Samyang Packaging: Decoding Samyang Corp’s Major Stake Increase

The market is buzzing after Samyang Corp, the largest shareholder of Samyang Packaging (272550), significantly increased its ownership. This strategic maneuver, boosting its stake to a commanding 71.47%, is far more than a simple stock transaction. It’s a clear signal of intent with profound implications for the company’s management, long-term growth trajectory, and overall corporate value. For investors, understanding the nuances of this development is critical.

What are the real-world impacts of this increased control? How does it affect Samyang Packaging’s fundamentals and its ambitious investment plans? This comprehensive analysis will explore the pros and cons, providing a clear roadmap for investors to navigate the changes and make well-informed decisions.

The Deal Explained: What Does the Stake Increase Mean?

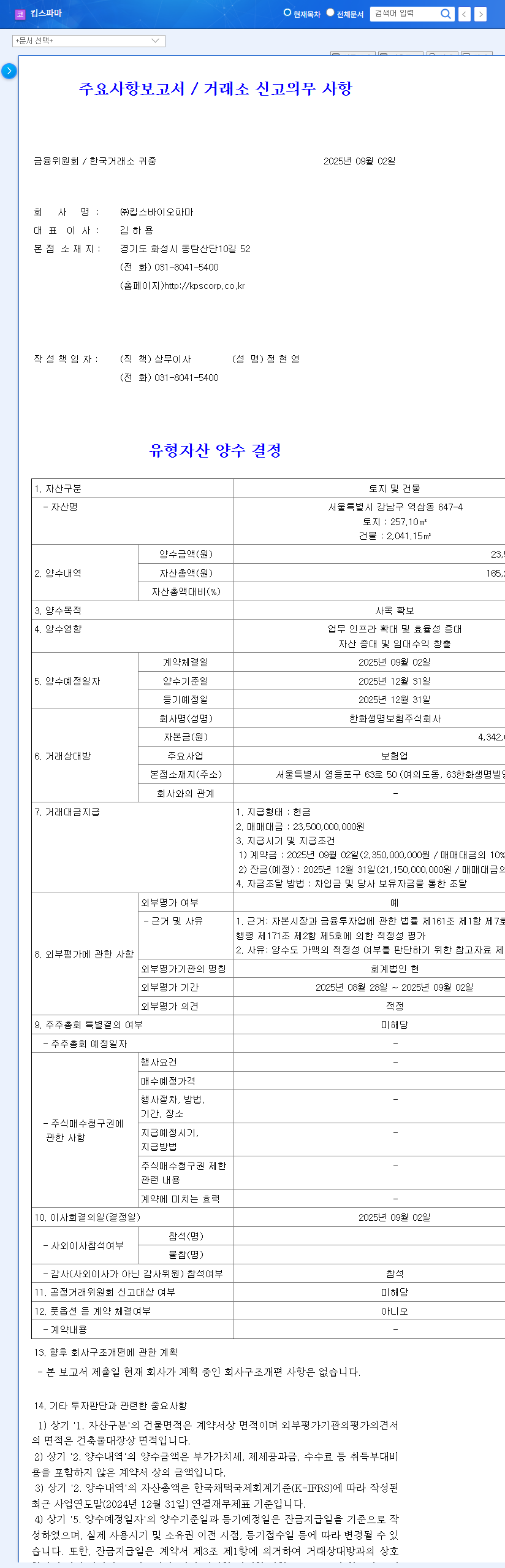

According to an Official Disclosure on DART, Samyang Corp acquired an additional 1,578,867 common shares of Samyang Packaging via an after-hours block trade. This raised its total stake from 66.00% to 71.47%. The stated purpose was unambiguous: ‘influence on management.’ This move effectively solidifies Samyang Corp’s control, enabling faster, more decisive strategic execution.

This action is widely seen as a vote of confidence, aimed at enhancing management stability and accelerating key initiatives. With large-scale facility investments already underway, the reinforced backing from its parent company provides a powerful tailwind for securing future growth engines, particularly in the promising recycling sector.

With a reinforced mandate, Samyang Corp’s increased stake is poised to accelerate Samyang Packaging’s strategic investments, particularly in high-growth areas like sustainable recycling and aseptic packaging.

Fundamental Diagnosis: The State of Samyang Packaging (272550)

To grasp the full context of this Samyang Corp stake increase, we must examine the current health of Samyang Packaging. While facing some short-term headwinds, the company’s core strengths and market position remain robust.

Current Financial & Operational Snapshot

- •Performance: H1 2025 results showed a temporary dip, with sales at KRW 212.1 billion (-7.6%) and operating profit at KRW 12.4 billion (-43%), primarily due to softer demand in PET containers and recycled materials.

- •Financial Health: The company maintains a very healthy balance sheet. Despite a slight asset decrease, a reduction in total liabilities has kept the debt-to-equity ratio at a solid 72.7%.

- •Major Investments: Significant capital is being deployed for future growth, including KRW 39.3 billion for advancing its container business and a massive KRW 71.3 billion for new logistics warehouse construction.

- •Market Leadership: Samyang Packaging holds the #1 market share in the domestic PET container sector and is the leading aseptic beverage OEM/ODM manufacturer in Korea, a high-growth area.

- •Macro Environment: The business is navigating a complex global landscape, including a rising USD/KRW exchange rate and fluctuating oil prices. Understanding how these factors impact corporate performance is key, a topic well-covered by resources like Investopedia.

Analyzing the Impact of the Increased Samyang Corp Stake

Samyang Corp’s tighter control introduces both significant opportunities and potential risks for investors in Samyang Packaging.

Positive Impacts:

The primary benefit is enhanced management stability and efficiency. With a stronger mandate, decision-making becomes faster and more aligned, reducing internal friction and allowing the company to pivot quickly to market changes. This leads to greater operational synergy. Furthermore, it signals stronger financial and strategic support for the company’s ambitious capital expenditures. The large investments in logistics and container technology are now more secure, and we can expect focused investment in high-potential areas like the recycling business (Samyang Ecopartners), which aligns with supportive government green policies. Ultimately, this combination of efficiency and focused growth aims for long-term shareholder value enhancement.

Negative Impacts & Potential Risks:

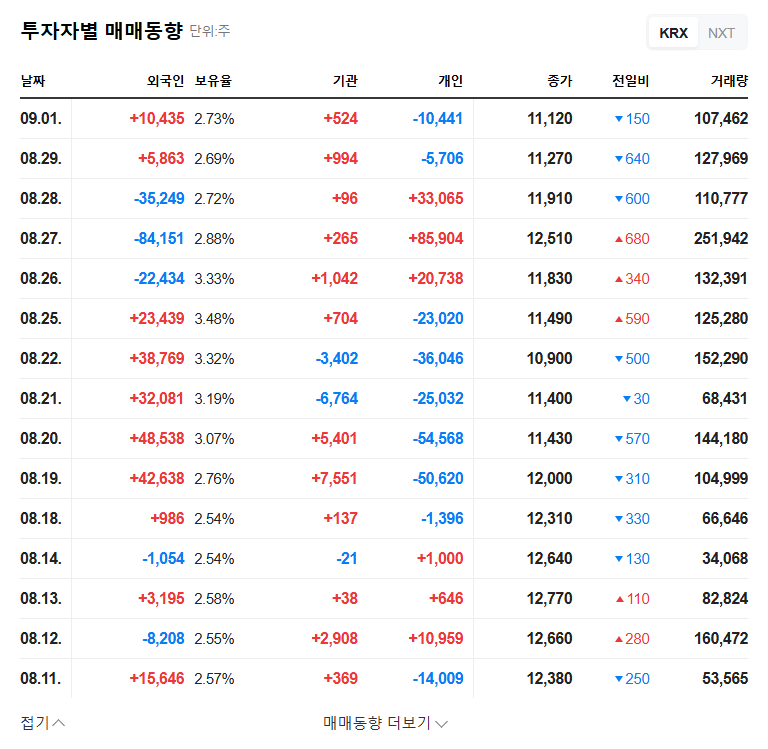

A high concentration of ownership can lead to concerns over centralized decision-making, where the interests of minority shareholders might be overlooked. While Samyang Corp’s track record suggests this risk is currently low, it remains a factor to watch. In the short term, such significant ownership changes can lead to stock price volatility as the market digests the news. Finally, investors should consider the financial health of the parent company, as the method used to finance the stake acquisition could have indirect effects.

Action Plan for Investors: Outlook & Key Watch Points

Overall, the increased stake is a net positive, signaling confidence and strategic alignment for Samyang Packaging. The move should de-risk the company’s major investment cycle and provide a clearer path to growth.

Investment Recommendation & Risk Management

A “Maintain Buy” perspective is warranted. The long-term growth potential, underpinned by market leadership and strategic investment, is compelling. However, investors must actively monitor the company’s ability to reverse the recent dip in performance and improve operating rates. Prudent risk management involves staying aware of macroeconomic pressures like currency fluctuations and interest rate policies.

Key Factors to Monitor

- •Execution of Facility Investments: Track the progress and ROI of the new logistics and container business facilities.

- •Recycling Business Growth: Monitor the profitability and market share expansion of Samyang Ecopartners.

- •Profitability Metrics: Watch for a recovery in operating profit margins and sales growth in the coming quarters.

- •Corporate Governance: Observe how the increased stake influences board decisions and shareholder relations. For a broader perspective, see our full analysis of the Korean corporate governance landscape.

Disclaimer: This analysis is based on publicly available information and represents an expert opinion. All investment decisions are the sole responsibility of the individual investor.