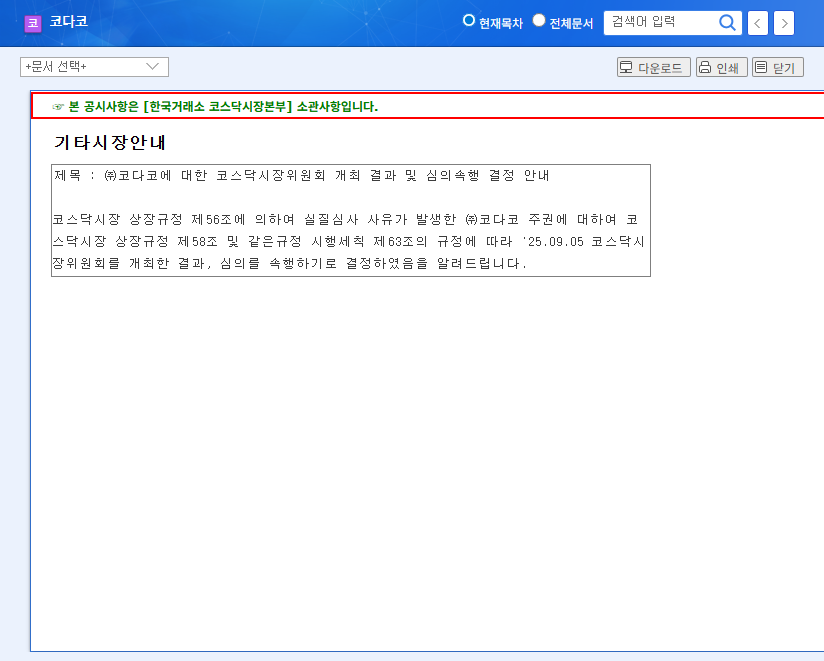

What Happened? NKMax Designated for Delisting Review

On September 24, 2025, NKMax was designated for delisting review due to a disclaimer of opinion from its 2023 audit. The Korea Exchange will decide whether to delist NKMax or grant a grace period by October 29, 2025. NKMax must submit a management improvement plan by October 22.

Why Did This Happen? Understanding NKMax’s Current Situation

NKMax, a developer of NK cell-based immunodiagnostic and therapeutic solutions, underwent corporate restructuring and returned to positive equity in June 2025. However, as of the first half of 2025, the company continues to face declining sales, operating losses, and net losses, along with losses from affiliates. While the growth potential of the immunocell therapy market is positive, increasing competition and development costs remain significant challenges.

What’s Next? Analyzing the Short-Term and Long-Term Impact

- Short-term Impact: Stock price decline, increased trading volatility, potential trading suspension.

- Long-term Impact: Depending on the management improvement plan and review results, NKMax faces delisting or a grace period. Even with a grace period, uncertainties in fundraising and business operations may persist.

What Should Investors Do? Investment Strategies and Key Considerations

- Conservative Approach: Investments in NKMax carry significant risks and require caution.

- Stay Informed: Closely monitor the management improvement plan, review outcomes, pipeline performance, and financial health.

FAQ

Why is NKMax facing delisting?

NKMax was designated for delisting review due to a disclaimer of opinion on its 2023 audit. Ongoing operating losses and other financial difficulties also contributed.

What happens if NKMax is delisted?

If delisted, trading of NKMax shares will be halted, potentially leading to significant losses for investors.

Is there a chance NKMax can avoid delisting?

NKMax can potentially avoid delisting by submitting a management improvement plan and passing the Korea Exchange’s review, earning a grace period. However, successful improvement efforts are crucial.

What should investors keep in mind?

Investors should exercise extreme caution and closely monitor the management improvement plan, review results, pipeline performance, and financial health of NKMax.