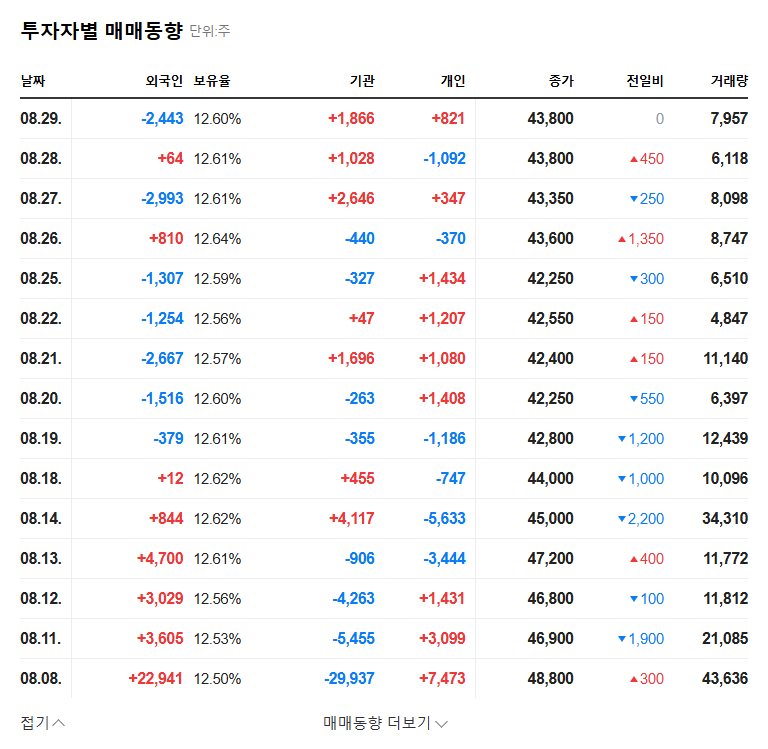

The timing of the Sindoh share buyback is critical. The company’s H1 2025 report revealed challenging results: sales fell 16.13% year-on-year to KRW 150.28 billion, and operating profit saw a steep 91.88% decline to just KRW 1.63 billion. A significant 27.27% drop in exports highlighted the impact of a global slowdown, ultimately pushing the company to a net loss of KRW 1.51 billion. These figures paint a picture of a company facing intense competition and volatile raw material prices, making the commitment of KRW 10 billion to a buyback a bold statement of confidence.

A Fortress Balance Sheet and Tech Foundation

Despite the operational struggles, Sindoh’s financial foundation is exceptionally strong. A staggering current ratio of 1,752.43% and a minuscule debt-to-equity ratio of 7.90% indicate immense liquidity and low financial risk. This robust balance sheet is precisely what enables the company to fund a significant stock repurchase without jeopardizing its operational stability. Furthermore, consistent R&D investment and a portfolio of 673 industrial property rights underscore a commitment to long-term technological competitiveness, a crucial asset in the rapidly evolving office equipment industry. For more information on what these metrics mean, you can read this guide on Understanding Financial Ratios for Tech Companies.

The core of this decision lies in the tension between recent poor performance and an incredibly strong financial structure. Management is signaling that they believe the company’s intrinsic value is far greater than its current market price reflects.

Potential Impacts of the Sindoh Share Buyback

A share buyback, also known as a stock repurchase, can have several positive effects. By reducing the number of shares outstanding, it mechanically increases key per-share metrics. A detailed explanation of this mechanism can be found on high-authority sites like Investopedia.

The Bull Case: Enhanced Value and Confidence

- •Increased EPS and ROE: With fewer shares in circulation, Earnings Per Share (EPS) and Return on Equity (ROE) are likely to increase, assuming profits stabilize or grow. This makes the stock appear more attractive on a fundamental basis.

- •Stock Price Support: The buyback creates a consistent source of demand for the stock, which can act as a floor, preventing sharp price declines and contributing to overall stability during volatile periods.

- •Positive Management Signal: A buyback is often interpreted as a sign that the company’s management believes its stock is undervalued. This can significantly boost investor confidence and sentiment.

The Bear Case: A Band-Aid on a Deeper Wound

- •Dependency on Performance: The positive effects of the buyback will be short-lived if not supported by a genuine turnaround in operational performance. A stock repurchase cannot indefinitely prop up a stock price if revenues and profits continue to decline.

- •Opportunity Cost: The KRW 10 billion could have been used for other strategic initiatives, such as acquisitions, aggressive R&D into new technologies, or marketing pushes to reclaim market share.

- •Market Headwinds: Broader macroeconomic factors, such as rising interest rates, currency fluctuations, and a sustained global slowdown, could overwhelm the positive impact of the buyback.

Investor Action Plan & Final Verdict

Our overall investment opinion for Sindoh 029530 remains Neutral. The Sindoh share buyback is an undeniably positive signal of commitment to shareholder value, made possible by an exemplary balance sheet. It provides a strong reason for existing shareholders to hold and a point of interest for potential investors.

However, this action must be viewed as a single piece of a larger puzzle. A sustainable rally in the stock price will depend entirely on the company’s ability to navigate the tough market, innovate, and restore its profitability. Investors should not rely on the buyback alone but should instead monitor the following key points closely.

Key Monitoring Points for Investors:

- •Buyback Execution: Track the progress and pace of the share repurchase over the next six months.

- •Quarterly Earnings Reports: Scrutinize the upcoming financial reports for any signs of a turnaround in sales and operating profit.

- •Strategic Initiatives: Look for announcements regarding new products, market expansion, or efficiency improvements that address the core performance issues.

- •Macroeconomic Indicators: Keep an eye on global trade data, currency exchange rates (especially USD/KRW), and raw material costs.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. All investment decisions should be made based on your own research and risk tolerance.