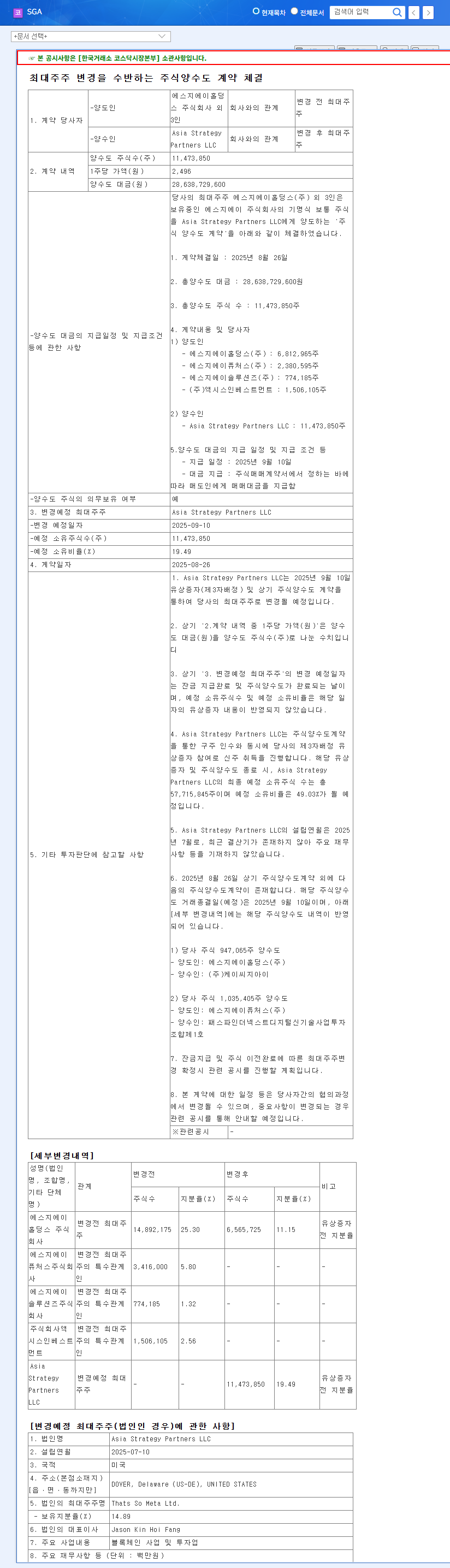

1. SGA’s Major Contract with Gyeonggi Provincial Office of Education: What’s New?

On July 16, 2025, SGA signed a KRW 7.5 billion contract to construct an AI-data-centric Gyeonggi Education Digital Platform with the Gyeonggi Provincial Office of Education. The contract duration is 11 months, representing a significant 20.81% of SGA’s 2024 revenue. This deal is expected to provide positive momentum for the growth of SGA’s Public ITS (Intelligent Transportation Systems) segment.

2. Mixed Q3 Performance: Assessing SGA’s Current Standing

SGA’s fundamentals currently present concerning indicators, marked by a decrease in revenue and continued net losses. The primary reasons behind this downturn are analyzed as follows:

- Slowing growth in the Education SI sector

- Intensified competition in the Public ITS sector

- High selling, general, and administrative (SG&A) expense ratios

- Reduced IT investment due to the global economic downturn

However, positive aspects are also evident. SGA has established a strong track record in the public sector and a significant presence in the Education SI market. Its ongoing facility investment plans also suggest long-term growth potential. Nevertheless, the discontinuation of research and development and the sale of certain assets raise questions about the maintenance of long-term competitiveness.

3. Impact of the KRW 7.5 Billion Contract on SGA’s Performance and Stock Price

The impact of the Gyeonggi Provincial Office of Education contract on SGA’s fundamentals and stock price can be analyzed as follows:

3.1. Short-Term Impact: A Quiet Start to Performance Improvement?

The KRW 7.5 billion contract is expected to have a positive impact on the Q4 2025 and Q1 2026 financial results. This could partially offset the underperformance reported in the recent Q3 earnings. However, its impact might be somewhat limited in fully reversing the declining revenue trend. The extent of net profit improvement will depend on the efficiency of SG&A expense management.

3.2. Long-Term Impact: Securing Future Growth Drivers and Enhancing Competitiveness

This contract will add a crucial reference in SGA’s Public ITS segment, potentially giving it an advantage in future bidding for similar large-scale projects. Furthermore, accumulating experience in building AI and data-centric platforms can significantly contribute to enhancing SGA’s technological competitiveness. Nevertheless, the increasing competition within the public sector remains a factor of uncertainty for long-term growth. The successful execution of the contract will be a decisive factor for future order wins.

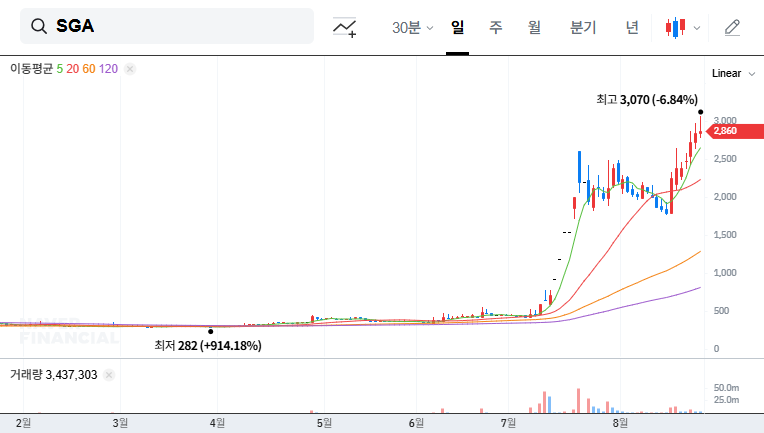

3.3. Stock Price Outlook: Between Expectation and Reality

In the short term, the positive news of the contract signing could attract investor attention and potentially trigger a stock price increase. However, it’s possible that the Q3 performance slump has already been priced into the stock, and the actual impact of the KRW 7.5 billion contract on corporate valuation might be less significant than market expectations. Therefore, rather than a sharp surge, a gradual recovery trend might be anticipated. The long-term stock performance will ultimately be heavily influenced by the company’s future performance improvement and the broader macroeconomic environment. For more accurate predictions, stock chart analysis and historical pattern analysis are essential.

4. Further Research: Key Considerations Before Investment Decisions

Before making an investment decision, the following additional research is crucial:

- Detailed Q3 Earnings Analysis: In-depth analysis of financial information, including revenue by business segment and detailed breakdown of SG&A expenses.

- Reasons for Decreased Order Backlog: Clear analysis of the factors contributing to the reduction in order backlog at the end of Q3 and an assessment of the effectiveness of new order strategies.

- Cost Efficiency Strategies: Examination of specific cost-saving measures to improve the high SG&A ratio and an analysis of their expected impact.

- Alignment with Long-Term Growth Strategy: Analysis of the connection between the decisions to halt R&D and divest assets, and the long-term growth strategy. Understanding the nature of divested assets and future investment plans is important.

- In-depth Competitive Landscape Analysis: A thorough analysis of the competitive environment in the Public ITS sector and SGA’s competitive advantages.

- Macroeconomic Variable Impact Assessment: Quantitative evaluation of the impact of macroeconomic variables such as exchange rates, oil prices, and interest rates on SGA’s performance and stock price.

5. Conclusion: A Prudent Approach Considering Both Opportunity and Risk

The large-scale contract with the Gyeonggi Provincial Office of Education is expected to positively influence SGA’s short-term financial performance. However, considering potential risk factors such as Q3 performance downturns and intensified competition, the impact on the stock price warrants a cautious approach. From a long-term perspective, the successful execution of the contract and the company’s efforts to improve its fundamentals will be crucial determinants of the stock’s performance.

Therefore, we recommend minimizing uncertainties through the additional research outlined in this report to make more accurate and informed investment decisions.