1. What Happened?

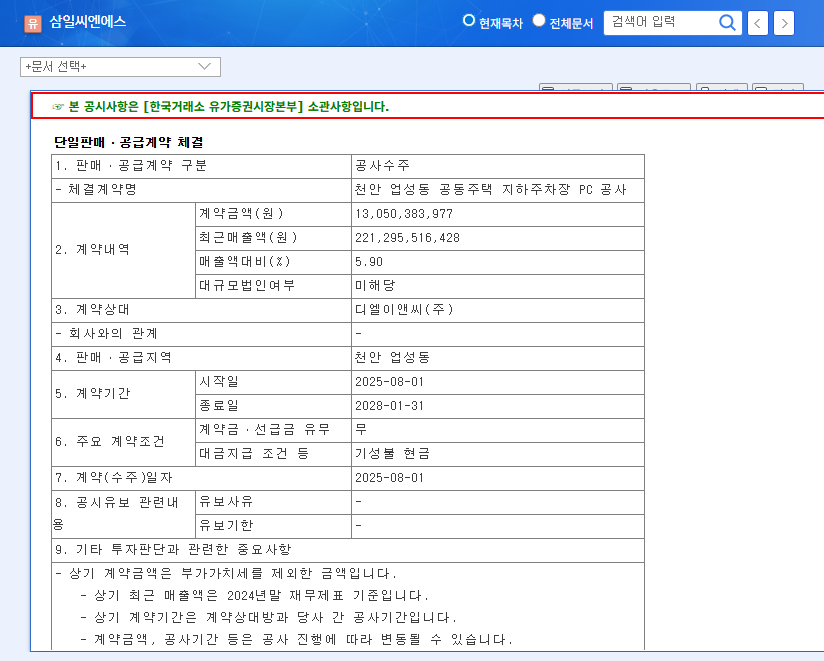

Samil CNS has signed a $10 million contract with DL E&C for the ‘Cheonan Upseong-dong Apartment Complex Underground Parking PC Construction.’ The contract period is 2 years and 6 months, from August 1, 2025, to January 31, 2028.

2. Why Does It Matter?

This contract is a welcome development for Samil CNS, which has been experiencing difficulties in its concrete segment due to the construction downturn. Representing 5.9% of Samil CNS’s sales, this contract is expected to contribute to short-term performance improvement and positively influence future contract acquisition opportunities. The PC construction method, aligning with smart construction trends, holds high growth potential. Furthermore, the contract with DL E&C, a major construction company, validates Samil CNS’s technological capabilities and credibility.

3. What’s Next?

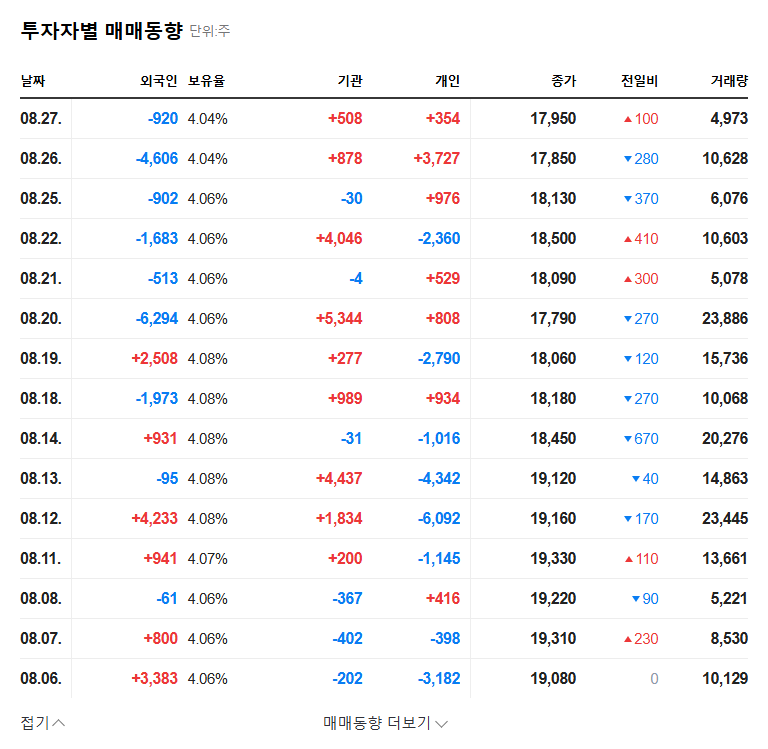

This contract is anticipated to improve the concrete segment’s performance and positively impact the stock price. However, the overall recovery of the construction industry and the continued growth of the wind power and steel segments will determine the mid-to-long-term stock price trend. Changes in macroeconomic conditions, such as interest rate fluctuations, also warrant attention.

4. What Should Investors Do?

- Short-term Investors: Can capitalize on the stock momentum following the contract but should exercise caution due to potential price volatility depending on the construction industry’s recovery and the company’s performance.

- Mid-to-Long-term Investors: Should consider various factors, including sustained growth in wind power and steel, additional orders and competitiveness enhancements in the concrete segment, and macroeconomic environment changes, before making investment decisions.

Q: What is the impact of this contract on Samil CNS’s performance?

A: The contract is worth $10 million, representing 5.9% of Samil CNS’s sales. While expected to improve short-term performance, the overall impact might be limited.

Q: How will this contract affect Samil CNS’s stock price?

A: The contract is likely to have a positive impact on the stock price. However, stock price volatility may occur depending on the construction market’s recovery and the performance of the wind power and steel sectors.

Q: What should investors consider when investing in Samil CNS?

A: Short-term investors can capitalize on the initial momentum, but should be wary of volatility. Mid-to-long-term investors should consider the sustained growth of wind power and steel, additional orders in concrete, and macroeconomic conditions.