1. What is KPF’s Shareholder Return Plan?

- Dividend in kind: TMC shares (1 TMC share per 31 common shares)

- Tax benefits on dividends through capital reduction

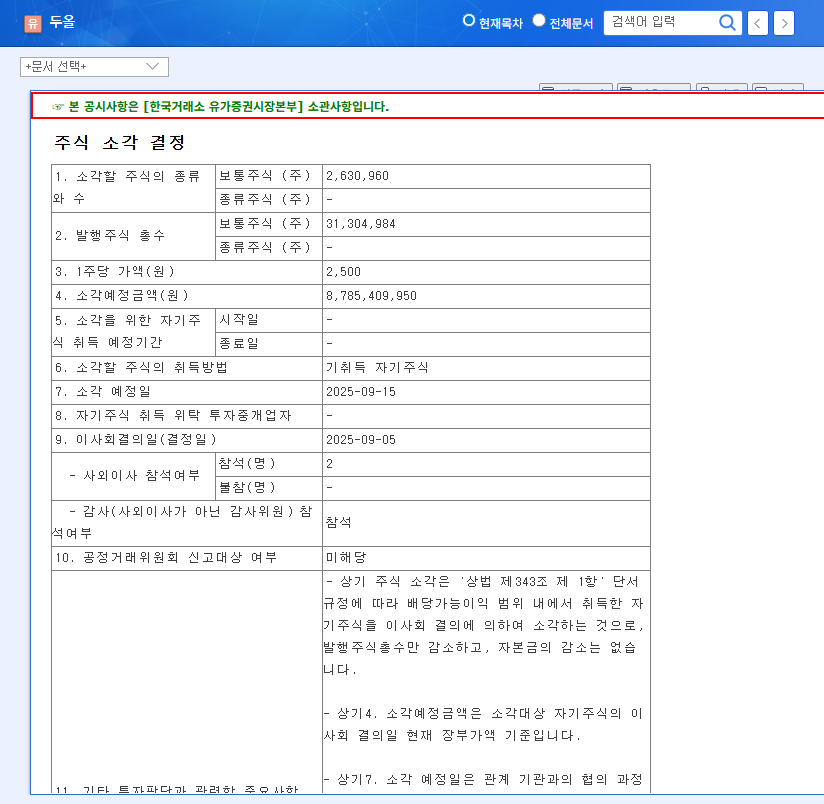

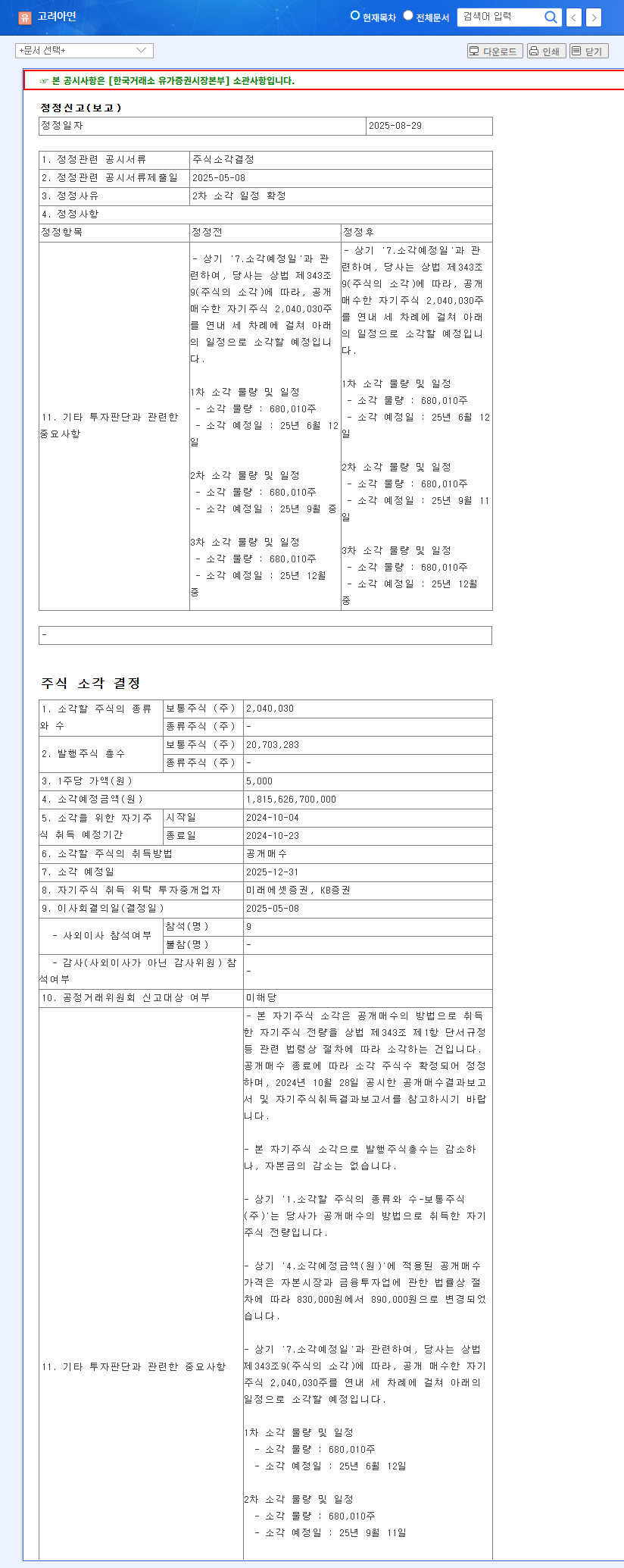

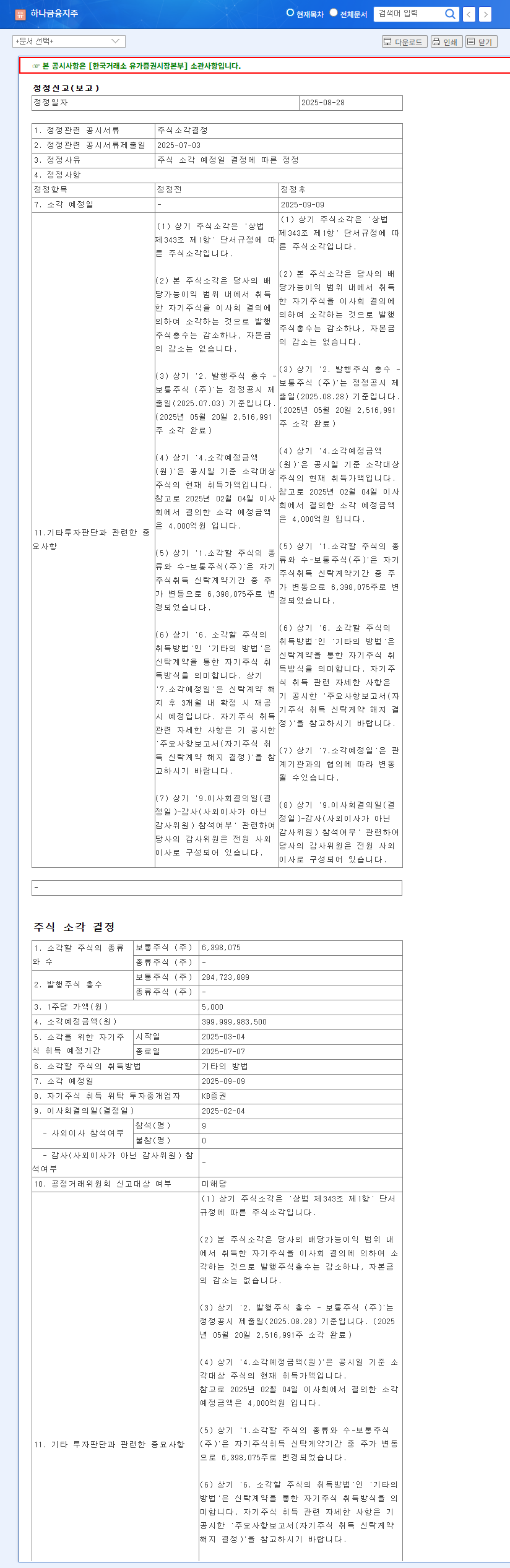

- Treasury stock cancellation worth KRW 4.5 billion (approx. 1.09 million shares)

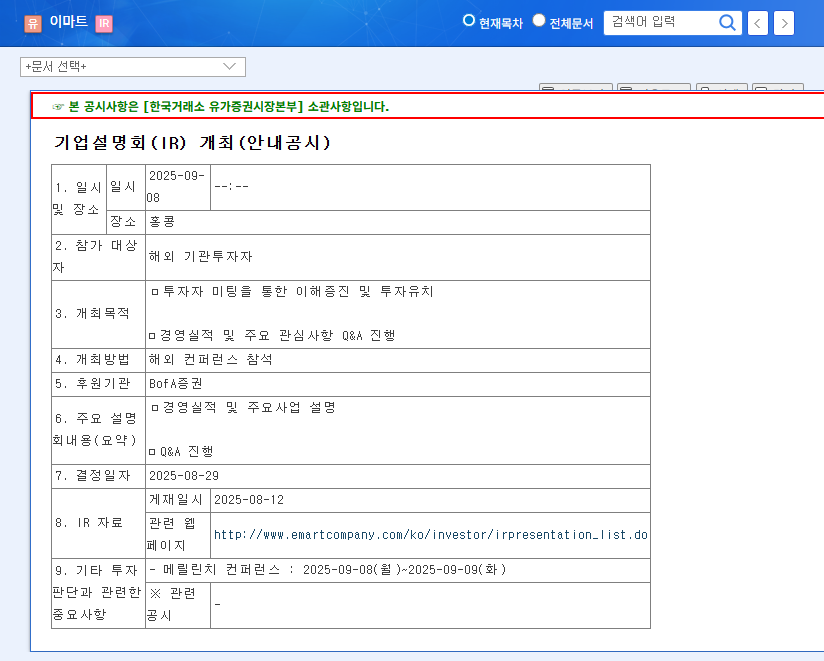

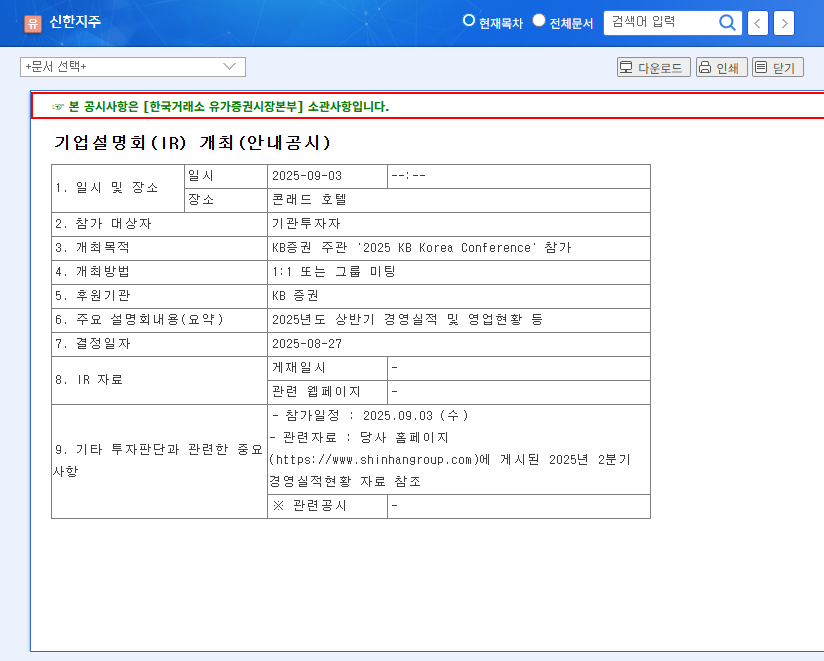

- Enhanced IR activities and increased public disclosures to boost stock price

2. Why Announce This Plan Now?

KPF has recently experienced declining performance due to the global economic slowdown and sluggishness in related industries. Both sales and operating profit decreased in the first half of 2025 compared to the same period last year, and profitability remains low. The shareholder return policy is interpreted as a strategy to alleviate shareholder concerns and improve investment sentiment.

3. Investment Implications of the Shareholder Return Plan

Positive aspects: Dividends in kind and treasury stock cancellation can contribute to enhancing shareholder value. If TMC’s listing is successful, shareholders can gain additional profits through the dividends.

Negative aspects: Given the continued sluggish performance, the shareholder return policy alone may not be enough to drive stock price growth. The possibility of delays in TMC’s listing and macroeconomic uncertainties also pose investment risks.

4. Action Plan for Investors

Before making investment decisions, investors should closely monitor KPF’s performance trends, news related to TMC’s listing, and macroeconomic variables. It is crucial to focus on long-term improvements in corporate fundamentals rather than being swayed by short-term stock price fluctuations. The success of TMC’s listing will be a critical factor in KPF’s investment outlook.

Frequently Asked Questions (FAQ)

What is KPF’s main business?

KPF manufactures fasteners, automotive parts, and marine cables.

What is TMC?

TMC is a subsidiary of KPF that manufactures cables, targeting the North American market.

When will the dividends be paid?

The dividends are expected to be paid as part of the 62nd fiscal year-end dividend after the completion of TMC’s listing. However, the listing schedule has not yet been finalized.

What are the key points to consider when investing in KPF?

Investors should consider the recent decline in performance, uncertainties surrounding TMC’s listing, and macroeconomic variables.