The recent announcement of the MIWON COMMERCIAL CO.,LTD share repurchase has captured significant market attention, and for good reason. On October 15, 2025, the company unveiled a strategic plan to buy back KRW 4.5 billion of its own stock. This isn’t just a financial transaction; it’s a powerful signal to investors about the company’s confidence in its future and its commitment to delivering shareholder value. But what does this corporate action truly mean for the stock’s trajectory and your portfolio? This in-depth analysis will dissect the decision, explore its potential impacts, and provide a clear roadmap for investors navigating this development.

The Details: A KRW 4.5 Billion Commitment

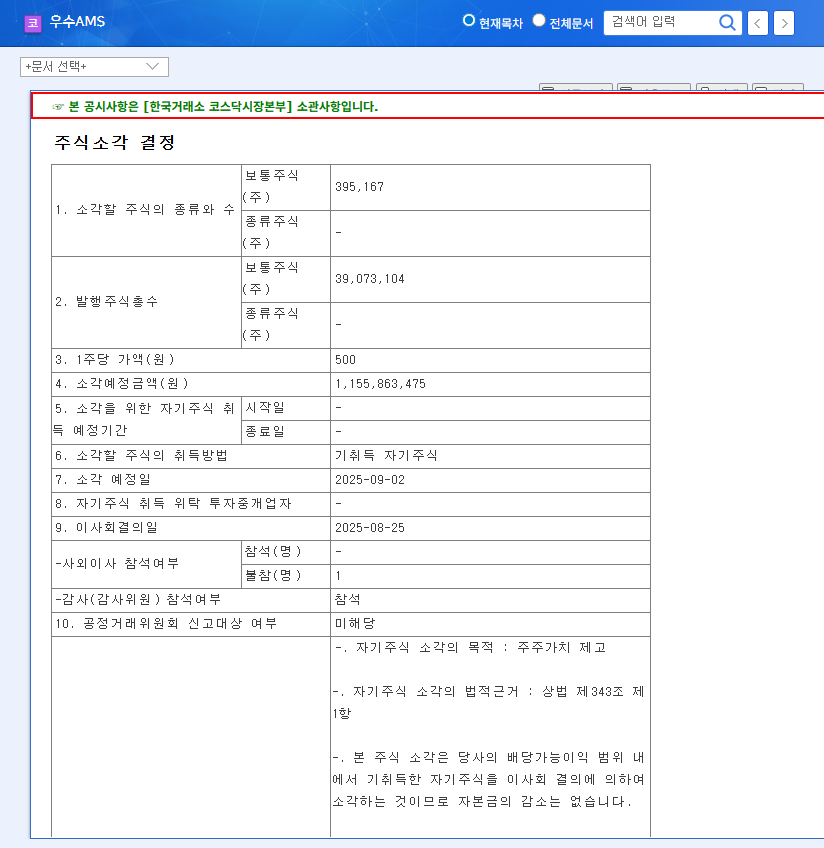

According to the official public filing, MIWON COMMERCIAL CO.,LTD has authorized the repurchase of 29,566 of its common shares. This transaction, valued at KRW 4.5 billion, represents approximately 0.62% of the company’s current market capitalization of KRW 741 billion. The repurchase will be executed via on-market purchases through the Korea Exchange, with NH Investment & Securities serving as the designated broker. For full transparency, investors can review the Official Disclosure (DART report) directly.

The ‘Why’: Unpacking the Strategy Behind the Buyback

Companies don’t spend billions without a clear purpose. The primary stated goals for the MIWON COMMERCIAL CO.,LTD share repurchase are to stabilize the stock price and enhance shareholder value. Let’s break down what these objectives mean in practice.

A share repurchase is often one of the clearest signals management can send that they believe their company’s stock is undervalued in the current market. It’s an investment in themselves.

By buying its own shares, the company effectively reduces the number of shares available on the open market. This can increase key financial metrics like Earnings Per Share (EPS), making the stock appear more attractive to investors. Furthermore, it demonstrates that the leadership team believes the company’s cash is best used to invest in its own equity, signaling strong confidence in its long-term financial health and growth prospects.

Analyzing the Potential Stock Price Impact

The impact of a share buyback can be multifaceted, affecting the stock differently in the short and long term. A thorough stock buyback analysis requires looking at both immediate market reactions and fundamental changes.

Short-Term Positive Catalysts

- •Increased Demand: The act of buying shares on the open market creates a new source of demand, which can directly push the price upwards, especially if trading volume is typically low.

- •Improved Investor Sentiment: The announcement itself often serves as a bullish signal. It boosts confidence among existing shareholders and can attract new investors looking for companies committed to shareholder returns.

- •Supply Reduction: As shares are repurchased, the available float shrinks. This reduction in supply, coupled with steady or rising demand, is a classic recipe for price appreciation.

Mid- to Long-Term Considerations and Risks

While the immediate reaction is often positive, the long-term success of a share repurchase depends on several factors.

- •Fundamental Performance is Key: A buyback cannot fix underlying business problems. If the company’s revenue or earnings falter, the stock price will likely decline regardless of the repurchase program.

- •Scale of Repurchase: At 0.62% of the market cap, the buyback is modest. It may not be large enough to counteract significant market headwinds or negative company-specific news.

- •Opportunity Cost: Could the KRW 4.5 billion have been better used for R&D, strategic acquisitions, or paying down debt? This is a critical question for long-term investors to consider. For more on this concept, you can read about capital allocation strategies.

An Actionable Plan for Investors

An event like the MIWON COMMERCIAL CO.,LTD share repurchase requires more than a passive observation. Here’s how to approach it:

- 1. Deepen Your Fundamental Analysis: Use this event as a trigger to re-evaluate the company’s core health. Go beyond the headlines and analyze their balance sheet, income statement, and cash flow. Our guide on How to Analyze a Company’s Financial Health can be a great starting point.

- 2. Monitor Execution: Keep an eye on subsequent disclosures. Confirm that the company is following through on the announced buyback. Also, watch for announcements on whether the repurchased shares will be retired (permanently cancelled) or held as treasury stock. Retirement is generally more bullish for long-term shareholder value.

- 3. Contextualize the Move: Compare this buyback to those of industry peers. Is it a standard practice in their sector, or is MIWON an outlier? Understanding the industry context provides a clearer picture of the move’s significance. For a broader view, authoritative sources like Bloomberg’s market analysis can be invaluable.

In conclusion, while the share repurchase is a clear positive signal, it should be viewed as one piece of a much larger puzzle. The long-term success for investors will ultimately depend on MIWON COMMERCIAL CO.,LTD’s ability to execute its core business strategy and continue growing its intrinsic value.