This comprehensive analysis of the latest POONGSAN CORPORATION earnings for Q3 2025 provides investors with a detailed breakdown of the recent ‘earnings shock’. POONGSAN (ticker: 103140), a key player in both the copper products and defense industries, reported preliminary results that significantly missed market consensus, triggering concerns about short-term stock performance. This article delves into the core reasons for this underperformance, evaluates the company’s long-term fundamentals against current macroeconomic headwinds, and outlines a strategic investment approach to navigate the potential volatility.

We will explore both the internal operational factors and the external market pressures that contributed to these results, equipping you with the critical insights needed to make informed decisions beyond the immediate market reaction.

Deconstructing the Q3 2025 ‘Earnings Shock’

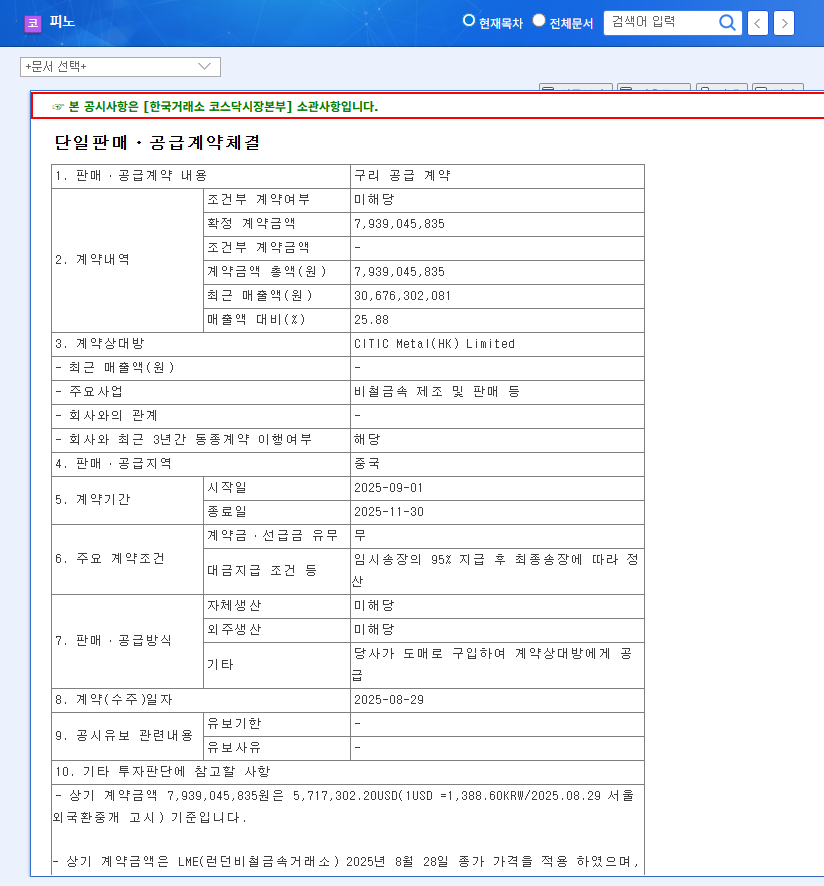

POONGSAN CORPORATION announced its preliminary Q3 2025 financial results, revealing a significant deviation from market expectations. The term ‘earnings shock’ is used when a company’s profits are substantially different from what analysts had forecast, and in this case, the variance was negative. The official figures, as per the company’s disclosure, are as follows:

“The preliminary Q3 2025 results indicate a challenging quarter, with operating profit falling approximately 44.9% short of market consensus. This highlights significant headwinds that impacted profitability more than anticipated.”

Key Financial Metrics vs. Expectations

- •Revenue: KRW 1,174.2 billion (vs. Expected KRW 1,231.1 billion, a -4.62% variance).

- •Operating Profit: KRW 42.6 billion (vs. Expected KRW 77.3 billion, a -44.89% variance).

- •Net Profit: KRW 32.6 billion (vs. Expected KRW 53.5 billion, a -38.88% variance).

The most alarming figure is the operating profit, which not only missed forecasts by a wide margin but also represents a stark decline from the KRW 93.6 billion reported in Q2 2025. This erosion of profitability is the primary driver of investor concern. For official figures, refer to the Official Disclosure (DART).

Analyzing the Causes of Underperformance

The disappointing POONGSAN CORPORATION earnings stem from a complex mix of internal challenges and external macroeconomic pressures. A clear understanding of these factors is essential for a complete 103140 stock analysis.

Internal Factors: Profitability and Operational Headwinds

The significant drop in operating profit points to margin compression. While the company utilizes long-term contracts and futures to hedge raw material risks, unexpected cost surges or unfavorable movements in derivative valuations likely played a key role. The revenue miss, although smaller, suggests softer demand in either the copper products segment or a temporary lull in defense sector deliveries. This heightened volatility, following a sharp profit decline in Q4 2024 and a subsequent recovery, indicates that the company’s profitability is currently sensitive to market dynamics.

External Factors: The Macroeconomic Squeeze

Several global economic trends directly impacted the POONGSAN Q3 2025 results:

- •Currency Volatility: A strong US Dollar (KRW/USD at 1,431.30) can negatively affect companies like Poongsan, which have significant international operations and are exposed to foreign exchange gains and losses.

- •Commodity Price Fluctuations: While rising gold prices can benefit the copper division’s pricing power, the volatility in other raw materials like zinc and the decline in crude oil prices create an unpredictable cost environment. Managing these swings is crucial for margin stability.

- •Global Economic Outlook: Persistent concerns about a global economic slowdown, as reported by institutions like the World Bank, can dampen demand for industrial copper products. Furthermore, ongoing geopolitical risks and interest rate uncertainty affect investment and borrowing costs.

Outlook & Investment Strategy for Poongsan Stock

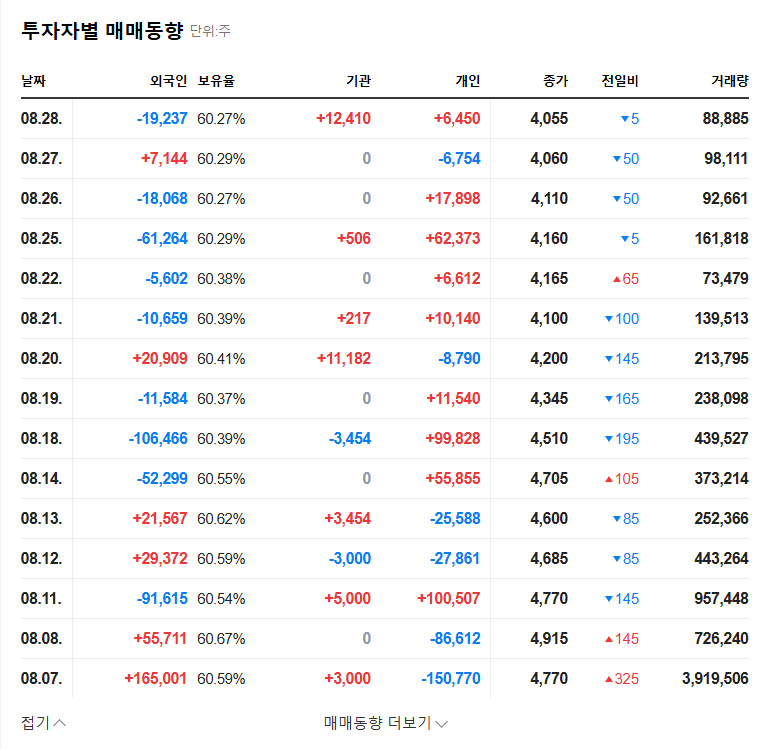

The immediate reaction to this earnings shock is likely to be negative. However, a prudent POONGSAN investment strategy requires looking beyond short-term sentiment and evaluating the company’s long-term value proposition.

Short-Term Pressure vs. Long-Term Fundamentals

In the short term, we expect downward pressure on the stock price as the market digests the negative surprise and analysts revise their forecasts. However, Poongsan’s core fundamentals remain solid. The company boasts a stable financial structure with a manageable debt-to-equity ratio (88.63% as of the last semi-annual report) and a resilient business model balanced between the cyclical copper industry and the robust defense sector. The defense business, in particular, offers significant long-term growth potential amidst rising global security demands. For more on this, consider reading about Investing in the Global Defense Sector.

Investment Thesis: A ‘Neutral’ Stance with a Value-Oriented Watch

Our official investment opinion is ‘Neutral’. Caution is advised in the immediate aftermath of the announcement. Investors should await the company’s official earnings conference call to gain clarity on the precise causes of the profit decline and management’s outlook for Q4 and beyond.

For long-term value investors, a significant price drop could present a compelling entry point. The investment thesis would be based on the company’s intrinsic value, strong position in the defense market, and eventual recovery in the copper cycle, rather than on short-term earnings momentum.

Key Monitoring Points for Investors

- •Conference Call Insights: Analyze management’s commentary on margin recovery and future demand.

- •Commodity Trends: Monitor the prices of key raw materials like copper and zinc.

- •Defense Sector Orders: Track new contracts and export trends in the high-margin defense division.

- •Macro Indicators: Keep an eye on global interest rate policies and currency exchange rates.

Disclaimer: This analysis is for informational purposes only. All investment decisions are the sole responsibility of the investor.