In the high-stakes world of biotech investment, few events are more telling than the achievement of a clinical milestone. For GI Innovation Inc., a recent development concerning its key pipeline asset, GI-301, has sent a clear signal to the market. The company announced the receipt of a significant GI-301 milestone payment from its partner, Yuhan Corporation. This isn’t just a simple cash infusion; it’s a powerful validation of the drug’s potential and a critical data point for current and prospective investors.

This in-depth analysis will dissect the announcement, exploring the financial implications, the scientific validation it represents, and what this pivotal moment means for the long-term value of GI Innovation Inc. We will explore the context behind the payment, its impact on the company’s fundamentals, and provide a strategic outlook for investors navigating the volatile biotech sector.

Deconstructing the KRW 5.5 Billion Announcement

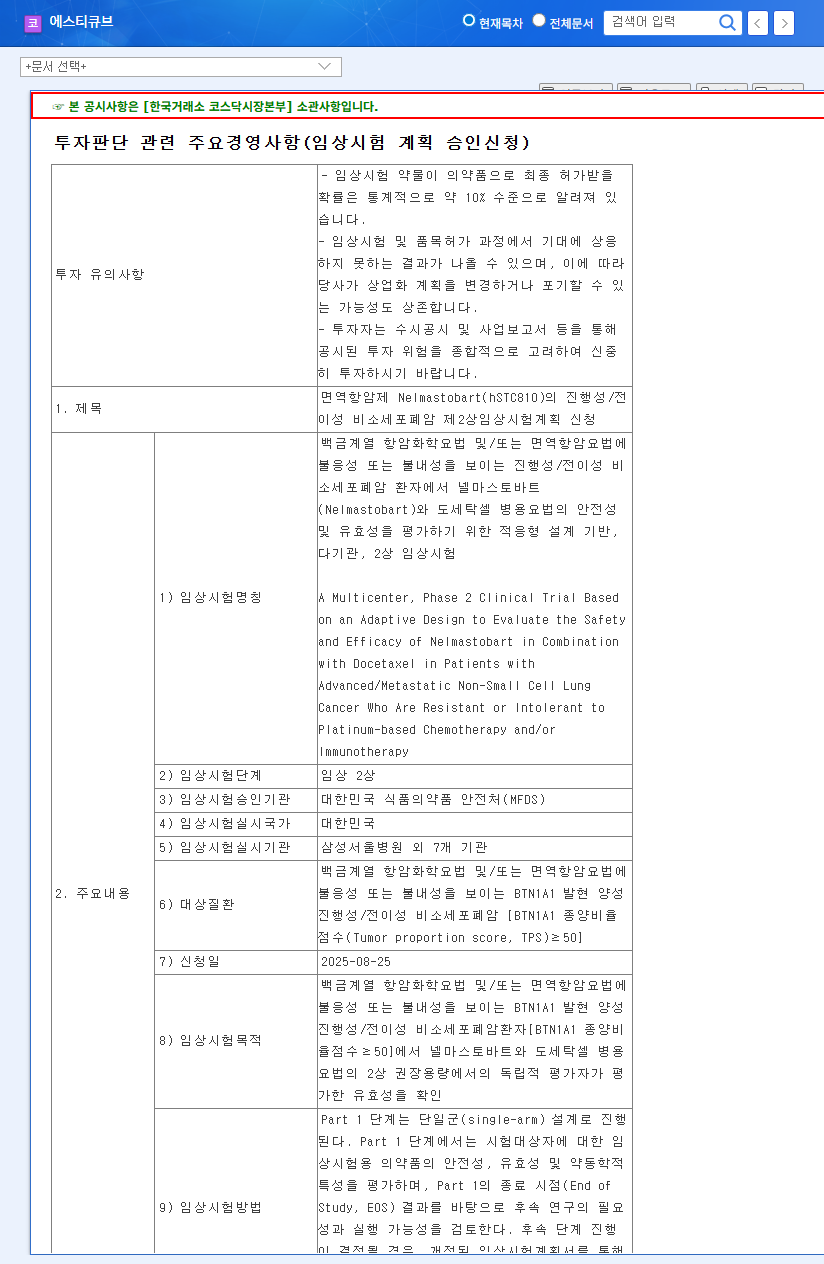

On October 15, 2025, GI Innovation Inc. formally disclosed the receipt of a KRW 5.5 billion (approx. USD 4.1 million) milestone payment from Yuhan Corporation. This payment was triggered by a crucial achievement in their licensing agreement for GI-301: the official approval to commence a Phase 2 clinical trial. This step is a major hurdle in drug development, moving the focus from initial safety assessments (Phase 1) to evaluating the drug’s efficacy in a larger patient population.

The financial weight of this payment is underscored by its regulatory implications. Representing over 10% of GI Innovation’s revenue from the previous year, this event mandated a public filing under the Capital Markets Act. The full details can be reviewed in the Official Disclosure (Source: DART). This transparency provides investors with concrete, verifiable information about the company’s progress.

Why This GI-301 Milestone Payment Matters

For any biotech company, especially one in the pre-commercial stage, pipeline progress is the primary driver of valuation. A milestone payment is more than just revenue; it’s a multi-faceted signal of success and future potential.

This payment from a major pharmaceutical partner like Yuhan Corporation serves as an external, objective validation of GI-301’s scientific merit and commercial viability. It signifies that the asset has been de-risked enough to justify continued, significant investment.

Positive Implications for GI Innovation

- •Enhanced Financial Runway: The KRW 5.5 billion inflow directly boosts the company’s liquidity, extending its operational runway. This crucial capital can fund ongoing R&D and operations without resorting to potentially dilutive financing rounds.

- •Pipeline Validation: Successfully advancing to a Phase 2 clinical trial is a significant scientific achievement. The associated payment from a partner validates this progress in financial terms, increasing confidence in the asset’s underlying technology. For more on this, investors can review the standard FDA drug development process.

- •Strengthened Partnership: This successful milestone reinforces the strategic alliance with Yuhan Corporation, one of Korea’s leading pharmaceutical firms. A strong partnership is critical for navigating the complex and costly path to commercialization.

- •Increased Investor Appeal: Tangible progress like this milestone payment boosts corporate credibility and visibility, making GI Innovation a more attractive candidate for institutional and retail biotech investment.

Potential Risks and Considerations

Despite the positive news, prudent investors must remain balanced. Clinical development is inherently risky, and Phase 2 trials have a significant failure rate. While this payment de-risks the asset to a degree, the ultimate outcome is not guaranteed. Furthermore, KRW 5.5 billion, while substantial, may not fundamentally alter the company’s long-term financial structure on its own. The market’s reaction can also be unpredictable, especially if expectations were already high.

Strategic Outlook for Investors

This GI-301 milestone payment is a significant green flag, but it’s one data point in a much larger picture. For a comprehensive investment thesis, consider the following actions:

- •Monitor Future Milestones: This is just the beginning. The licensing agreement likely contains larger payments tied to Phase 3 initiation, regulatory submission, approval, and sales thresholds. Keep a close watch on the clinical progress of GI-301.

- •Analyze the Competitive Landscape: Research the target indication for GI-301. Who are the competitors? What are the existing standards of care? Understanding the market potential is crucial for valuing the asset.

- •Evaluate the Entire Pipeline: A diversified pipeline reduces single-asset risk. Investors should review our guide on How to Evaluate a Biotech Company’s Pipeline to assess the other programs GI Innovation is developing.

- •Observe Market Sentiment: Track analyst reports and market reaction to gauge institutional sentiment. However, always base decisions on fundamental analysis rather than short-term market noise.

In conclusion, the GI-301 milestone payment is a material and positive development for GI Innovation Inc. It provides a welcome financial buffer, validates its R&D strategy, and strengthens a key partnership. While significant risks inherent to drug development remain, this event marks a tangible step forward in the company’s journey toward commercialization. For investors, it serves as a powerful confirmation that the company is executing on its promises, warranting continued and careful observation.