For investors holding or considering Icure Pharmaceutical stock (175250), the coming weeks represent a pivotal moment filled with significant uncertainty and potential volatility. The company is currently under a substantive listing eligibility review by the Korea Exchange after submitting an improvement plan. A final decision, expected by November 12, 2025, will determine the company’s future on the exchange and could drastically impact its valuation.

This comprehensive analysis delves into the reasons behind the review, the critical timeline investors must watch, the three potential scenarios, and actionable strategies for navigating this high-stakes period. Understanding these factors is essential for making informed decisions regarding your investment in Icure Pharmaceutical.

The Background: Why is Icure Under Review?

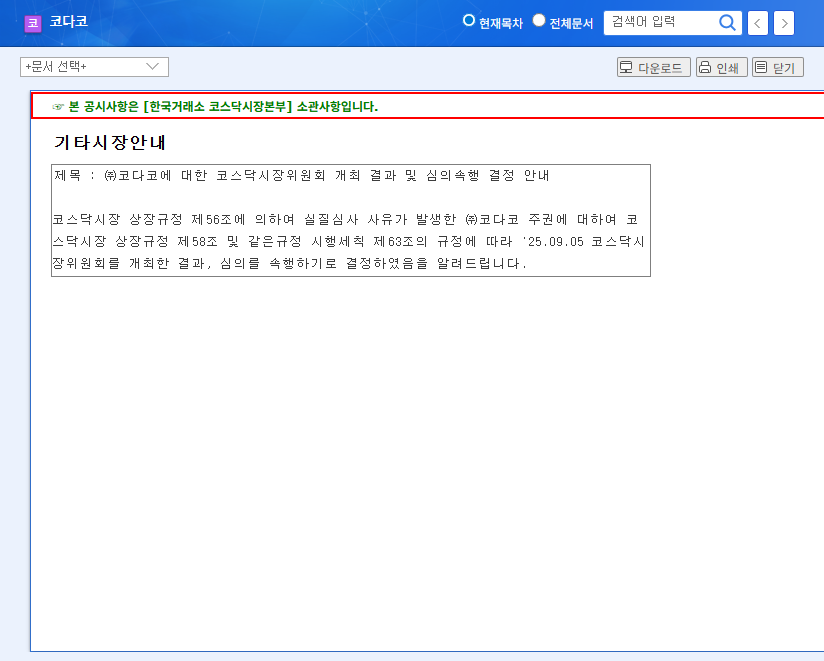

On September 17, 2025, Icure Pharmaceutical was flagged for a substantive listing eligibility review. While the company’s official disclosure provides the direct context, such reviews by the Korea Exchange are typically triggered by significant events related to a company’s financial health, operational stability, or corporate governance. This can include issues like operating losses for consecutive fiscal years, a disclaimer of opinion from an auditor, or other events that may compromise shareholder value and market integrity.

In response, Icure submitted a detailed improvement plan on October 15, 2025. This document outlines the company’s proposed actions to rectify the underlying issues and demonstrate its viability as a publicly-traded entity. The entire market is now awaiting the Corporate Review Committee’s verdict on whether this plan is sufficient. The official filing can be reviewed directly via the DART system: Official Disclosure.

Three Potential Scenarios for Icure Pharmaceutical Stock

The decision by the Korea Exchange’s committee will lead to one of three distinct outcomes, each with profound implications for shareholders.

- •Scenario 1: Listing Maintained (Best Case)

If the committee deems the improvement plan satisfactory and believes the causes for review have been resolved, trading will resume. This positive outcome would likely trigger a significant relief rally in the Icure Pharmaceutical stock price as the immediate delisting risk is removed. - •Scenario 2: Improvement Period Granted (Uncertainty Continues)

The committee may find the plan promising but require more time for execution and validation. In this case, they will grant a formal improvement period (e.g., 6-12 months). While this avoids immediate delisting, the trading suspension would continue, and the company remains under scrutiny. The stock’s fate would then depend on meeting specific milestones during this period. - •Scenario 3: Delisting Decision (Worst Case)

If the committee rejects the improvement plan, it will move to delist the company. Icure would have a short window (typically 15 business days) to appeal to the KOSDAQ Market Committee. If the appeal fails, the stock will be delisted, leading to a catastrophic loss for investors and a move to a less liquid over-the-counter market. For more information, you can learn more about the delisting process and its impact on shareholders.

The critical date for investors is November 12, 2025. This is the deadline for the Corporate Review Committee to deliberate, marking the next major inflection point for Icure’s future.

Investment Strategy: Managing Extreme Uncertainty

Given the binary nature of the upcoming decision, investing in Icure Pharmaceutical at this stage is speculative and carries exceptionally high risk. A prudent strategy should be centered on risk management and information gathering.

Strategic Approaches for Icure Pharmaceutical Stock Investors

- •Acknowledge the Delisting Risk: Do not underestimate the possibility of a worst-case scenario. Ensure your position size reflects this risk and that a total loss would not severely impact your overall portfolio.

- •Monitor Official Channels: The most reliable information will come directly from the Korea Exchange or Icure’s official disclosures on DART. Avoid market rumors and focus on primary sources.

- •Avoid Averaging Down: Adding to a position in a company facing a potential delisting is an extremely high-risk strategy. It’s often better to wait for clarity before committing new capital.

- •Prepare for Volatility: Regardless of the outcome, expect extreme price swings. If trading resumes, the stock could gap up or down significantly based on the news. As top market analysts at Bloomberg often note, such events create a binary outcome that defies traditional technical analysis.

Frequently Asked Questions (FAQ)

What is the current status of Icure Pharmaceutical (175250)?

Icure Pharmaceutical is under a listing eligibility review by the Korea Exchange and has submitted an improvement plan. The company and investors are awaiting a decision by the exchange’s committee.

When is the decision on Icure’s listing status expected?

The decision is expected on or before November 12, 2025, which is 20 business days after the improvement plan was submitted on October 15, 2025.

What are the key risks for Icure Pharmaceutical stock?

The primary risk is delisting, which would result in a substantial or total loss of invested capital. Other risks include prolonged trading suspension and extreme price volatility once trading resumes.