The latest KRAFTON Q3 2025 earnings report has sent a complex but ultimately compelling message to the market. The gaming powerhouse behind global hits like PUBG has posted financials that showcase incredible profitability, with net profits soaring past expectations. However, a simultaneous miss on operating profit has left investors and analysts digging deeper. Is this a sign of trouble, or a calculated move in a much larger strategic game? This comprehensive analysis will unpack the numbers, explore the fundamentals, and provide a clear outlook on what this means for the future of KRAFTON stock.

KRAFTON Q3 2025 Earnings: The Official Numbers

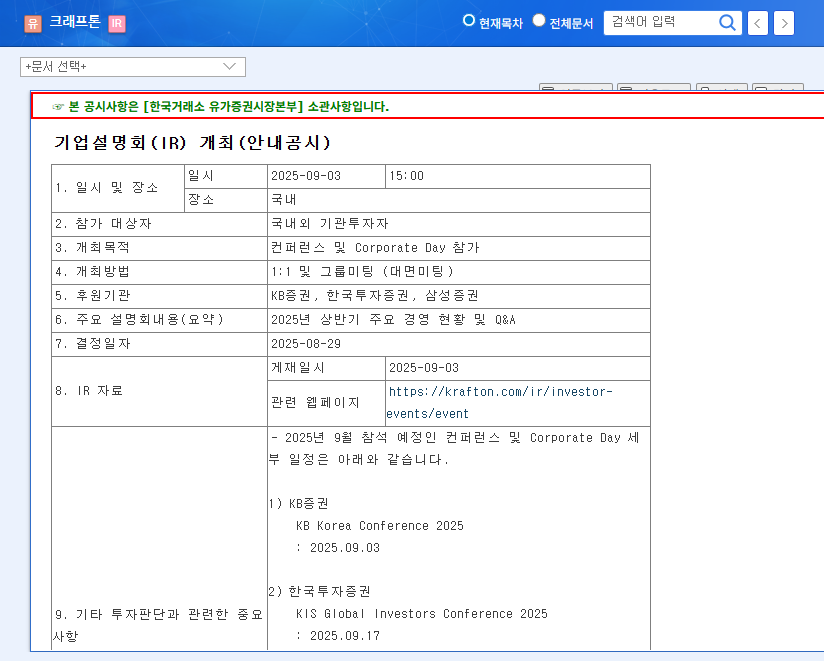

On November 4, 2025, KRAFTON released its provisional consolidated KRAFTON financial results for the third quarter. The report revealed a company firing on all cylinders in terms of revenue and pure profit, while strategically increasing investment for future endeavors. The key figures, when compared to market consensus, paint a fascinating picture:

- •Revenue: KRW 870.6 billion, a solid 2% above the market expectation of KRW 849.8 billion.

- •Net Profit: KRW 367.5 billion, an impressive 24% surge above the market expectation of KRW 296.6 billion.

- •Operating Profit: KRW 348.6 billion, falling 5% short of the market expectation of KRW 368.5 billion.

These figures are based on the company’s official filing. For a detailed breakdown, investors can refer to the Official Disclosure on DART.

The dip in operating profit isn’t a sign of weakness, but rather a deliberate investment in KRAFTON’s future. Increased spending on R&D, new IP development, and AI integration is a strategic cost essential for long-term dominance.

Analyzing KRAFTON’s Core Strengths & Strategy

To understand the long-term potential, it’s crucial to look beyond a single quarter’s operating profit. KRAFTON’s foundation is built on several key pillars that continue to drive its growth and insulate it from market volatility.

Global Dominance and Financial Fortitude

KRAFTON is a truly global entity, with a staggering 95% of its total revenue originating from overseas markets. This demonstrates not just brand power but a diversified revenue stream that is less susceptible to regional economic downturns. Financially, the company is a fortress, boasting total assets of KRW 7.6 trillion against liabilities of only KRW 0.84 trillion, resulting in immense financial soundness and flexibility for future investments.

The ‘Scale-up the Creative’ IP Pipeline

The company’s core ‘Scale-up the Creative’ strategy is focused on building massive, enduring franchise IPs. This involves both strengthening existing titles and aggressively developing new ones. Projects like the highly anticipated life-sim game inZOI and the multimedia expansion of The Bird That Drinks Tears IP are prime examples of this long-term vision in action. These are not just new games; they are foundational pillars for future revenue, merchandising, and entertainment ecosystems. You can learn more by reading about KRAFTON’s deep IP development strategy.

Navigating Potential Risks and Market Headwinds

Despite its strengths, KRAFTON operates in a highly dynamic and competitive environment. Investors should remain aware of several key risks that could impact future performance.

- •New Game Performance: The ultimate success of major investments hinges on the market reception of new titles. A blockbuster launch can send the stock soaring, while a miss can temper growth expectations.

- •Intense Market Competition: The global gaming industry is fiercely competitive. As documented by industry analysts at major publications like Bloomberg, maintaining market share requires constant innovation and significant marketing spend.

- •M&A Integration: Successfully integrating acquired companies like Neptune and realizing the projected synergies from strategic investments is crucial for validating the company’s expansion strategy.

- •Macroeconomic Factors: With its high proportion of overseas sales, fluctuations in currency exchange rates (KRW/USD, KRW/EUR) can significantly impact reported earnings.

Investment Outlook for KRAFTON Stock

The KRAFTON Q3 2025 earnings report solidifies a ‘cautiously neutral’ to ‘long-term positive’ outlook. The market may react with short-term uncertainty to the operating profit miss, potentially creating price adjustments. However, the underlying strength shown in revenue and KRAFTON net profit provides a strong floor.

The long-term value of KRAFTON stock will be determined by the successful execution of its growth strategy. Astute investors should monitor the progress of new IP launches, the tangible results from AI technology investments, and the synergistic performance of its M&A activities. While short-term patience may be required, KRAFTON is clearly investing today for a more dominant and profitable tomorrow.