What Happened?

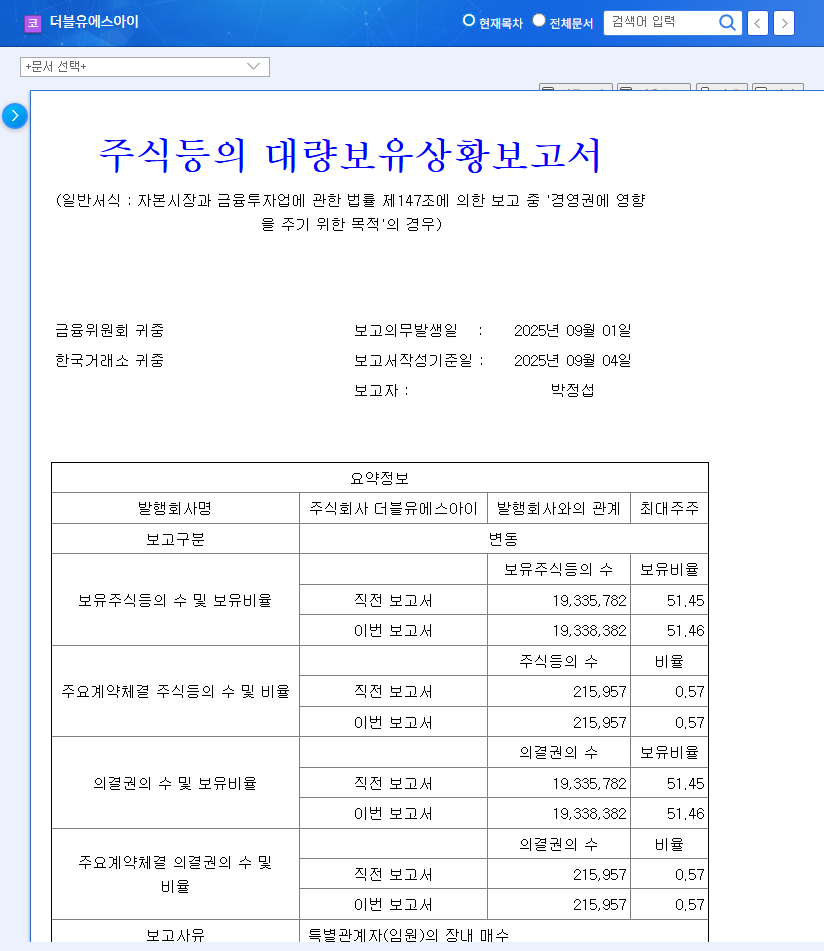

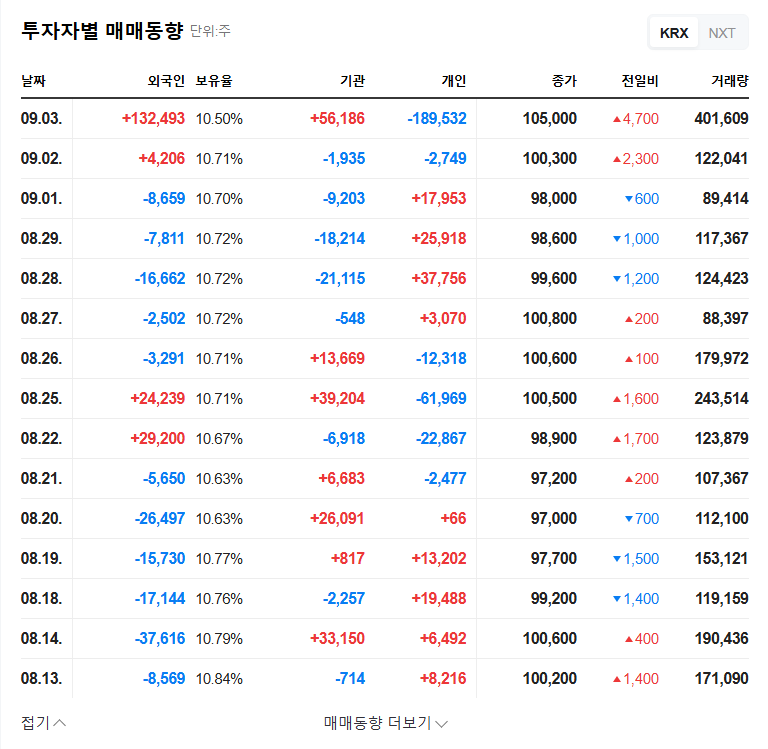

A special relation shareholder of WSI, Mr. Jin-soo Ahn, purchased 2,600 common shares on the open market on September 1, 2025. This resulted in a slight increase in the stake held by CEO Jeong-seop Park and related parties, from 51.45% to 51.46%.

Why is this Stake Change Important?

This change is noteworthy because it involves the representative reporter, who has the objective of influencing management rights. The purchase of shares by a related party can be interpreted as a positive signal, demonstrating management’s commitment to responsible management.

So What Should I Do? Investment Impact Analysis

Short-Term Impact

- Positive: Demonstration of responsible management commitment, potential improvement in investment sentiment.

- Neutral: Minimal stake change limits direct impact on short-term stock price.

Mid-to-Long-Term Impact

- Positive: Management stabilization, momentum for business diversification and new business initiatives.

- Caution: Requires improvement in financial structure and profitability; otherwise, positive impact on stock price is limited.

Macroeconomic Impact

- Macroeconomic uncertainties, such as interest rate hikes and exchange rate fluctuations, could increase WSI’s financial burden.

Investor Action Plan

Investors should closely monitor the following:

- Future earnings improvement trend.

- Debt management and efforts to improve financial structure.

- Response to interest rate and exchange rate fluctuations.

Investment decisions should be based on a thorough analysis of the company’s fundamental financial improvements and business performance, rather than short-term stake changes.

Frequently Asked Questions (FAQ)

What are WSI’s main businesses?

WSI’s main business is pharmaceutical distribution. Recently, through the acquisition of IntroBio Pharma, it expanded into pharmaceutical manufacturing and R&D. WSI is also engaged in medical robot and cardiovascular intervention device businesses.

Will this stake change have a positive impact on the stock price?

In the short term, it may positively influence investor sentiment, but it is unlikely that a minimal stake change alone will significantly reverse the stock price. The company’s financial improvement will likely have a greater impact on the stock price.

What is the most important thing to watch out for when investing?

WSI is currently facing financial difficulties, including a large deficit and high debt ratio. Therefore, when investing, it is essential to closely monitor efforts to improve the financial structure and the trend of earnings improvement.