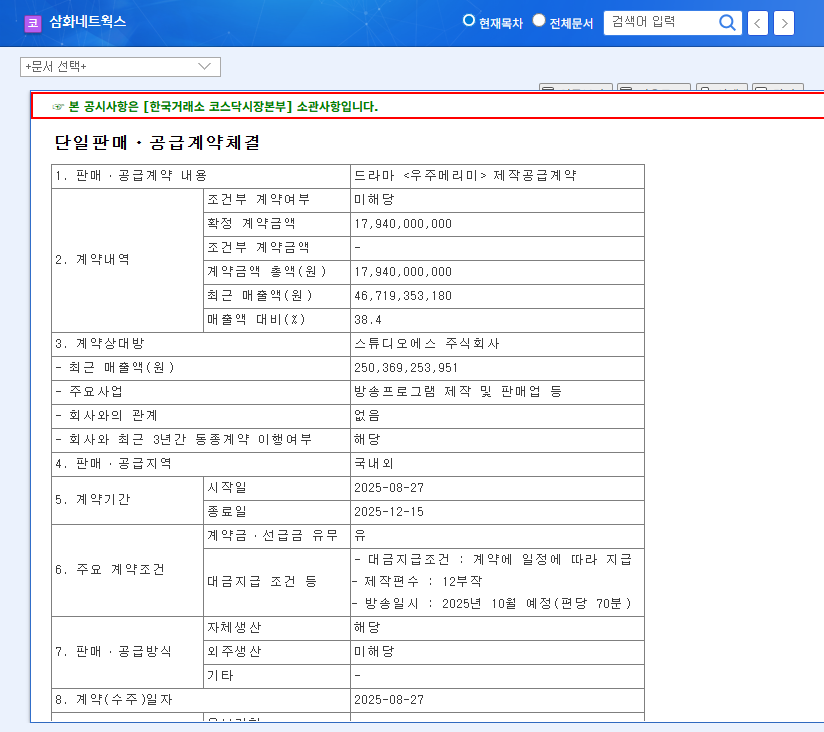

1. What Happened? : $134 Million Contract for Drama

Samhwa Networks secured a $134 million drama production contract with Studio S for the drama

2. Why Does it Matter? : A Glimmer of Hope Amidst Financial Struggles

Samhwa Networks recorded dismal results in the first half of 2025, including sharp revenue declines, operating losses, net losses, and a surge in debt-to-equity ratio. This large-scale contract offers a potential turning point, signaling a possible return to normal business operations. By demonstrating its drama production capabilities and business prowess, the company has an opportunity to regain market confidence.

3. What’s the Impact? : Positive Signal, but Uncertainties Remain

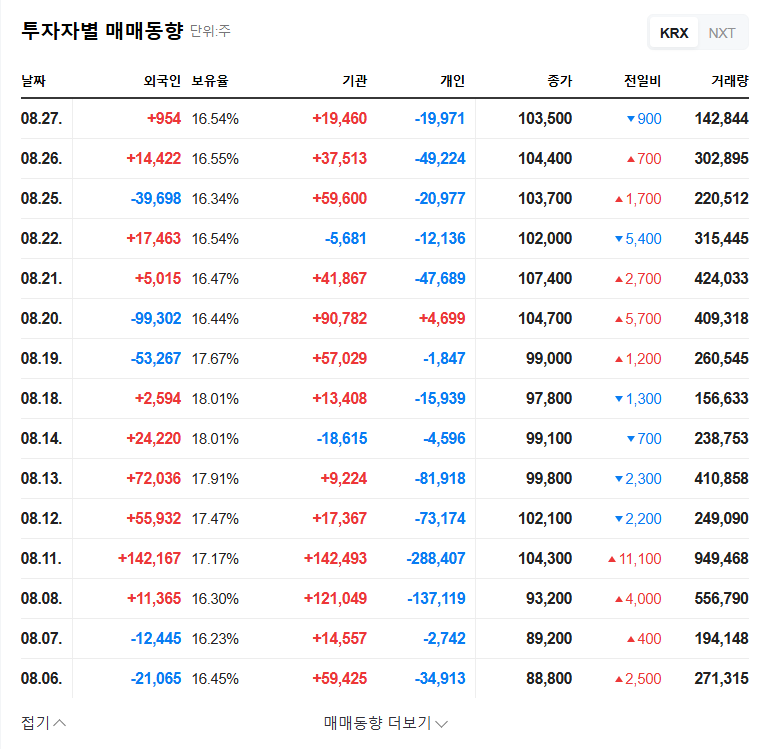

This contract presents both positive and negative aspects. On the positive side, we can anticipate increased revenue, potential business normalization, and a positive impact on stock prices. However, the short three-month contract period, uncertainties surrounding profitability, and limited impact on fundamental financial structure improvements are all negative factors to consider.

4. What Should Investors Do? : Careful Monitoring and Prudent Investment

Investors should avoid being swayed by short-term stock price fluctuations and approach the situation with a long-term perspective. Carefully monitoring factors like the contract’s profitability, the possibility of future contracts, Q3 and Q4 earnings announcements, and the company’s efforts to improve its financial structure is crucial before making investment decisions.

How much will Samhwa Networks’ performance improve with this contract?

The $134 million contract considerably exceeds the first half of 2025 revenue and is therefore expected to contribute significantly to improving performance in Q3 and Q4. However, actual profitability depends on production costs and cost control, so it is essential to check the earnings announcement.

Is this contract just a short-term effect?

The short three-month contract period raises concerns about a one-time effect. Therefore, investors should keep an eye on the potential for future contracts and the company’s long-term business strategy.

Should I invest in Samhwa Networks?

While this contract is a positive signal, the fundamental problem of deteriorating financial health remains. Investors should carefully review the contract’s profitability, future business prospects, and financial restructuring plans before making any investment decisions.