1. MK Electron Issues ₩10.7B Convertible Bonds: What’s Happening?

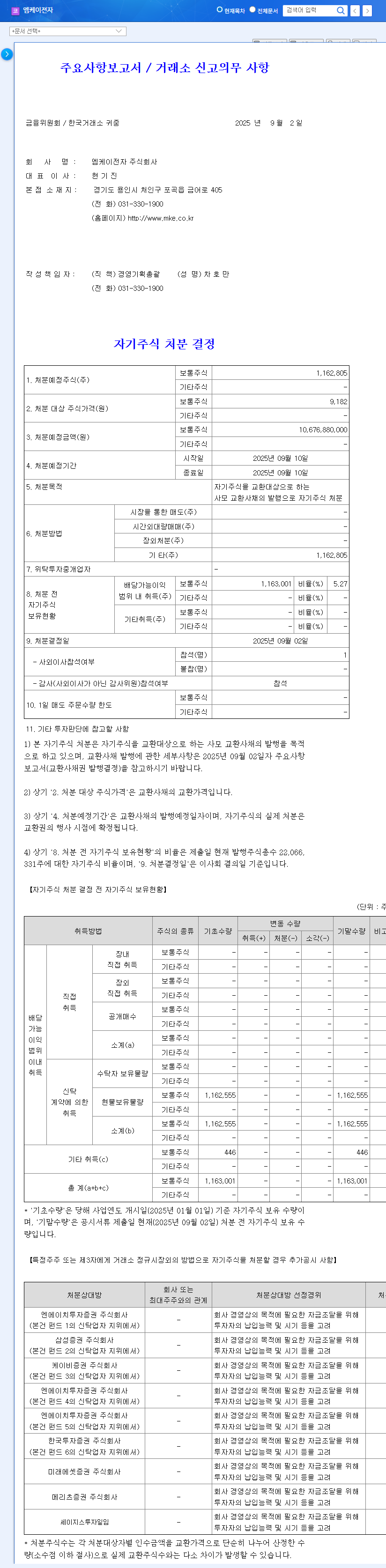

MK Electron announced on September 2, 2025, the issuance of ₩10.7 billion in convertible bonds. These bonds will be issued privately, with a conversion price of ₩9,182 and a maturity rate of 2.0%. Key investors include Paros Multi Private Equity Trust No. 3 and others.

2. Why the Convertible Bond Issuance?

This bond issuance serves two main purposes. First, it aims to improve MK Electron’s financial structure, given its high debt-to-equity ratio. Second, it seeks to secure funds for investments in new businesses, such as secondary battery materials.

3. What Does This Mean for Investors?

- Positive Aspects: Enhanced financial stability, potential for increased corporate value through securing new growth engines.

- Negative Aspects: Potential dilution of share value due to the conversion price being lower than the current stock price, potential increase in interest burden due to rising interest rates.

MK Electron is leveraging its strong position in the bonding wire market to expand into new businesses. However, the sluggish performance in the first half of 2025 is a point of caution for investors.

4. Investor Action Plan!

Investors should consider the following factors when making investment decisions:

- Recovery of the semiconductor industry

- Performance of new businesses

- Trends in financial structure improvement

- Stock price volatility

FAQ

What are MK Electron’s main businesses?

MK Electron specializes in semiconductor post-processing materials (bonding wires, solder balls). They are also venturing into new businesses like solder paste, test materials, and secondary battery materials (silicon anode materials).

What are convertible bonds?

Convertible bonds are bonds that can be converted into the issuing company’s stock after a certain period.

How will this convertible bond issuance affect the stock price?

In the short term, there are concerns about the dilution of share value. However, in the long term, improved financial structure and securing new growth engines can lead to stock price increases. However, stock price volatility may increase depending on various factors like the semiconductor industry and the performance of new businesses.