1. What Happened?

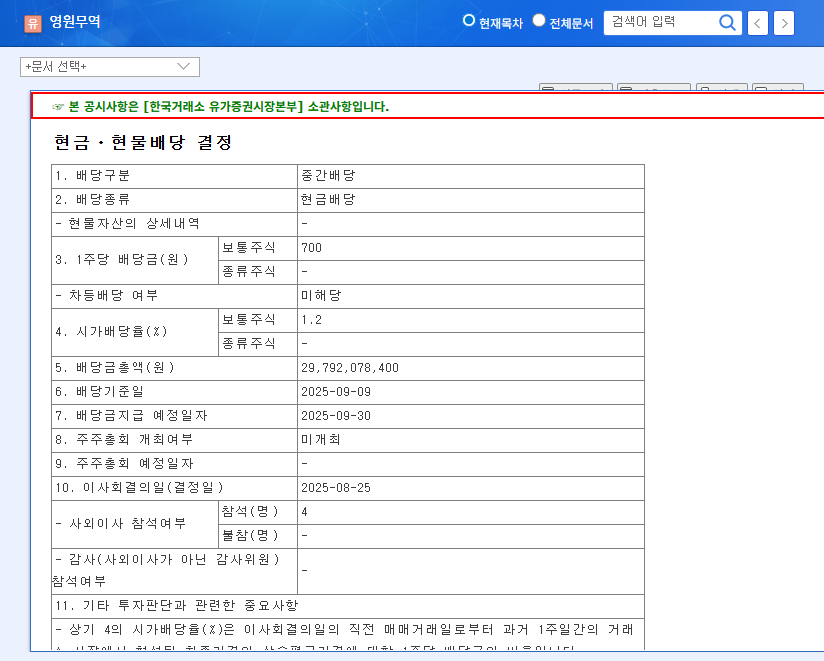

Youngone Corporation will pay an interim cash dividend of 700 KRW per share, with a record date of September 9, 2025. The dividend yield based on the current share price is approximately 1.2%.

2. Why the Dividend Decision?

While the company hasn’t officially stated a reason, it’s interpreted as a move to enhance shareholder return policy based on the strong performance of its OEM business. However, the decision raises concerns given the ongoing struggles of the SCOTT division and increasing financial burden.

3. What are the Potential Outcomes?

- Positive Impact: Potential short-term boost to share price and demonstration of shareholder-friendly management.

- Negative Impact: Increased liquidity burden due to cash outflow and potential reduction in business investment capacity.

In conclusion, while the dividend might positively impact the stock price in the short term, investors should carefully monitor the company’s fundamental improvement efforts in the long run.

4. What Actions Should Investors Take?

- Monitor SCOTT Division’s Recovery: Scrutinize the company’s plans and execution for performance improvement.

- Assess Financial Health: Pay close attention to the increasing debt and the declining trend in operating cash flow.

- Check for Long-Term Growth Drivers: Examine the company’s strategy for strengthening its OEM business competitiveness and securing new growth engines.

Frequently Asked Questions

When will the interim dividend be paid?

The dividend is scheduled to be paid on September 30, 2025.

What is the dividend amount per share?

The dividend amount is 700 KRW per share.

What is the current financial status of Youngone Corporation?

While the OEM business is showing robust growth, the company faces financial challenges, including the struggling SCOTT division and increasing debt.