Investors following the dynamic K-Beauty and e-commerce sectors are turning their attention to the upcoming SILICON 2 IR event for the second quarter of 2025. Scheduled for October 23, 2025, at 09:30 AM, this event is more than a simple financial report; it’s a critical window into the company’s health, strategy, and future trajectory. Understanding the nuances of SILICON 2’s performance and outlook is essential for making a sound investment decision, as the information revealed can significantly influence market sentiment and stock valuation.

This comprehensive guide provides a multifaceted analysis of the upcoming SILICON 2 investor relations briefing. We will explore the company’s market position, break down potential scenarios following the announcement, and offer a detailed checklist to help you prepare, analyze, and act on the information presented.

Who is SILICON 2? A Leader in K-Beauty E-Commerce

Before diving into the event itself, it’s crucial to understand the company’s landscape. SILICON 2 Co., Ltd. has carved a significant niche as a global e-commerce platform specializing in Korean beauty (K-Beauty) products. The company connects hundreds of Korean cosmetic brands with a global consumer base, navigating complex logistics and marketing channels. Its performance is often seen as a bellwether for the broader K-Beauty stock analysis, making its financial disclosures highly anticipated.

Why the Q2 2025 Earnings Call Matters

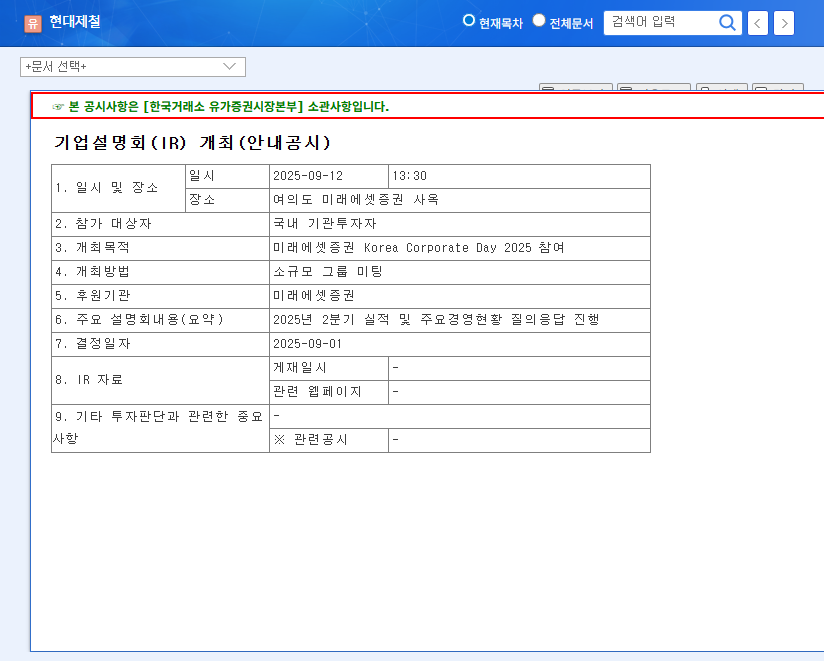

An Investor Relations (IR) event is a direct line of communication between a company’s management and its shareholders. The primary objectives for this specific event are to clarify the Q2 2025 earnings and performance, and to outline strategies for enhancing corporate and investment value. The key details, as per the Official Disclosure, include a comprehensive business overview and a crucial Q&A session with analysts and investors.

The market’s reaction hinges not just on the numbers reported, but on the narrative management weaves around them. Guidance for future quarters, commentary on competitive pressures, and updates on strategic initiatives are often more impactful than the historical data itself.

Potential Scenarios: Decoding the Market’s Reaction

The outcome of the SILICON 2 IR event will create ripples. Here are the potential bullish and bearish scenarios investors should prepare for.

Positive Impact Scenarios (The Bull Case)

- •Earnings Beat: Announcing Q2 revenues and profits that significantly surpass analyst consensus would be the most direct catalyst for a price increase.

- •Strong Forward Guidance: A confident outlook for Q3 and the rest of the fiscal year, signaling sustained growth, could boost investor confidence.

- •Strategic Growth Drivers: Unveiling successful expansion into new geographic markets (e.g., Europe, South America) or new high-margin product categories would excite the market about future potential.

Negative Impact Scenarios (The Bear Case)

- •Earnings Miss: If Q2 performance falls short of market expectations, especially on key metrics like operating profit margin, it could trigger a sell-off.

- •Growth Deceleration: Any indication that the rapid growth of the K-Beauty market is slowing, or that SILICON 2 is losing market share, would be a major red flag.

- •Margin Compression: Discussing rising costs related to logistics, marketing, or inventory without a clear plan to mitigate them could signal pressure on future profitability.

Your Action Plan: A Strategic Investment Checklist

A proactive SILICON 2 investment strategy requires preparation. Don’t just wait for the news; anticipate it and be ready to analyze it objectively.

1. Pre-Event Research (Homework)

Gather context. Review SILICON 2’s previous quarterly reports and read recent analyst coverage to understand the market consensus. What are the expected revenue and EPS figures? Familiarize yourself with our guide on K-Beauty Market Trends to understand the industry’s tailwinds and headwinds.

2. During the Event (Active Listening)

Listen carefully to management’s tone during the presentation and the Q&A. Are they confident and transparent, or evasive and defensive? Pay close attention to questions from analysts regarding competition, supply chain, and international expansion, as these often highlight key investor concerns.

3. Post-Event Analysis (Objective Assessment)

Once the numbers are out, the real work begins. Meticulously compare the actual results to both your expectations and the market consensus. Analyze key metrics beyond the headline numbers, such as customer acquisition cost, average order value, and inventory turnover. Following the event, monitor financial news outlets like Bloomberg for professional commentary and track stock volume and price action to gauge the market’s collective verdict.

In conclusion, the SILICON 2 IR event offers a valuable opportunity for investors. By conducting thorough due diligence and analyzing the information within the broader market context, you can move beyond speculation and make informed decisions based on a solid, strategic foundation.