After a turbulent period following its KOSDAQ listing, NRB, inc has captured the market’s attention with a landmark announcement. The company has secured a large-scale housing construction agreement with the esteemed Korea Land and Housing Corporation (LH), a deal that represents far more than just a number on a balance sheet. For investors and market watchers, the critical question is whether this collaboration can genuinely overhaul NRB, inc’s financial structure, reverse its persistent losses, and act as the much-needed catalyst for a sustained stock rebound.

This comprehensive analysis delves into the specifics of the NRB-LH contract, scrutinizes the company’s fundamentals, and outlines the critical factors investors must monitor. We will explore how NRB, inc aims to leverage this pivotal opportunity within a dynamic market environment and what the future may hold for its stock.

The Landmark Deal: NRB, inc & LH’s ₩29.9 Billion Partnership

Project Overview: A Major Public Housing Initiative

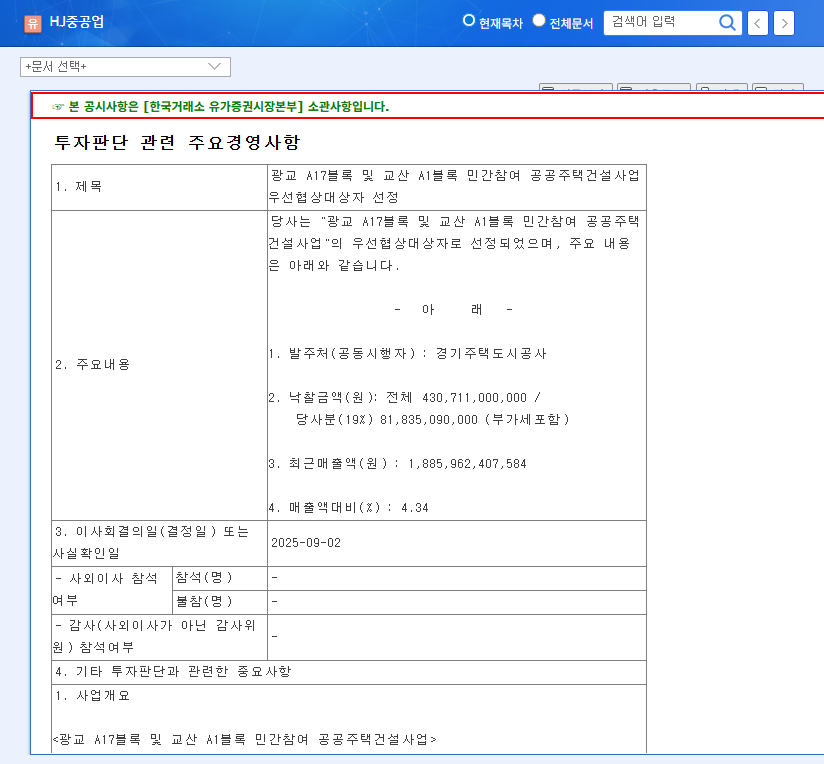

On October 31, 2025, NRB, inc officially announced the signing of a business agreement with the Korea Land and Housing Corporation (LH). This partnership is for private-sector participation in small-scale public housing construction projects in the ‘Wandojungdo’ and ‘Goheungdoyang’ regions. The news, confirmed in the company’s Official Disclosure, marks a significant milestone.

- •Total Contract Value: ₩29.9 billion (approx. $22 million USD)

- •Contract Period: October 31, 2025, to December 31, 2027 (2 years, 2 months)

- •Scale Significance: This single contract is equivalent to a staggering 56.68% of NRB, inc’s entire 2024 annual revenue.

This agreement is more than a simple revenue boost; it’s a powerful endorsement. Partnering with a major public entity like LH officially validates NRB, inc’s modular construction technology and project management capabilities. This recognition is a critical stepping stone that could unlock a pipeline of future public and private sector contracts, positioning the company as a leader in innovative building solutions.

This isn’t just a contract; it’s a seal of approval. The LH partnership provides NRB, inc with a crucial revenue stream and the credibility needed to pursue larger, more ambitious projects in the burgeoning modular construction market.

NRB, inc’s Financial Health: A Tale of Opportunity and Concern

Positive Catalysts for Growth

- •Technological Edge: NRB, inc holds core technologies in PC Ramen modular methods and seismic performance, making it a strong contender for modern construction projects like the ‘Green Smart Future School’ initiative.

- •Improved Capital Access: A successful KOSDAQ listing and issuance of convertible bonds have improved the company’s ability to raise funds for crucial investments in factory expansion and production capacity.

Persistent Headwinds and Risks

- •High Debt Load: With a debt-to-equity ratio of approximately 285%, the company is highly leveraged. This means significant financial costs can eat into profitability, especially in a volatile interest rate environment.

- •Profitability & Efficiency Issues: The company posted a net loss in the first half of 2025, compounded by a very low factory utilization rate of just 17.5%. This signals significant inefficiency in its current production pipeline.

- •Competitive Market: The modular market is intensely competitive, and expanding into new areas like electrical and fire facility construction requires costly recruitment of specialized personnel.

Investor Guide: Navigating the Future of NRB, inc Stock

The LH contract is undeniably a positive development for NRB, inc. It provides a clear revenue path and validates its market position. The global modular construction market is projected to grow significantly, and this deal places NRB at the forefront of that trend in Korea. For investors, this creates a compelling but complex opportunity.

However, the underlying financial concerns remain. A single contract, no matter how large, does not instantly solve issues of high debt and low operational efficiency. The long-term success of the NRB, inc stock will depend entirely on flawless execution and strategic management.

Key Monitoring Points for a Potential Stock Rebound

- •Quarterly Profitability: Watch for a clear trend of improving margins. Is the LH project translating into actual profit, or are costs running higher than expected?

- •Factory Utilization Rate: This is a critical metric. The company must demonstrate that this contract is significantly boosting its factory output above the current 17.5% level.

- •Debt Reduction Strategy: Look for announcements or actions from management regarding plans to use new cash flow to pay down its substantial debt.

- •Future Contract Wins: The true test will be if NRB, inc can leverage the LH deal to secure a steady stream of new orders, proving this is not a one-off success. For more insights, see our guide to Investing in the KOSDAQ Market.

In conclusion, this event offers NRB, inc a golden opportunity to transform its trajectory. While the short-term stock price may see a positive reaction, sustainable growth hinges on the company’s ability to execute flawlessly and translate this massive project into tangible, long-term financial health.

Frequently Asked Questions

Q1: What is the nature of the contract NRB, inc signed with LH?

A1: On October 31, 2025, NRB, inc signed a business agreement with the Korea Land and Housing Corporation (LH) for private-sector participation in small-scale public housing construction projects in the ‘Wandojungdo’ and ‘Goheungdoyang’ regions, utilizing modular construction technology.

Q2: How significant is this contract for NRB, inc’s operations?

A2: The contract value is ₩29.9 billion, a substantial order equivalent to 56.68% of NRB, inc’s 2024 annual revenue. It is expected to be a major contributor to revenue growth and performance improvement.

Q3: What is NRB, inc’s current financial health?

A3: The company faces challenges, including a high debt-to-equity ratio of approximately 285% and a history of recent losses. However, it is also actively raising funds and investing in business expansion to fuel future growth.

Q4: How might this contract affect the NRB, inc stock price?

A4: News of a large order can positively impact the stock price in the short term. However, long-term performance will be heavily influenced by successful project execution, achieving real profitability, and improving factory utilization rates.