Key Takeaways from Cellbion’s IR

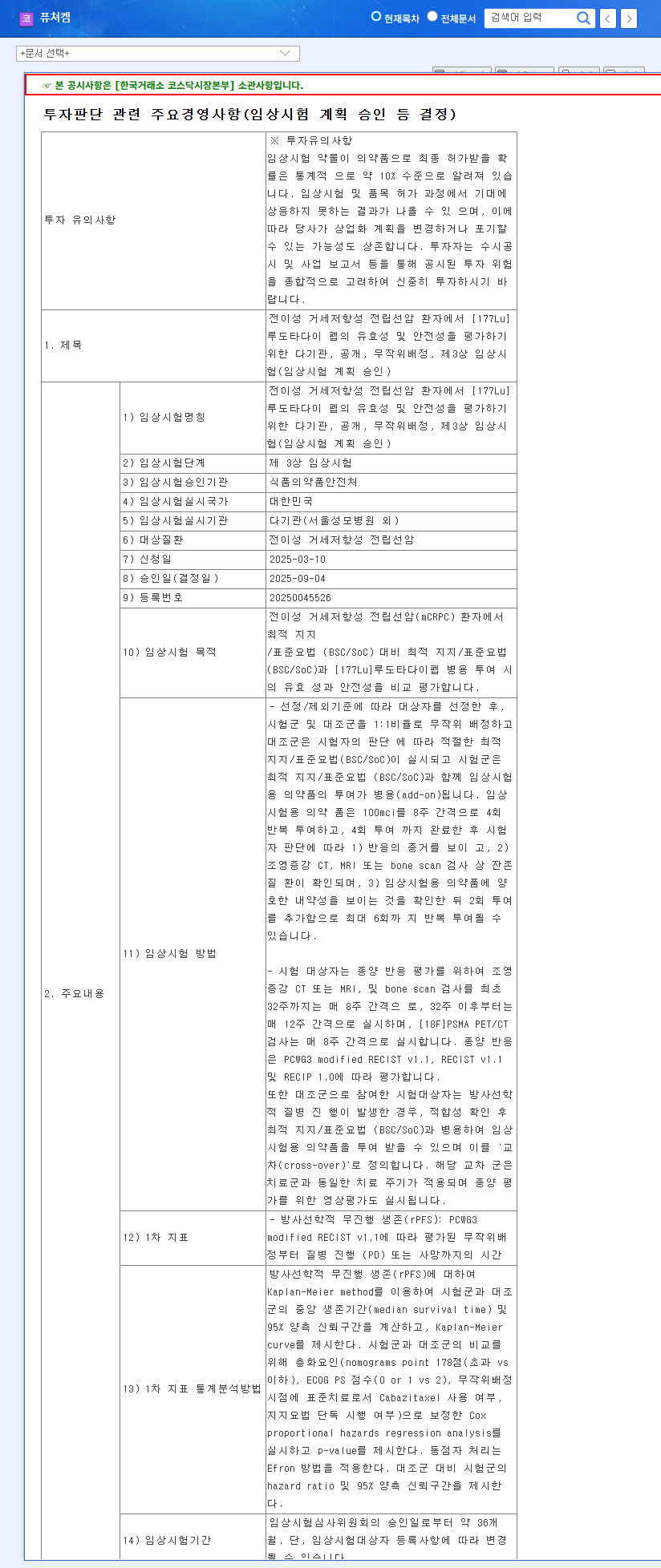

- Lu-177-DGUL Phase 2 Clinical Trial Results: Positive results exceeding market expectations could significantly impact the stock price.

- Conditional Approval and Commercialization Strategy: A clear explanation of the drug’s differentiation from competitors like Pluvicto and its market entry strategy is crucial.

- CDMO Business Growth Plan: Investors will be looking for details on Cellbion’s CDMO expansion strategy and specific performance targets for stable revenue generation.

- Financial Restructuring Plan: Addressing concerns about high R&D costs with a clear funding plan and financial stability measures is essential.

Investment Opportunities and Risks

- Opportunities: Successful clinical outcomes and market entry for Lu-177-DGUL could boost Cellbion’s valuation.

- Risks: Disappointing clinical results or difficulties in securing funding could lead to a decline in the stock price.

Investor Action Plan

Investors should carefully analyze the information presented during the IR meeting, considering the market competitiveness of Lu-177-DGUL and Cellbion’s financial stability. A long-term investment strategy, rather than focusing on short-term price fluctuations, is recommended.

Frequently Asked Questions

What is Lu-177-DGUL?

Lu-177-DGUL is a radiopharmaceutical drug being developed by Cellbion for the treatment and diagnosis of prostate cancer. It is currently in phase 2 clinical trials and has been designated as an orphan drug and GIFT 11.

What are Cellbion’s main businesses?

Cellbion’s primary businesses are new drug development (Theranostics-based precision medicine), production of generic pharmaceuticals, and CDMO services.

What are the key investment considerations for Cellbion?

Investors should consider the uncertainties inherent in drug development, the company’s ongoing operating losses, and competition from other drugs. It is crucial to carefully review IR materials and public disclosures before making any investment decisions.