1. DASCO-SolEco Merger: What’s Happening?

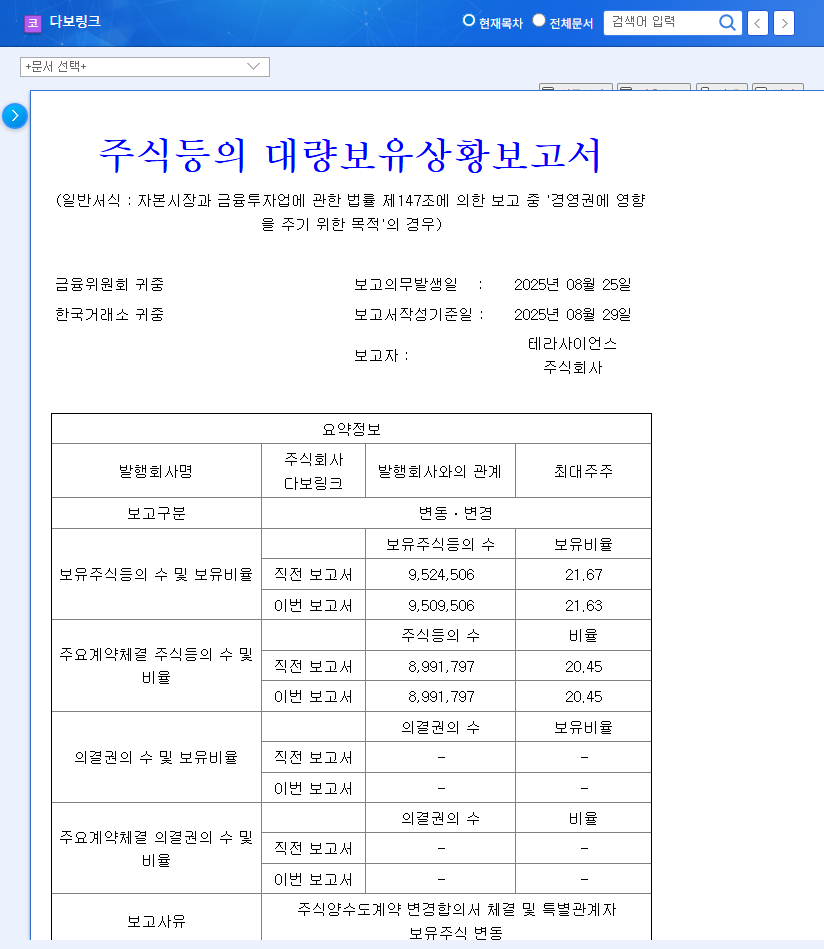

DASCO announced on September 24, 2025, its plan to acquire its subsidiary, SolEco. SolEco, a manufacturer of floating structures and supplier of construction materials, will be fully absorbed by DASCO. The primary goal of this merger is to strengthen DASCO’s renewable energy business, specifically in the floating solar power sector. The merger date is set for November 29, 2025, and DASCO’s stock is currently halted from trading.

2. Why Merge? Analyzing Synergies and Risks

DASCO aims to secure SolEco’s floating solar buoy technology and create synergies within its renewable energy business segment to secure future growth engines. The merger is also expected to increase operational efficiency by eliminating overlapping functions and reducing costs. However, SolEco’s weak performance (sales of 3.7 billion KRW and a net loss of 2.4 billion KRW in the first half of 2024) could burden DASCO’s financial health post-merger. The uncertainties surrounding the merger process and the actual realization of synergy effects also require careful consideration.

3. DASCO’s Business Status and Future Prospects

DASCO operates in SOC, energy, building materials, and steel businesses. While the SOC business has returned to profitability, the energy and building materials sectors are recording losses. The steel business remains profitable but faces challenges due to intensified competition. DASCO is seeking diversification through new business ventures, but its R&D investment ratio is relatively low.

4. Action Plan for Investors

While this merger can be viewed positively in the long term, short-term risks exist. Investors should consider various factors before making investment decisions, including SolEco’s post-merger profitability, the performance improvement of DASCO’s existing businesses, changes in financial structure after the merger, and the macroeconomic and market conditions. The potential for short-term stock price volatility should also be noted.

What is the purpose of the merger between DASCO and SolEco?

DASCO is acquiring SolEco to enhance its competitiveness and create synergies within its renewable energy business, particularly in the floating solar power sector.

What are the risks associated with the merger?

Key risk factors include SolEco’s poor financial performance, uncertainties surrounding the merger process, and the potential failure to achieve synergy effects.

What precautions should investors take?

Investors should consider various factors, including SolEco’s profitability after the merger, the performance of DASCO’s existing business, and changes in financial structure post-merger. They should also be aware of potential short-term stock price volatility.