What Happened? JP Morgan Sells Off Protina Shares

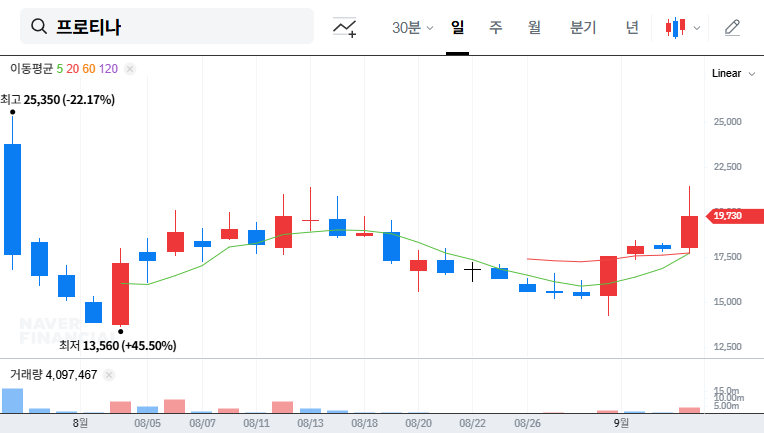

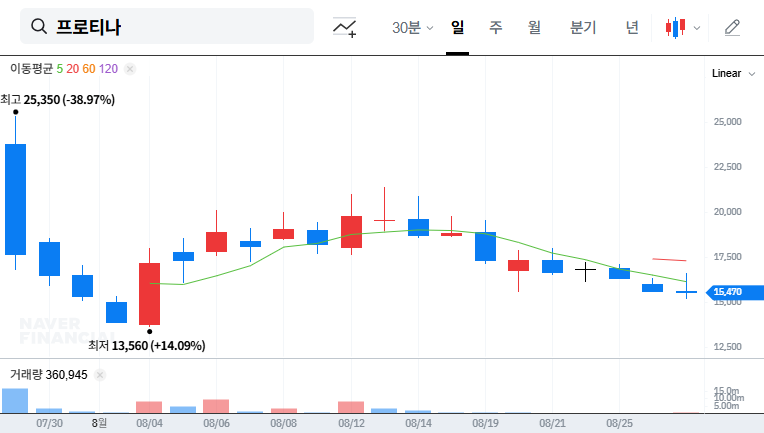

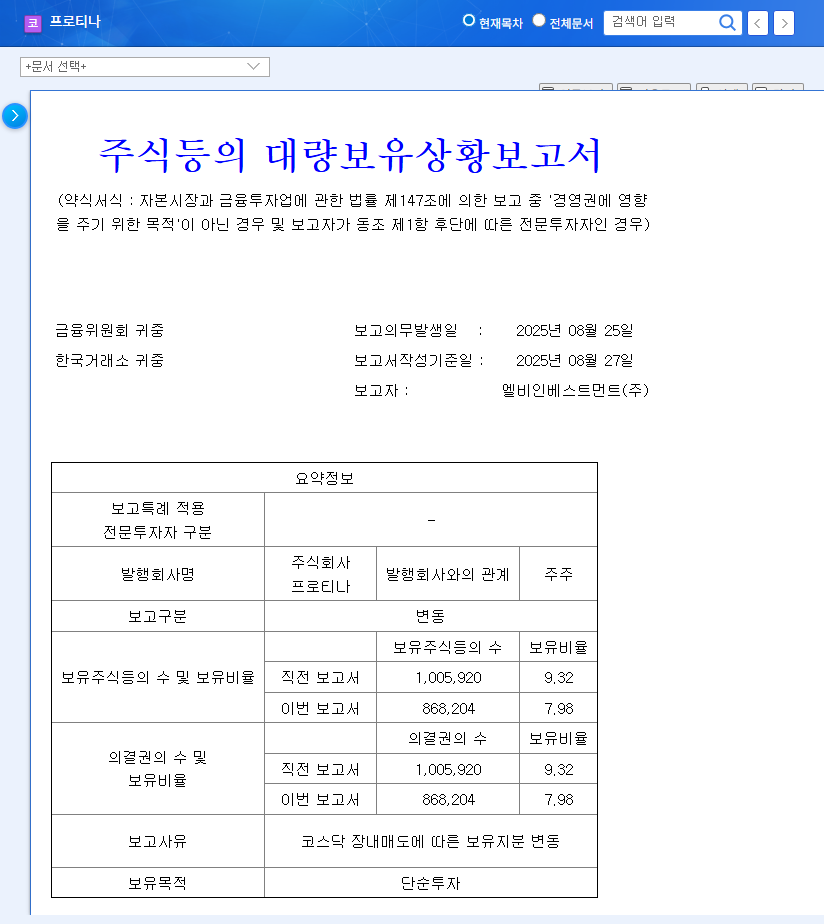

On September 10, 2025, JP Morgan Asset Management sold 12,408 shares of Protina, reducing its stake from 5.16% to 2.89%. This sell-off occurred between September 5th and 8th.

Why Did JP Morgan Sell? Analyzing the Motives

While JP Morgan stated the purpose as ‘simple investment,’ various interpretations are circulating in the market. Profit-taking after the recent IPO and portfolio adjustments due to changes in investment strategy are among the primary speculated reasons. It’s crucial to understand that based on currently available information, it’s difficult to definitively conclude that this sell-off reflects a negative assessment of Protina’s fundamentals.

Protina’s Current State: Fundamental Analysis

- Positive Factors:

- Growth of PPI analysis platform-based services

- Funds secured through KOSDAQ listing

- Negative Factors:

- Continued operating losses and decline in sales in H1 2025

- Increased sensitivity to USD exchange rate fluctuations

What Should Investors Do? Investment Strategy Recommendations

- Short-term Investors: A cautious approach is advised, considering the potential for short-term price decline.

- Long-term Investors: Carefully analyze upcoming earnings announcements, service sector performance, and new contract signings to reassess the company’s long-term growth potential.

- All Investors: Monitor changes in macroeconomic indicators such as exchange rates and interest rates, and adjust investment positions accordingly.

Frequently Asked Questions

What does JP Morgan’s selling of Protina shares mean?

While JP Morgan officially stated the reason as ‘simple investment,’ it is likely due to profit-taking after the recent IPO or portfolio adjustments following changes in investment strategy. This doesn’t necessarily indicate a deterioration in the company’s fundamentals.

Is it a good idea to invest in Protina now?

A cautious approach is needed in the short term due to potential downward pressure on the stock price. From a long-term perspective, investment decisions should be made after carefully analyzing factors such as future earnings improvements, growth in the service sector, and management of exchange rate volatility.

What is the outlook for Protina?

Protina possesses innovative technology, but faces short-term challenges related to profitability and exchange rate volatility. Future earnings performance and growth momentum in the service sector will be key determinants of the stock’s direction.