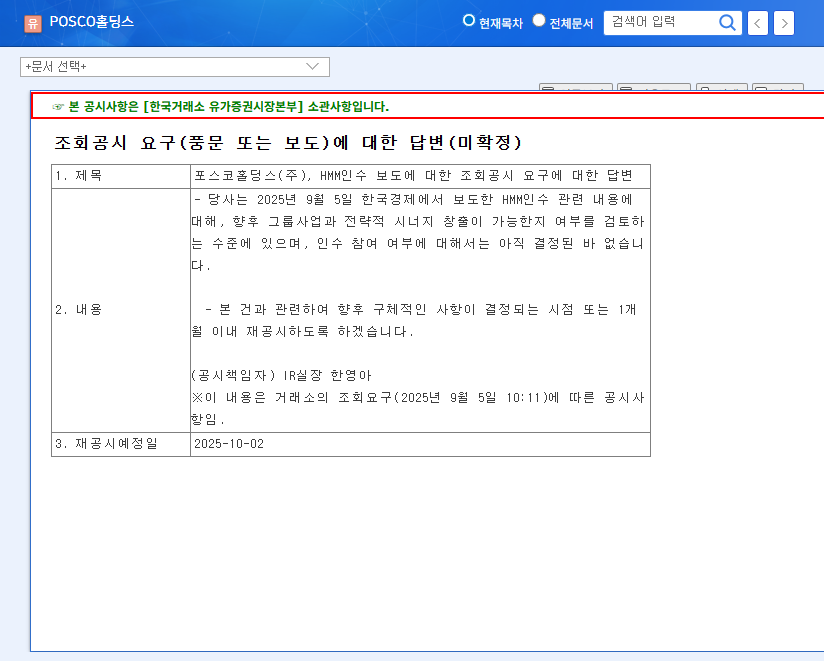

1. What’s Happening? POSCO Holdings Explores HMM Acquisition

POSCO Holdings recently announced that it is exploring the possibility of acquiring HMM. Although nothing has been finalized, the market is already buzzing with speculation.

2. Why Consider HMM? Background and Synergy Analysis

- Strengthening Global Supply Chain: The acquisition could enhance POSCO Holdings’ global competitiveness by improving logistics efficiency for its core businesses like steel and secondary battery materials.

- Business Diversification: Entering the shipping and logistics business would provide a new growth engine and increase stability against economic fluctuations.

- Increased Market Power: Acquiring HMM, Korea’s largest shipping company, would significantly expand POSCO Holdings’ influence in the global logistics market.

3. Are There Risks? Potential Downsides to Consider

- High Acquisition Cost: A hefty price tag could strain POSCO Holdings’ financial health.

- Shipping Industry Uncertainty: The possibility of a global economic downturn and volatility in shipping rates could negatively impact HMM’s profitability.

- Post-Merger Integration (PMI) Risk: Potential challenges such as cultural clashes and failure to realize synergies need to be addressed.

4. What Should Investors Do? Action Plan

The HMM acquisition presents both opportunities and risks for POSCO Holdings. Investors should carefully consider the following:

- Acquisition Price and Financing: Excessive debt could weaken the company’s financial soundness.

- Potential for Synergy: Closely examine the specific business plans and potential synergies after the acquisition.

- Future Announcements and Market Conditions: Continuously monitor future announcements and market reactions.

Always invest cautiously! Be sure to check the disclaimer.

FAQ

How will the HMM acquisition affect POSCO Holdings’ stock price?

It’s difficult to predict at this point. The stock price could react differently depending on various factors such as the acquisition price, synergy effects, and market conditions.

When will the HMM acquisition be finalized?

POSCO Holdings is expected to announce its decision on October 2, 2025.

What are the potential synergies between POSCO Holdings and HMM?

It’s expected that POSCO Holdings could benefit from increased logistics efficiency for its steel and secondary battery material businesses, while HMM could secure stable cargo volume.