The latest development in the KPM Tech New On saga has sent ripples through the investment community. KPM Tech has officially increased its ownership stake in the financially embattled New On to 63.93%, a move that solidifies its management control. For investors conducting a New On stock analysis, the central question is clear: Is this a lifeline that signals an imminent turnaround, or does it merely amplify the risks associated with a company in crisis? This comprehensive analysis will dissect the fundamentals, explore the potential outcomes, and provide a strategic guide for any potential New On investment.

While the KPM Tech stake increase does not directly fix New On’s deep-seated financial issues overnight, it provides a powerful catalyst for management stabilization and accelerated corporate restructuring.

The Core Event: KPM Tech’s Decisive Stake Increase

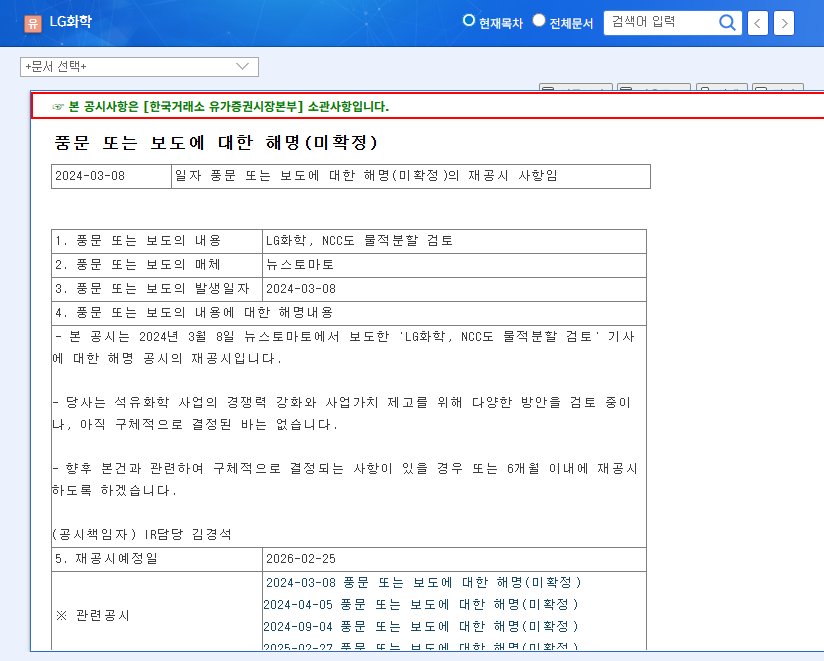

KPM Tech, the reporting entity and majority shareholder, has formally announced an increase in its stake in New On from 55.91% to 63.93%. This was not just a simple share purchase; it was a strategic move involving the addition of special related parties, effectively tightening KPM Tech’s grip on New On’s operational and strategic direction. This action is a clear signal of intent to intervene more directly in the company’s affairs, a move necessitated by New On’s prolonged period of financial distress.

Diagnosing the Crisis: New On’s Fundamental Weaknesses

Before evaluating the impact of KPM Tech’s move, it’s crucial to understand the depth of New On’s challenges. The company’s financial health has been deteriorating for years, creating a high-risk environment for any New On investment.

Severe Financial Instability

- •Persistent Losses: The company has recorded operating losses for six consecutive years, indicating a chronic inability to achieve profitability.

- •Massive Accumulated Deficit: A staggering deficit of KRW 133.5 billion significantly increases the risk of capital impairment.

- •Liquidity Crisis: With current liabilities exceeding current assets, the company’s ability to meet short-term obligations is severely compromised.

- •Rising Debt: The debt-to-equity ratio has climbed by 34.68%, a clear sign of deteriorating financial leverage and increased risk. For more on this metric, see this guide on analyzing debt ratios.

Operational Inefficiency and Business Stagnation

The financial issues are symptoms of deeper operational problems. The special-purpose machinery division is operating at a critically low production utilization rate of just 5.56%, indicating severe inefficiency. Meanwhile, the health functional food division, a sector with high growth potential, has failed to deliver significant profitability, pointing to a need for a major strategic overhaul. These issues are central to any credible New On stock analysis.

Impact Analysis: A Turnaround Catalyst or Increased Volatility?

The KPM Tech stake increase introduces both opportunities and risks. For investors, the path forward will depend on KPM Tech’s ability to execute a successful turnaround strategy.

The Bull Case: Potential for a Turnaround

- •Management Stabilization: A stronger controlling shareholder can end management turmoil and provide a clear, unified strategic direction.

- •Accelerated Restructuring: KPM Tech can now force through necessary but difficult changes, such as reorganizing inefficient divisions and optimizing operations. Learn more about corporate restructuring strategies here.

- •Potential Funding Support: As the majority owner, KPM Tech has a vested interest in New On’s survival and could provide crucial financial backing if required.

The Bear Case: Lingering Risks

- •Short-Term Volatility: Major management shifts often create market uncertainty, which can lead to stock price volatility.

- •Execution Risk: A turnaround plan is only as good as its execution. There is no guarantee that KPM Tech’s new strategies will succeed.

- •Macroeconomic Headwinds: Global economic slowdowns and rising interest rates create a difficult environment for any company, especially one in a precarious financial position.

Investor Checklist & Strategic Recommendations

For those considering a New On investment, a cautious and well-researched approach is paramount. The situation is speculative and requires diligent monitoring.

- •Verify the Plan: Closely monitor KPM Tech’s official announcements for a concrete restructuring and investment strategy. The first step is to review the Official Disclosure (Source).

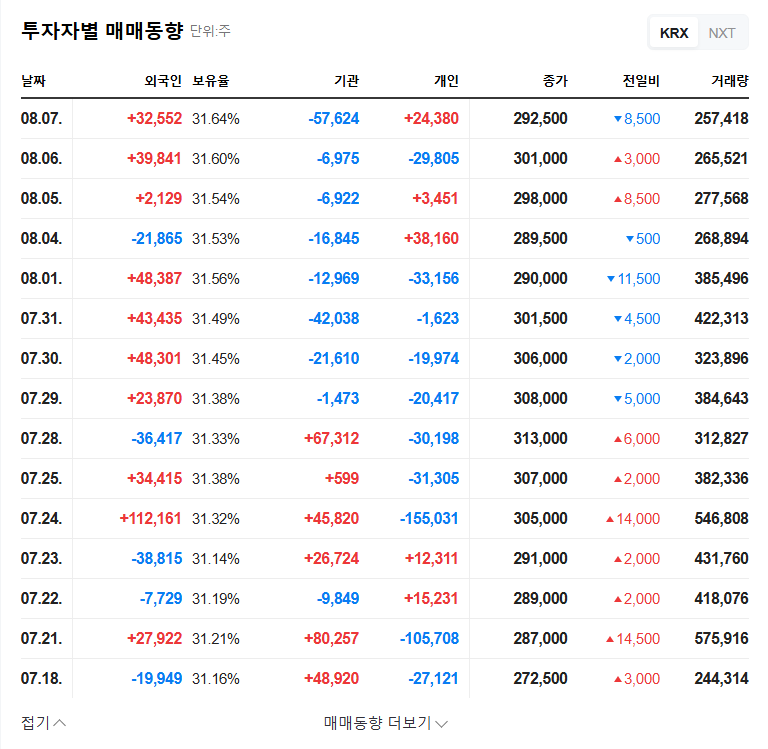

- •Watch for Tangible Results: Look for verifiable signs of improvement in quarterly reports, such as reduced operating losses, improved profit margins, and a stronger balance sheet.

- •Assess Business Performance: Track the production utilization rates in the machinery division and sales figures from the health food division for signs of life.

- •Maintain a Long-Term View: Avoid speculative short-term trading based on news. A successful turnaround will take several quarters, if not years, to materialize.

Conclusion: A High-Risk, High-Reward Scenario

The KPM Tech New On dynamic has entered a new chapter. KPM Tech’s increased stake offers a glimmer of hope for the beleaguered company, providing a potential pathway to stability and recovery. However, the road ahead is fraught with challenges. For investors, New On remains a high-risk, speculative play. Success hinges entirely on the new management’s ability to execute a flawless turnaround. Prudence, patience, and a sharp eye for fundamental improvements are the keys to navigating this complex investment opportunity.