1. What Happened? DaeSung Hi-Tech’s 59.4 Billion Won Rights Offering

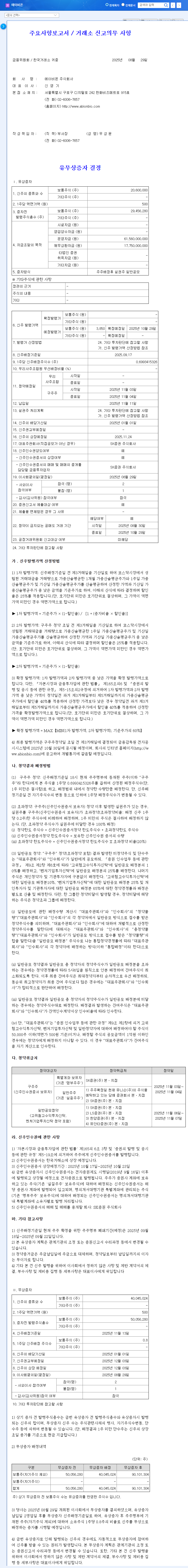

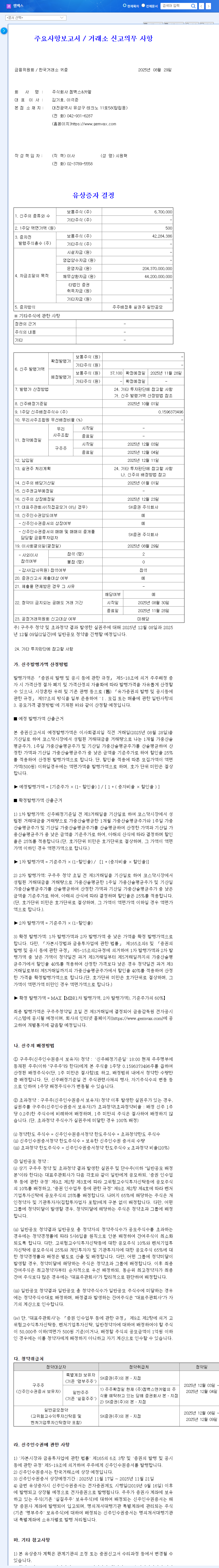

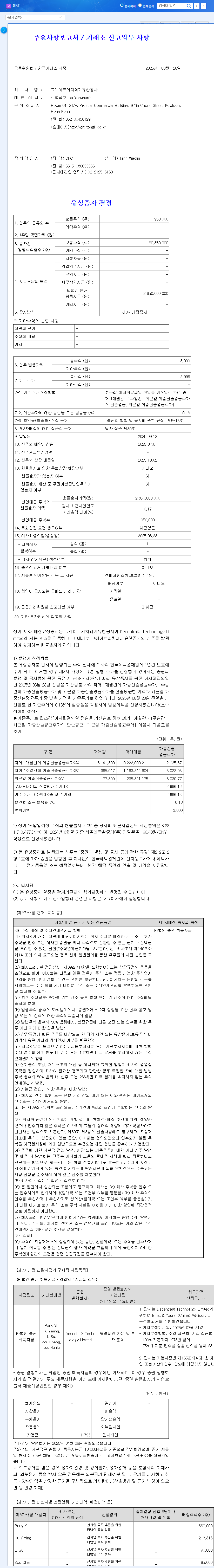

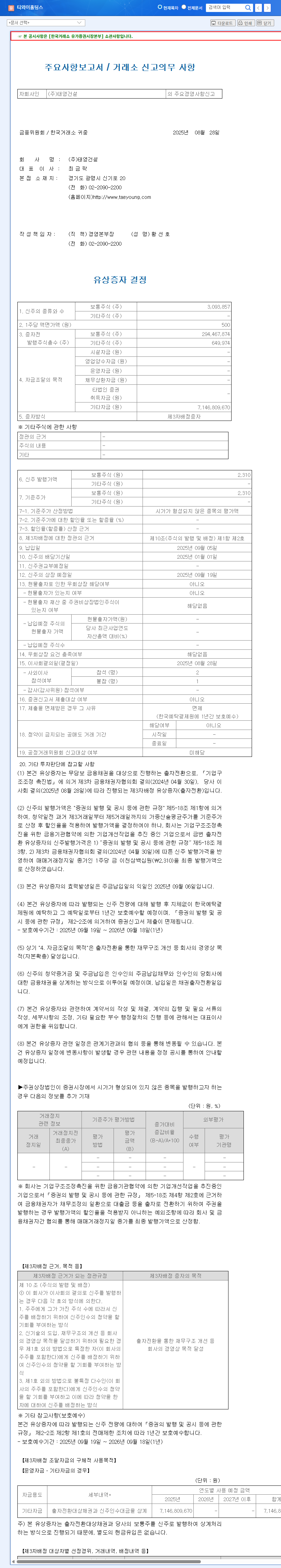

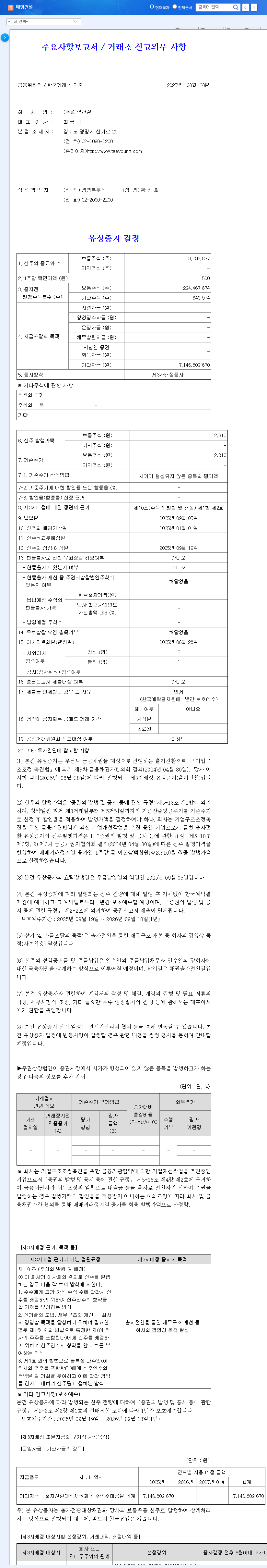

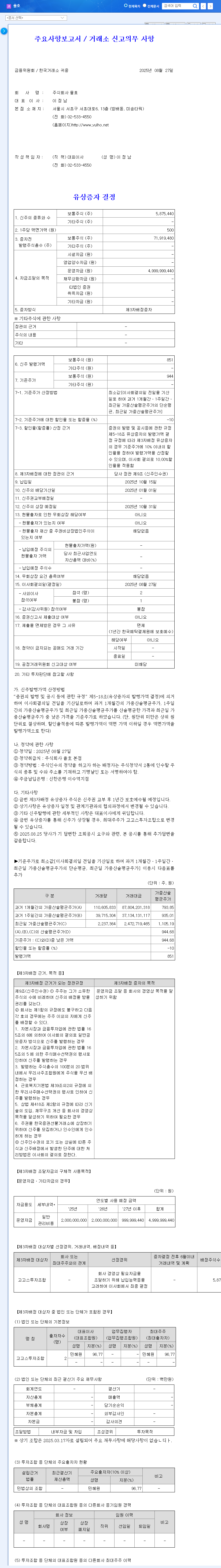

DaeSung Hi-Tech has announced a rights offering to raise 59.4 billion won. They will issue 1,354,707 common shares at 4,429 won per share, representing a 10% increase in outstanding shares. The payment date is September 8, 2025, and the main investor is Pulp Project No. 1 Private Equity Fund.

2. Why the Rights Offering? Analyzing the Background and Objectives

While the official purpose hasn’t been disclosed, considering DaeSung Hi-Tech’s current situation, the most likely reasons are investments in new businesses (defense, medical devices, electric vehicle components), strengthening R&D, securing operating funds, and repaying debt. Given the company’s weak first-half performance and high debt-to-equity ratio, improving financial stability is likely a top priority.

3. What’s Next? Stock Price Outlook and Investment Strategies

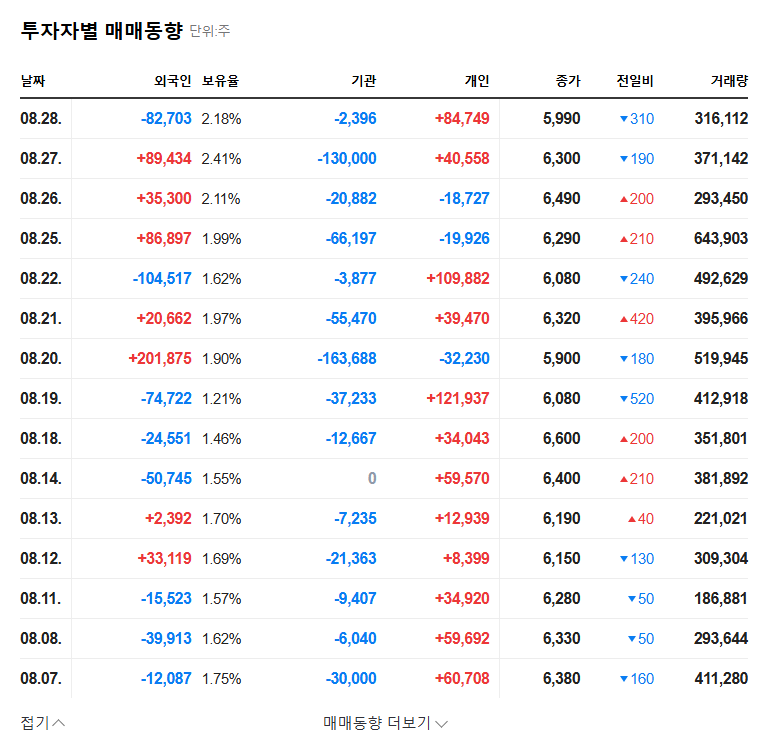

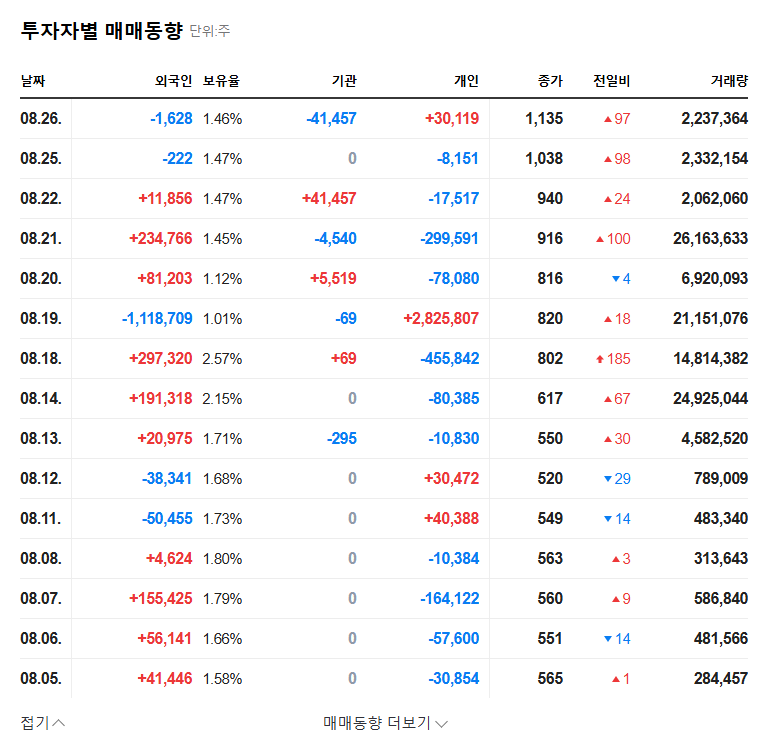

In the short term, there’s a possibility of a stock price decline due to concerns about share dilution from the new issuance. However, the offering price is lower than the market price, which could partially offset the dilution effect. In the medium to long term, if the funds are used effectively for new business investments and financial restructuring, it could lead to increased corporate value and a rebound in the stock price. The key is the success of the new businesses. The visibility of results from high-growth sectors like defense, medical devices, and electric vehicle components will be crucial for driving stock price appreciation.

- Positive Factors: Private equity investment, growth potential of new businesses

- Negative Factors: Short-term stock dilution concerns, weak performance and financial instability

4. What Should Investors Do? Key Checkpoints

Investors should closely monitor the following:

- Concrete sales and profit generation from new businesses

- How the funds are utilized and the improvement in financial health indicators (debt-to-equity ratio, cash flow, etc.)

- The impact of the economy and industry trends on key business segments, and global macroeconomic variables (interest rates, exchange rates, raw material prices)

Frequently Asked Questions

What is the purpose of this rights offering?

While not officially stated, it is likely for new business investment, R&D, operating funds, and debt repayment.

How will the rights offering affect the stock price?

Short-term decline is possible, but long-term growth depends on the success of new ventures.

What are the key investment considerations?

Monitor new business performance, financial health improvements, and macroeconomic trends.