The recent announcement regarding the Saltlux stock warrant exercise has sent ripples through the investment community. As a pioneering force in artificial intelligence, Saltlux presents a compelling growth story. However, the prospect of new shares entering the market raises valid concerns about value dilution. This comprehensive Saltlux investment analysis will dissect the event, examine the company’s core fundamentals, and provide a clear framework for evaluating the risks and opportunities for your portfolio.

We’ll explore whether this capital injection will fuel Saltlux’s ambitious AI projects or simply create short-term volatility. By understanding the full context, investors can move beyond the headlines and make a truly informed decision.

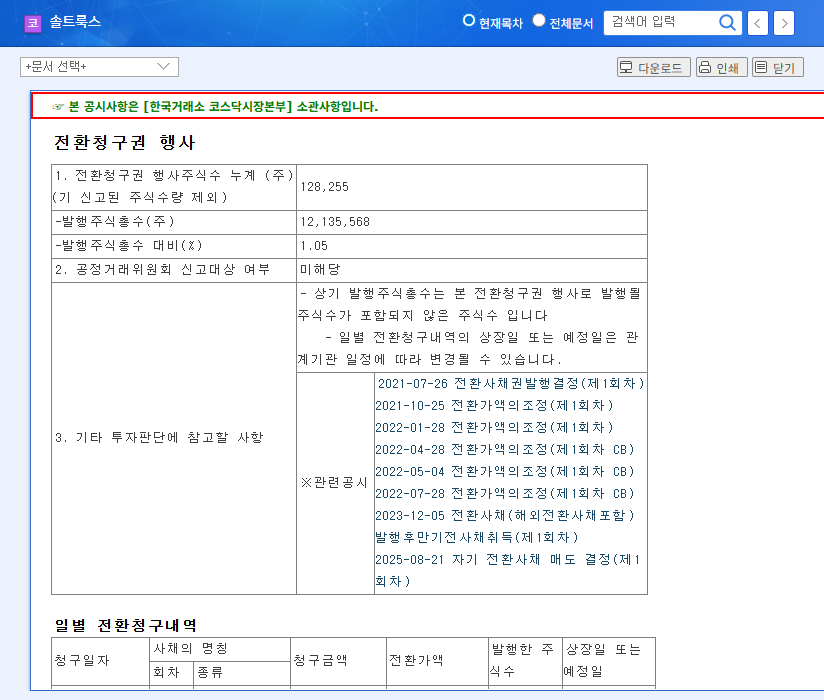

Breaking Down the Saltlux Stock Warrant Exercise

First, let’s clarify what’s happening. A stock warrant gives the holder the right, but not the obligation, to buy a company’s stock at a specific price (the exercise price) within a certain timeframe. When these warrants are exercised, the company issues new shares and receives cash. Saltlux has officially announced the details of this financial maneuver.

Key Details of the Issuance

- •Event: Exercise of New Stock Warrants

- •Number of New Shares: 330,032 shares

- •Ratio to Market Cap: Approximately 2.69%

- •Exercise Price: KRW 12,120 per share

- •Scheduled Listing Date: October 20, 2025

- •Capital Raised: Approximately KRW 4 billion

This move is intended to raise capital, likely to fund ongoing research and development or support global expansion efforts. For full transparency, you can view the Official Disclosure on the DART system.

Saltlux Fundamentals: A Tale of Two Tapes

To understand the context of the Saltlux stock warrant exercise, we must look at the company’s strengths and weaknesses. It’s a classic case of groundbreaking technology meeting financial headwinds.

The Bull Case: A Leader in AI Technology

Saltlux is not just another player in the AI field. Its competitive edge stems from its proprietary Large Language Model (LLM), ‘Lucia 3.0’, and the global expansion of its AI agent service, ‘Goover’. The company’s unique integration of Retrieval-Augmented Generation (RAG) with its LLM sets it apart, allowing its AI to pull from vast, real-time datasets to provide more accurate and context-aware responses. This technological prowess positions Saltlux to capture a significant share of the rapidly growing generative AI market, a sector that market analysts predict will see exponential growth.

The Bear Case: Financial Pressures

Despite its technological achievements, Saltlux’s recent financial performance is a cause for concern. The Q1 2025 report showed a year-on-year revenue decrease of 33% and widening operating and net losses. This is partly due to aggressive R&D spending, which accounts for 23% of revenue. While essential for long-term innovation, this continuous investment puts significant pressure on short-term profitability. The negative operating cash flow highlights the company’s need for capital, which this warrant exercise aims to address.

The core dilemma for any Saltlux investor is weighing its undeniable AI innovation and market potential against its current financial instability and the immediate impact of share dilution.

Impact Analysis for the Saltlux Stock

The issuance of over 330,000 new shares will inevitably have consequences for the Saltlux stock and its holders.

- •Share Value Dilution: With more shares in circulation, the ownership stake of each existing share decreases. This can dilute key metrics like Earnings Per Share (EPS), potentially lowering the stock’s valuation in the short term.

- •Increased Volatility: The significant difference between the exercise price (KRW 12,120) and the current market price may incentivize new shareholders to sell for a quick profit around the listing date, increasing supply and creating price volatility.

- •Improved Financial Health (Potentially): The KRW 4 billion capital injection could stabilize the company’s balance sheet, fund critical R&D, and extend its operational runway. The long-term success of this move depends entirely on how effectively management deploys these new funds to generate growth and profitability.

Investment Strategy & Key Monitoring Points

For those considering an investment in Saltlux, a nuanced approach is required. The story is more complex than a simple ‘buy’ or ‘sell’. Investors interested in this space should also explore other AI technology stocks to benchmark performance and valuation.

Recommendation: Cautious Hold & Vigilant Monitoring

In the immediate short term, a ‘Hold’ strategy is advisable. It’s prudent to wait and observe the market’s reaction as the October 2025 listing date approaches and passes. For long-term investors with a higher risk tolerance, the focus should be on the company’s execution.

Key points to monitor over the next several quarters include:

- •Commercialization of ‘Lucia 3.0’: Are they securing major contracts and generating meaningful revenue from their flagship LLM?

- •Growth of ‘Goover’ Service: Is the global expansion translating into user growth and a clear path to monetization?

- •Path to Profitability: Is there a clear strategy to reverse the trend of operating losses and improve margins?

- •Competitive Landscape: How is Saltlux faring against giants like OpenAI and other emerging competitors in the fierce AI market?

Ultimately, the success of the Saltlux stock will depend on its ability to convert its technological lead into sustainable financial performance. This warrant exercise provides the fuel; now, the company must prove it can build a powerful and efficient engine.