Investor sentiment surrounding DAE-IL Corporation stock (ticker: 092200) has turned cautious. The company finds itself at a challenging crossroads, grappling with a significant drop in profitability despite rising revenues in its Q3 2025 report. Compounding this concern, a major shareholder has reduced their stake, sending a potentially worrying signal to the market. This detailed DAE-IL Corporation analysis will dissect these events, examine the underlying fundamentals, and provide a clear investment strategy for current and potential investors.

The Catalyst: A Major Shareholder Stake Reduction

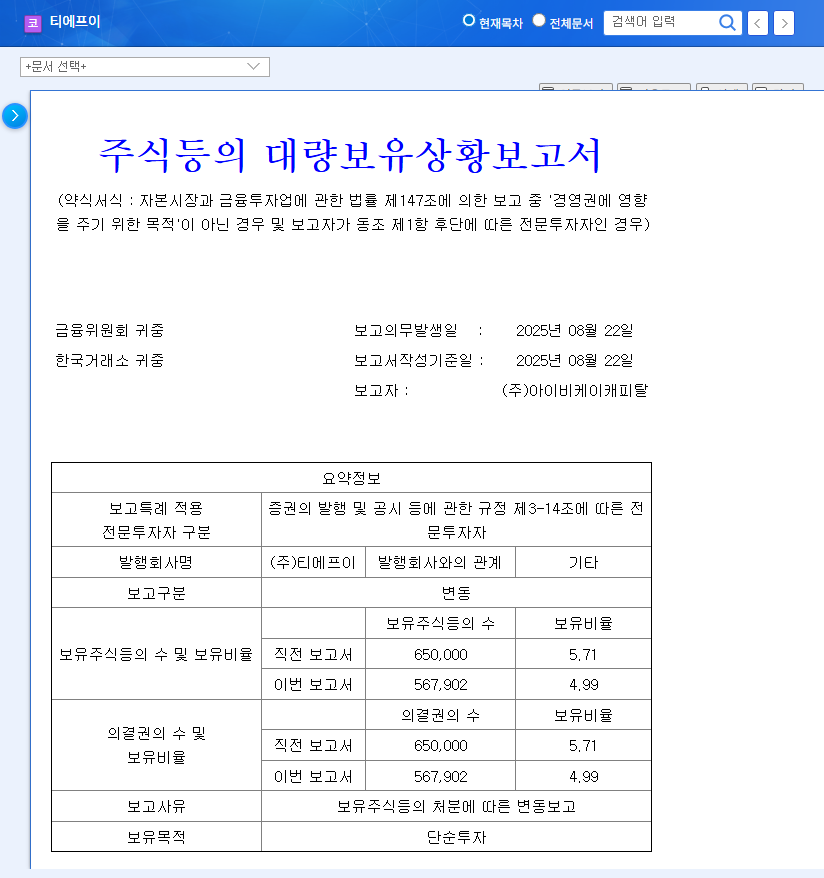

On November 12, 2025, a significant disclosure captured the market’s attention. According to the Official Disclosure filed with DART, major shareholder Kim Seong-moon’s ownership stake in DAE-IL Corporation decreased from 38.89% to 35.68%. While the stated purpose for holding the shares remains ‘management influence,’ the sale itself raises questions. A reduction in stake by a key insider, especially when timed with poor financial performance, is often interpreted by investors as a lack of confidence in the company’s near-term prospects. This major shareholder sale, involving related parties like DAE-IL Innovate Co., Ltd., has understandably created downward pressure on the stock.

Decoding the Q3 2025 Performance Slump

The shareholder sale appears to be directly linked to the company’s deteriorating fundamentals in the third quarter of 2025. While top-line growth seems healthy, the bottom line tells a different, more concerning story.

The Paradox: Revenue Growth vs. Profitability Collapse

DAE-IL Corporation reported a consolidated revenue of KRW 588.5 billion, a respectable 10.3% increase year-on-year, driven primarily by its automotive components sector. However, this growth was overshadowed by a severe decline in profitability.

Operating profit plummeted to KRW 21.3 billion, a staggering 36.1% decrease compared to the same period last year. This resulted in the operating profit margin shrinking to just 3.62%, a drop of 2.25 percentage points.

This profitability crisis is attributed to a combination of external and internal pressures, including rising raw material prices, unfavorable exchange rate fluctuations, and increased capital expenditures for new vehicle models and the crucial transition to eco-friendly vehicle components.

Key Financial Health Indicators

- •Assets & Liabilities: Both total assets (KRW 728.9 billion) and liabilities (KRW 551.8 billion) saw a slight increase, mainly due to a rise in inventory and borrowings, suggesting potential financial strain.

- •Cash Flow: Operating cash flow decreased to KRW 36.7 billion, with significant cash being used for investments in tangible assets, highlighting the heavy cost of future-proofing the business.

- •Risk Exposure: The company faces notable foreign exchange risk (USD, JPY, EUR) and interest rate risk from its variable-rate borrowings. You can learn more about managing such risks from authoritative sources like leading financial publications.

Future Outlook: The EV Promise vs. Market Headwinds

The long-term investment strategy for DAE-IL Corporation hinges on its ability to navigate the transition to electric vehicles (EVs) while surviving current macroeconomic pressures. The company is heavily investing in future growth drivers like reducers, Shift-by-Wire (SBW) systems, and e-Axles. This forward-looking approach is essential for long-term survival in the automotive industry. However, these investments are costly and are currently weighing down profitability.

The global trend toward eco-friendly vehicles is a massive tailwind, but it’s countered by the headwinds of a potential global economic slowdown, volatile raw material costs, and currency fluctuations. For investors, this creates a classic battle between short-term pain and long-term gain. For more on this sector, check out our complete guide to automotive components stocks.

Conclusion: An Investment Strategy for DAE-IL Corporation Stock

Given the confluence of declining profitability and a major insider sale, a conservative and cautious approach to DAE-IL Corporation stock is warranted. The negative signals are likely to suppress investor sentiment and exert downward pressure on the share price in the short to medium term. The uncertainty around management’s confidence further clouds the outlook.

Investment Opinion: Sell / Against Holding.

Before considering an investment, it is crucial to wait for tangible signs of a turnaround. This includes seeing a clear recovery in profit margins and concrete results from the company’s investments in the eco-friendly vehicle business.

Key Investor Precautions

- •Monitor Profitability: Watch future earnings reports closely for any signs of margin improvement.

- •Track Shareholder Activity: Keep an eye out for any further changes in the stakes of major shareholders.

- •Analyze Macro Trends: Pay attention to exchange rates and commodity prices, as they have a direct impact on the company’s performance.