What Happened?

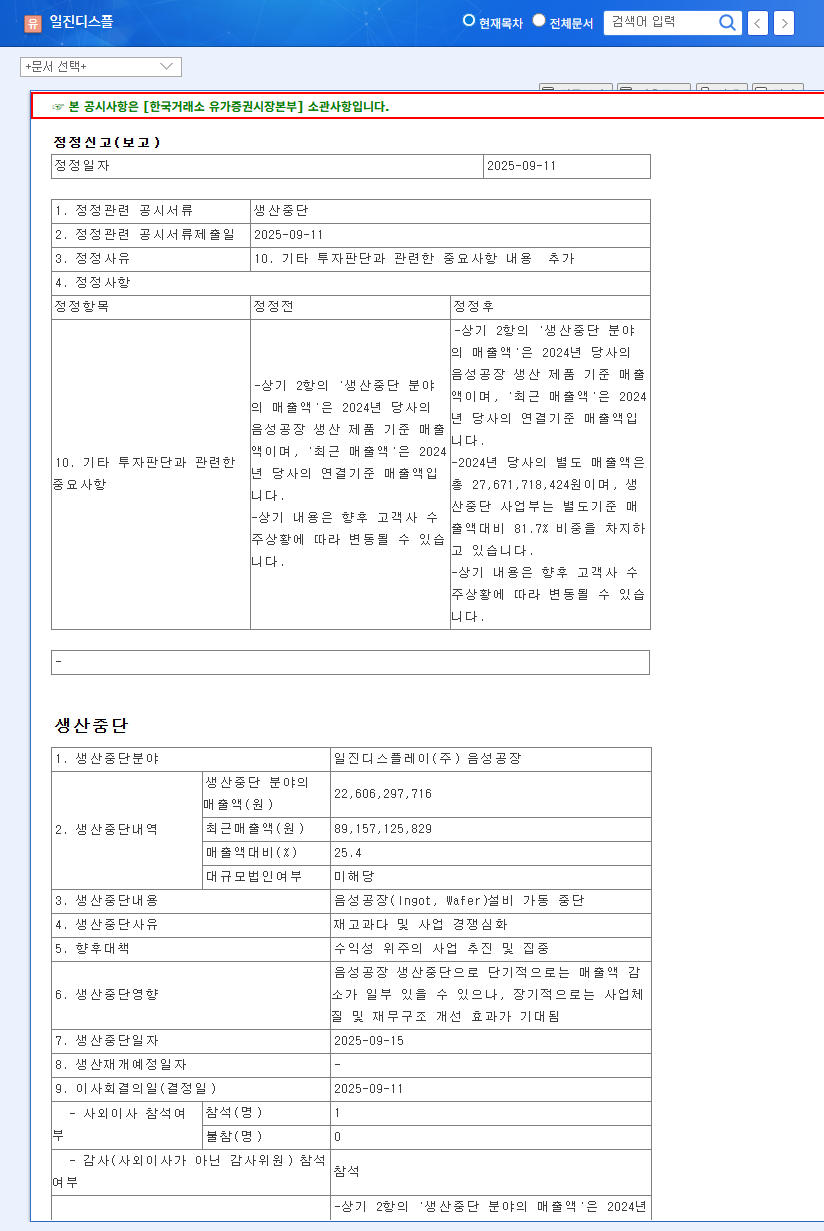

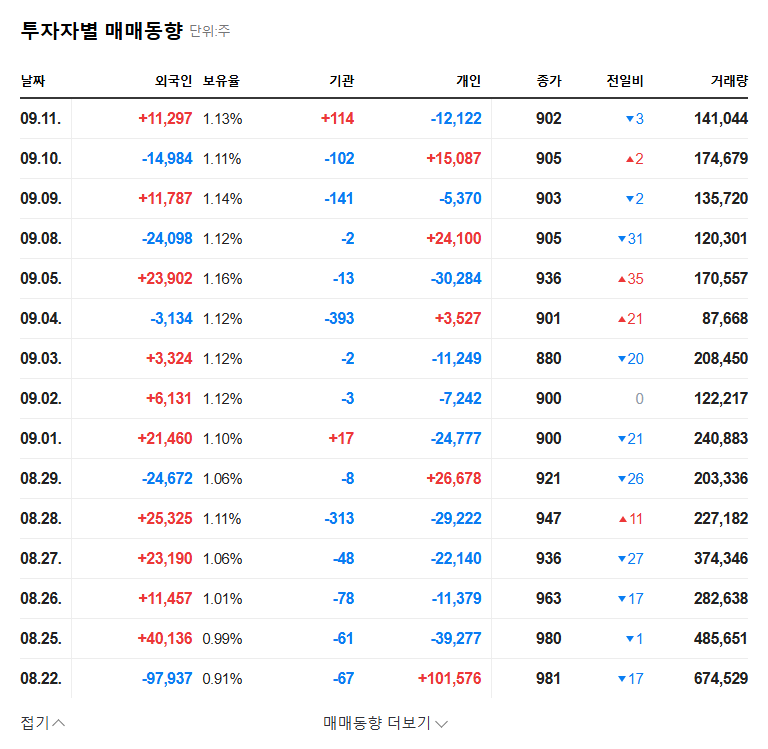

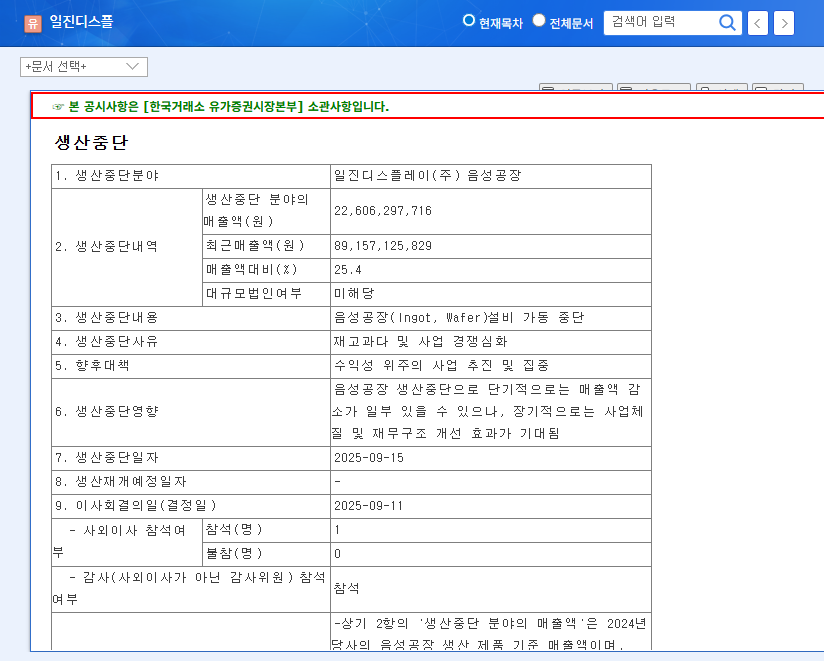

Iljin Display announced on September 11, 2025, the suspension of Ingot and Wafer production at its Eumseong plant. This is projected to result in a sales decrease of approximately 226 billion won, representing 25.4% of the company’s total revenue.

Why the Halt?

Iljin Display has been facing declining sales in its DS (Touch Screen Panel) and AD (Sapphire Wafer) divisions due to a slowdown in the smartphone market and intensified competition. The production halt appears to be an inevitable choice to improve profitability. The company stated its intention to focus on new businesses, such as Micro-LED substrates and SiC processing.

What’s the Impact?

- Short-term Impact: Sales decline, profit deterioration, worsening financial health, stock price drop

- Long-term Impact: Accelerated business restructuring, focus on new businesses, potential weakening of competitiveness, need for strengthened financial risk management, downward adjustment of market expectations

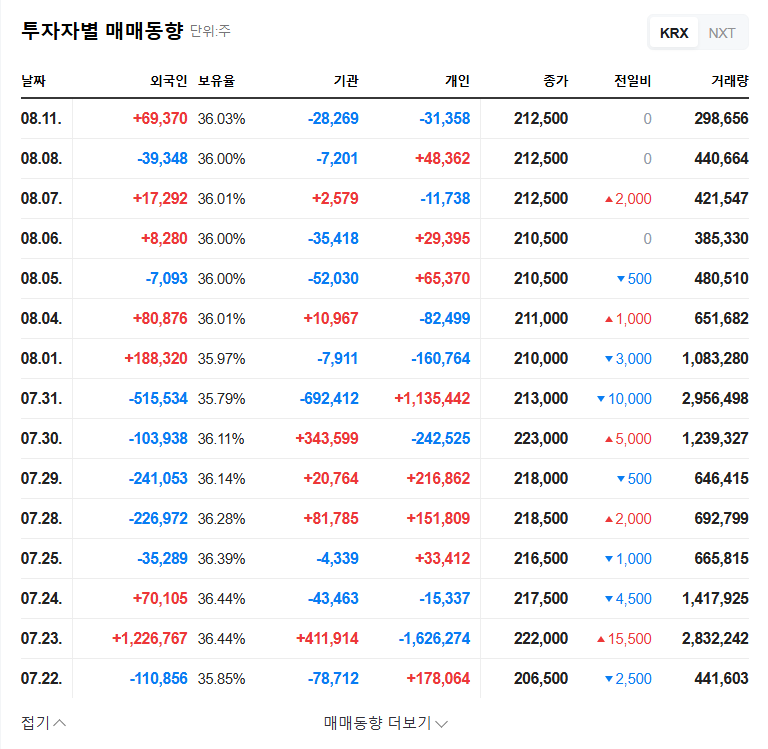

What Should Investors Do?

Investors should exercise extreme caution with Iljin Display at this time. Selling or reducing holdings should be considered. Closely monitor the company’s business restructuring, progress in new ventures, and efforts to improve financial health.

FAQ

Why did Iljin Display halt production at its Eumseong plant?

The production halt is a strategic decision driven by struggling existing businesses due to a smartphone market slowdown and increased competition, coupled with a focus on new ventures.

How will this production halt affect Iljin Display’s stock price?

The halt is expected to increase downward pressure on the stock price due to weakened investor sentiment.

How should investors respond?

Investors should consider selling or reducing their holdings and closely monitor the company’s restructuring efforts and progress in its new business ventures.