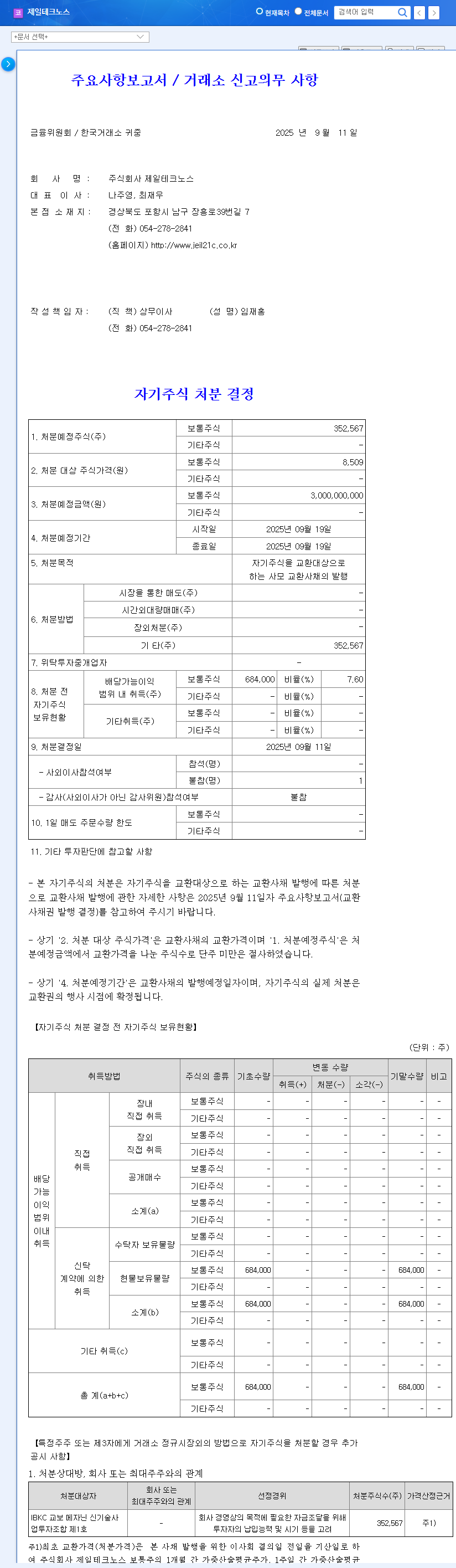

1. Jeil Technos Announces ₩3 Billion Convertible Bond Issuance

On September 11, 2025, Jeil Technos announced the issuance of ₩3 billion in convertible bonds to IBKC Kyobo Mezzanine New Technology Business Investment Association No. 1. The conversion price is set at ₩8,509 (current price ₩7,640), and the conversion period is from September 26, 2025, to August 19, 2030.

2. Why Issue Convertible Bonds? The Purpose

The purpose of this convertible bond issuance is presumed to be securing operating funds and investing in new businesses, specifically graphene. Considering the 0% maturity interest rate, investors likely anticipate profit realization through conversion based on stock price appreciation.

3. Impact on Investors: Short-Term vs. Long-Term

- Short-Term Impact: As the conversion price is higher than the current stock price, there are concerns about potential stock dilution. This could negatively impact investor sentiment.

- Long-Term Impact: If the procured funds are invested in future growth engines like the graphene business and yield successful results, long-term corporate value growth can be expected. The booming shipbuilding industry is also a positive factor.

4. Investment Action Plan

Short-term investors should approach cautiously, considering the possibility of stock dilution. Long-term investors should closely monitor the shipbuilding market conditions, the progress of the graphene business, fund management plans, and develop investment strategies accordingly. Pay close attention to the company’s specific announcements regarding the use of funds.

FAQ

What are convertible bonds?

Convertible bonds are bonds that give the holder the right to convert them into shares of the issuing company’s stock. Investors can receive bond interest until maturity or convert them into stocks within a specified period to aim for capital gains.

Will this convertible bond issuance negatively affect the stock price?

Since the conversion price is higher than the current stock price, there is a possibility of stock dilution due to an increase in the number of shares upon conversion. This could put downward pressure on the stock price in the short term.

What are the key investment points for Jeil Technos?

Benefits from the booming shipbuilding industry and the growth potential of the graphene business are considered key investment points. However, the sluggish construction sector and declining profitability are risk factors.

What precautions should investors take?

Investors should closely monitor the use of the funds raised through the convertible bond issuance, shipbuilding market conditions, and the progress of the graphene business. It’s also important to be mindful of the earnings volatility due to the construction industry slowdown.