1. What is the iROBOTICS Case?

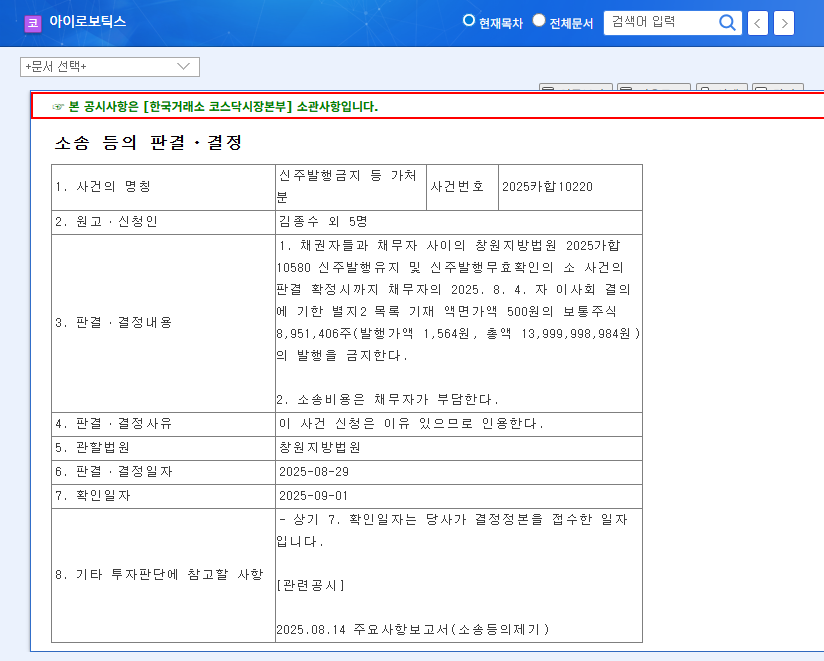

On September 1, 2025, the court issued an injunction prohibiting iROBOTICS from issuing new shares. This is an important precedent for protecting the rights of minority shareholders and has significant implications for YOUM.

2. What is the Impact on YOUM?

YOUM has a history of sanctions for false disclosures and accounting violations, and there has been recent shareholder activism. The iROBOTICS case could trigger similar activism among YOUM’s minority shareholders.

3. Key Investment Points

- Monitor Shareholder Activism: Pay close attention to the results of shareholder meetings, proposals from minority shareholders, and management’s responses.

- Check Financial Health: Considering the large net loss and high debt ratio in 2024, it’s crucial to monitor improvements in YOUM’s financial structure.

- Identify Links to iROBOTICS: Investigate any business or governance connections between the two companies.

4. Investment Strategy Recommendations

Investments in YOUM should be approached with caution. Focus on the long-term potential for improved corporate value rather than short-term market interest, and consider exchange rate and interest rate volatility.

Frequently Asked Questions

Will the iROBOTICS case directly impact YOUM’s stock price?

The direct impact is currently expected to be limited, but it could signal increased shareholder activism.

What should investors be most cautious about when investing in YOUM?

Investors should carefully consider YOUM’s history of sanctions, financial status, and the potential for shareholder activism.

What is the outlook for YOUM?

The company’s value could change significantly depending on shareholder demands, management responses, and improvements in financial structure. Continuous monitoring of relevant information is essential.