The recent announcement of the TESCO.,LTD. exchangeable bond issuance has sent ripples through the market. Valued at 15.7 billion KRW, this financial maneuver is particularly noteworthy because the sole investor is the ‘Samsung-Spacetime AI Semiconductor New Technology Fund No. 1’. For investors in the competitive semiconductor equipment industry, this news presents a complex puzzle. Is this a strategic masterstroke paving the way for unprecedented growth, or does it introduce risks that could impact the TESCO.,LTD. stock price? This comprehensive analysis will break down the deal, explore the implications of Samsung’s involvement, weigh the potential rewards against the risks, and provide a strategic guide for current and prospective investors.

Deconstructing the 15.7B KRW Bond Issuance

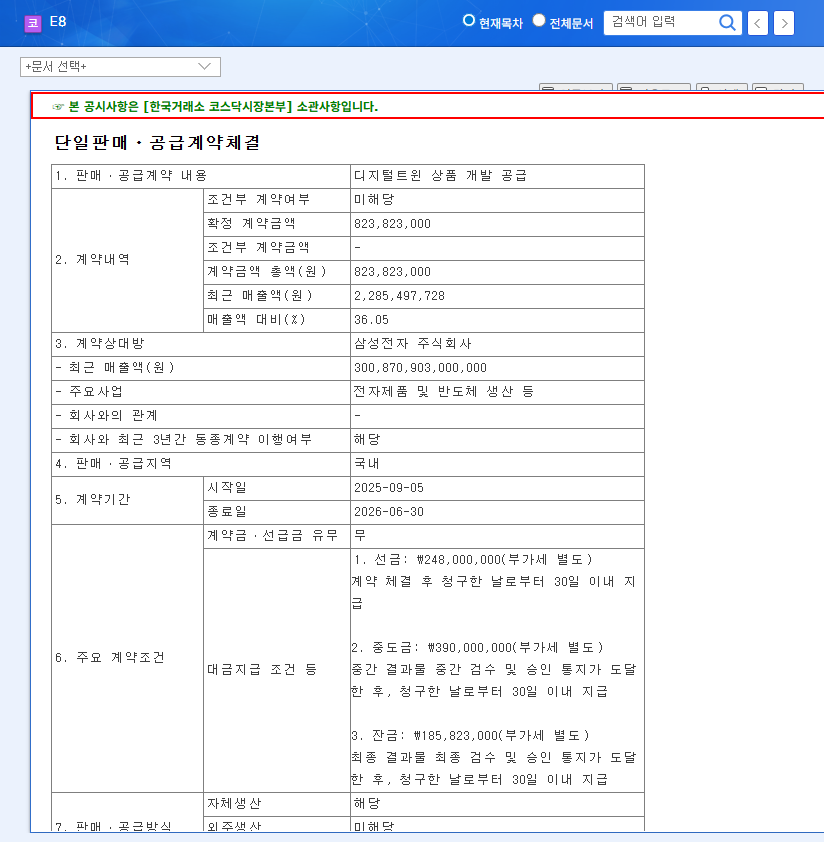

First, let’s look at the core details of this financial instrument. TESCO.,LTD. has opted for a private placement of exchangeable bonds, a decision that has specific implications. While the total amount of 15.7 billion KRW represents a modest 1.68% of the company’s market capitalization, the terms of the deal are what truly demand attention.

- •Issuance Amount: 15.7 billion KRW, providing a direct injection of capital.

- •Investor: ‘Samsung-Spacetime AI Semiconductor New Technology Fund No. 1’, a clear signal of strategic alignment.

- •Interest Rate: 0.0% surface and maturity interest. This means TESCO.,LTD. acquires this capital with no direct interest cost, a significant financial advantage.

- •Exchange Price: 52,223 KRW. This is the pivotal figure, set drastically higher than the current stock price.

- •Exchange Period: The exchange right can be exercised starting from November 6, 2025.

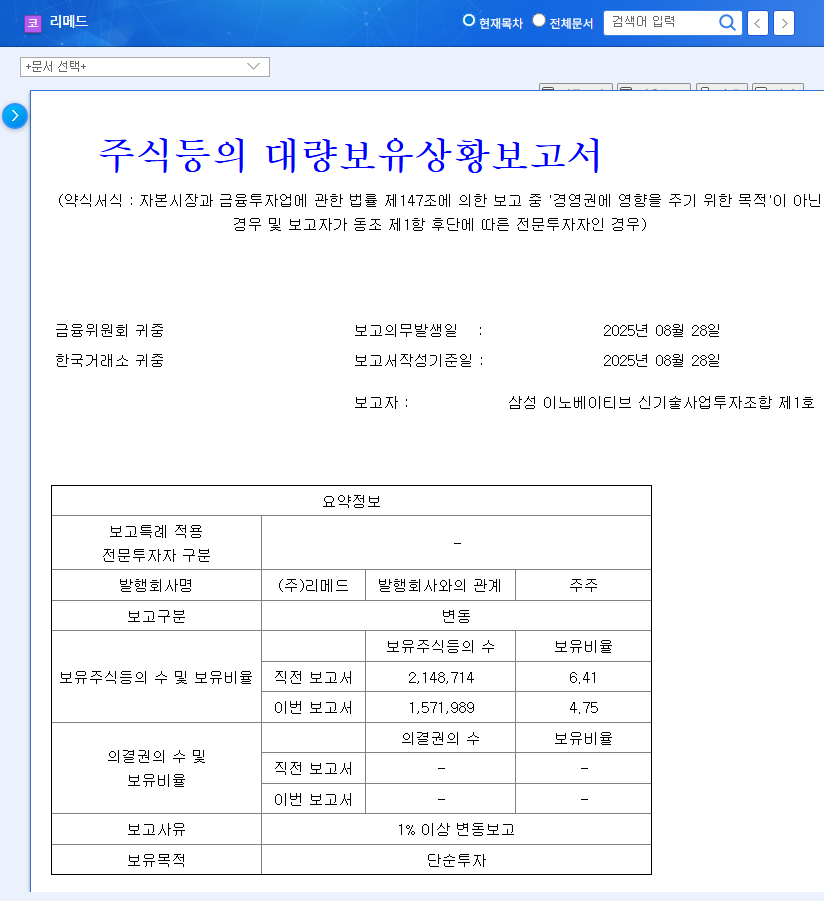

The Samsung Factor: A Powerful Vote of Confidence

The involvement of the Samsung AI semiconductor fund is the most compelling aspect of this deal. This isn’t just a financial transaction; it’s a strategic endorsement. For a company like TESCO.,LTD., having a fund associated with an industry titan like Samsung Electronics provides immense credibility. It suggests that Samsung sees significant untapped potential in TESCO.,LTD.’s technology and its role in the future of AI semiconductors.

This investment can be interpreted as a precursor to deeper collaboration, potentially leading to joint R&D projects, preferential supplier status, or access to Samsung’s extensive technological ecosystem. It’s a powerful signal that TESCO.,LTD. is a key player in a high-growth sector.

The capital itself, though modest, can be strategically deployed into critical R&D, helping TESCO.,LTD. to innovate faster and solidify its competitive advantage. The 0% interest rate means this growth is financed without adding any debt service burden to the company’s balance sheet, preserving financial flexibility for future operations and investments.

Navigating the Risks: The High Exchange Price and Dilution

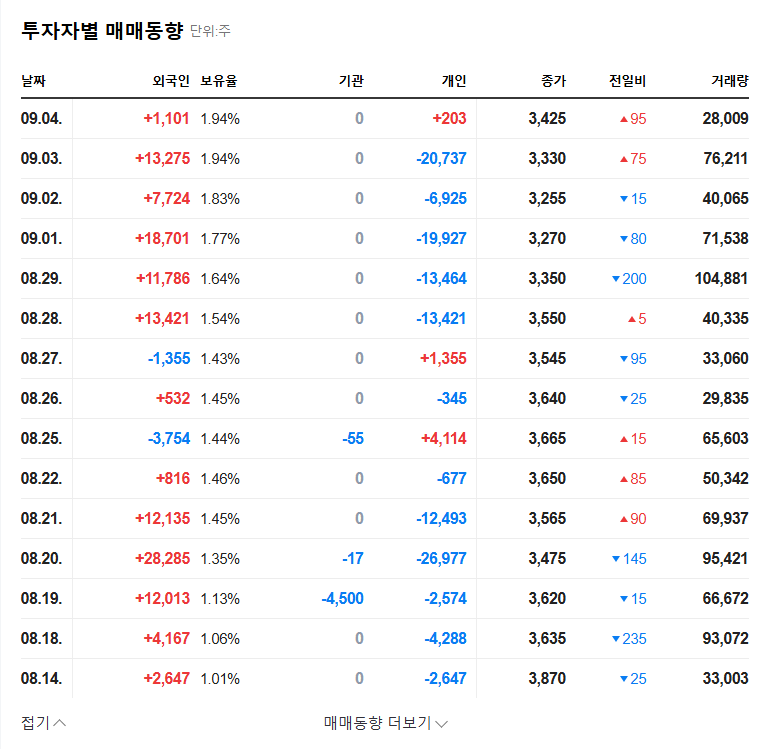

While the Samsung endorsement is a clear positive, savvy investors must also analyze the potential risks associated with the TESCO.,LTD. exchangeable bond. The primary concern stems from the vast difference between the current stock price (around 3,580 KRW) and the exchange price (52,223 KRW). For the investor to profit by converting the bonds to stock, the share price must increase more than tenfold. This high bar implies immense confidence from the Samsung fund, but it also creates uncertainty.

If the stock price does surge past this level, the conversion of bonds into shares will introduce new shares into the market. This could lead to a ‘dilution effect,’ where the value of existing shares is reduced because the company’s ownership is spread across a larger number of shares. Although the issuance size is small (1.68% of market cap), the principle of potential dilution remains a factor that long-term shareholders must monitor. For a deeper understanding of market dynamics, it’s often useful to consult analysis from major financial publications like The Wall Street Journal’s market section.

A Strategic Playbook for Investors

Given this landscape of opportunity and risk, how should an investor approach TESCO.,LTD.? A well-rounded investment analysis requires diligent research beyond the headlines. Here are critical steps to take:

- •Review the Primary Source: The most crucial step is to examine the Official Disclosure on DART. This document contains the unfiltered facts of the deal straight from the company.

- •Analyze Capital Utilization: Monitor company announcements for specific plans on how the 15.7 billion KRW will be used. Is it for a new factory, specific R&D, or talent acquisition? Concrete plans add to the investment thesis.

- •Understand the AI Semiconductor Market: Research the broader industry trends. Is the demand for TESCO.,LTD.’s specific technology growing? Who are the main competitors? A rising tide in the AI chip sector will lift all quality players.

- •Compare Financial Instruments: To fully grasp the implications, it can be helpful to understand the differences between various corporate bonds. You can learn more by reading our guide on Exchangeable vs. Convertible Bonds.

In conclusion, TESCO.,LTD.’s exchangeable bond issuance is a significant long-term positive indicator, largely due to the strategic backing of a Samsung-affiliated fund. It signals strong belief in the company’s future growth trajectory within the vital AI semiconductor space. While investors must remain mindful of the potential for future share dilution, the immediate benefits of a cost-free capital injection and a powerful strategic alliance appear to outweigh the risks. Careful and continuous due diligence will be key to capitalizing on this development.