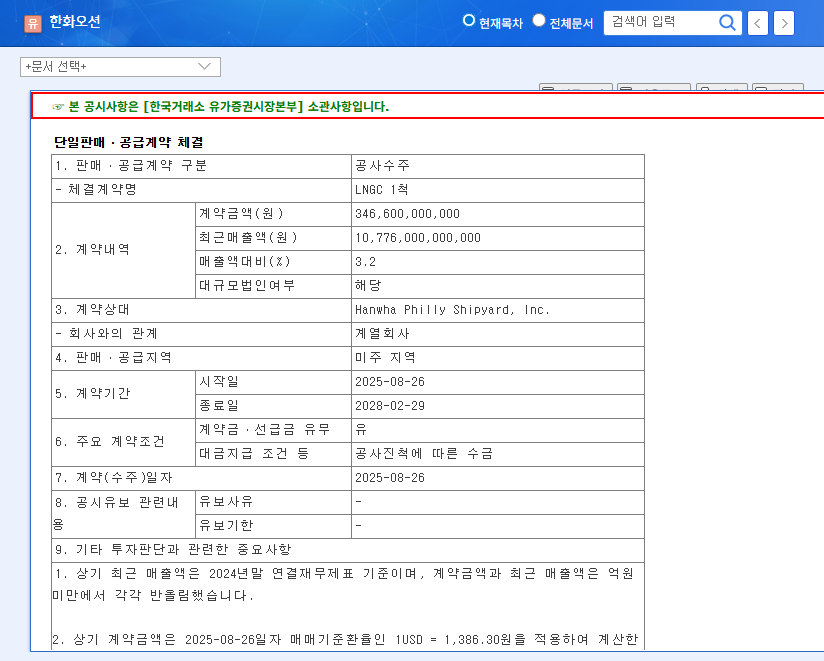

What’s Happening? The HHI and Hyundai Mipo Merger

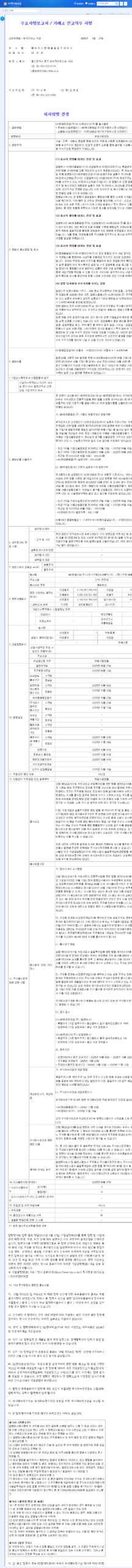

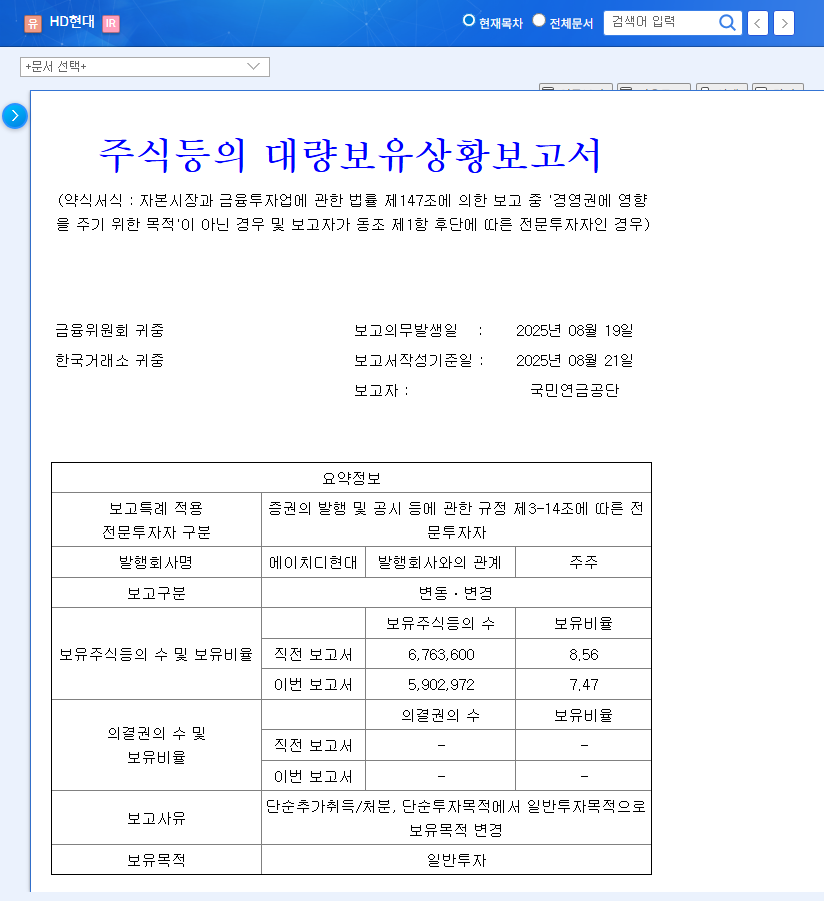

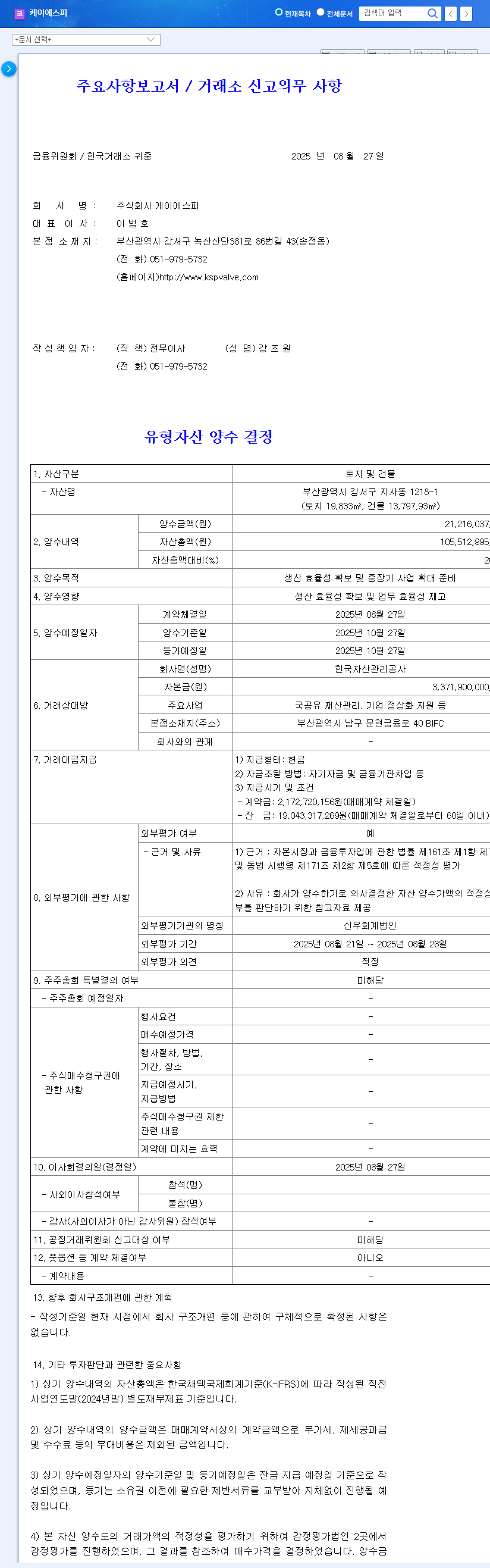

HHI is merging with Hyundai Mipo Dockyard, with HHI as the surviving entity and Hyundai Mipo being dissolved.

Why the Merger? Background and Objectives

The merger aims to integrate technology, workforce, and resources to effectively respond to future changes in the shipbuilding industry, strengthening core competencies and securing a competitive edge in the global market. HHI anticipates enhanced competitiveness in eco-friendly and high-value-added vessels, diversification of its business portfolio, and improved financial structure and management efficiency.

The Merger’s Impact: Expected Synergies and Risks

Expected Synergies

- Synergy Creation: Combining the strengths of both companies to enhance order competitiveness and improve profitability.

- Increased Management Efficiency: Organizational integration and operational streamlining to reduce costs and increase productivity.

- Strengthened Market Position: Enhanced dominance in the domestic shipbuilding industry and increased global market competitiveness.

Risks

- Merger Uncertainty: Potential stock price volatility due to merger ratios and new share issuance.

- Cultural and Organizational Integration Challenges: Potential friction during the integration of organizational cultures and systems.

- Regulatory Risks: Necessity of merger approval from regulatory bodies such as the Fair Trade Commission.

What Should Investors Do? Investment Strategies

Long-term Perspective: Closely monitor the realization of merger synergies and earnings trends, adopting a long-term approach.

Short-term Perspective: Consider merger schedules, stock appraisal rights exercise results, and market reactions to prepare for volatility.

Key Points to Watch

- Merger ratio and results of stock appraisal rights exercise.

- Improvements in management efficiency and synergy creation performance after the merger.

- Changes in the global shipbuilding market and major macroeconomic indicators.

FAQ

When will the HHI and Hyundai Mipo merger be completed?

The merger completion date is yet to be determined and is subject to change depending on the progress of related procedures.

How will the merger affect shareholders?

Shareholders’ stake may change depending on the merger ratio and new share issuance. The exercise of stock appraisal rights should also be considered.

What is the outlook for HHI’s stock price after the merger?

Stock prices can be affected by various factors such as merger synergy effects, market conditions, and macroeconomic environment, requiring careful investment decisions.