1. What Happened?

Daewoong Pharmaceutical’s Fexuclue has been granted marketing authorization by the National Medical Products Administration (NMPA) of China. While the company also released its 2024 business report (amended), the amendments primarily clarified existing information, with minimal direct impact on fundamentals.

2. Why Does It Matter?

China represents the second largest pharmaceutical market globally. Fexuclue’s entry into China presents a significant opportunity for Daewoong to boost sales and expand its global presence. As a P-CAB inhibitor with superior efficacy compared to existing PPIs, Fexuclue is expected to offer a new treatment option for Chinese patients suffering from gastroesophageal reflux disease. This also validates Daewoong’s R&D capabilities and could pave the way for further expansion into other global markets.

3. What’s Next?

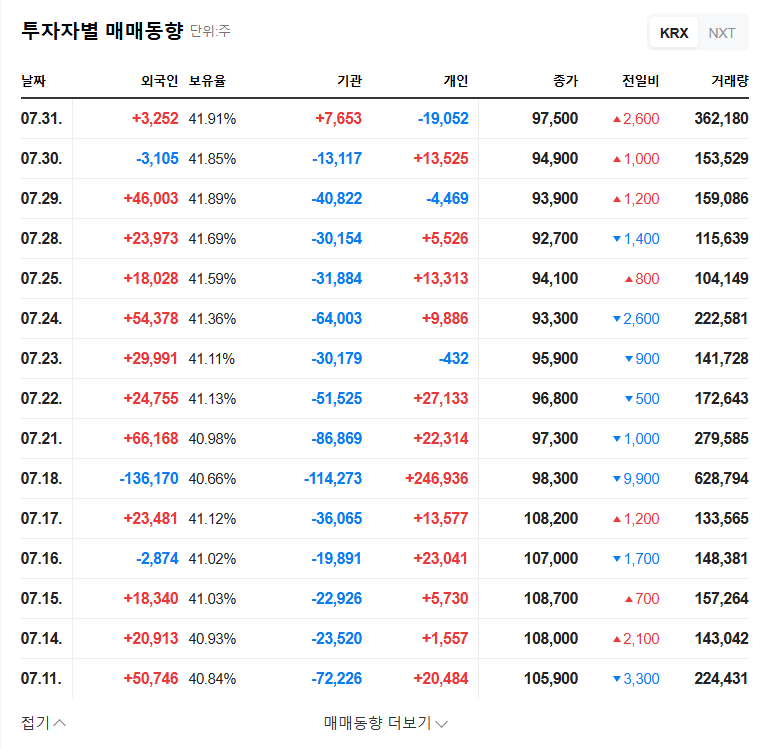

Positive Scenario: If Fexuclue successfully establishes itself in the Chinese market, Daewoong’s sales and operating profit are likely to experience substantial growth. This could serve as a powerful catalyst for a rise in stock price.

- Short-term: Positive investor sentiment and stock price appreciation are anticipated.

- Long-term: Transformation into a global pharmaceutical company and increased corporate value are expected.

Considerations: Potential risk factors include intensified competition within the Chinese market, changes in local regulations, and the effectiveness of Daewoong’s marketing strategies. Fluctuations in exchange rates and rising interest rates are also factors to consider.

4. What Should Investors Do?

While Fexuclue’s entry into China is positive, investors should carefully consider the following factors before making investment decisions:

- Fexuclue’s sales performance and market share trends in China

- Competitive landscape and Daewoong’s marketing strategies

- Global market expansion strategy and the progress of R&D pipelines

- Impact of changes in the macroeconomic environment

Thorough analysis is crucial for identifying investment opportunities and managing risks.

Frequently Asked Questions

When will Fexuclue be launched in China?

The exact launch date has not yet been announced. Investors should monitor relevant news and official announcements from Daewoong Pharmaceutical.

How much is Fexuclue expected to sell in China?

Considering the market size and Fexuclue’s efficacy, substantial sales are expected. However, precise predictions are difficult due to various factors such as competition and marketing strategies.

How will Fexuclue’s entry into China affect the stock price?

While a positive short-term impact is likely, the long-term stock price trend will depend on Fexuclue’s actual sales performance, the success of the global market expansion strategy, and changes in the macroeconomic environment.