1. What Happened? – Decoding the Amended Business Report

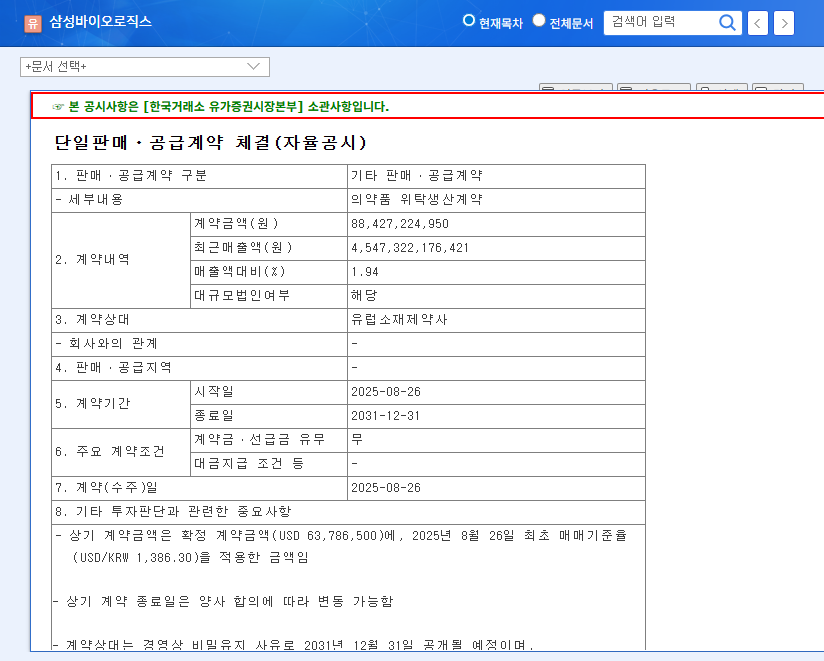

Samsung Biologics recently amended its business report regarding single sales and supply contracts. The key takeaway is the ‘reinforcement of contract stability and transparency’.

- Clarification of contract amount calculation criteria

- Emphasis on client payment obligations and contract stability

- Supplementation of fulfillment rate information

- Emphasis on contract fulfillment efforts

2. Why Does it Matter? – Securing Contract Stability, Building Investor Confidence

Given the nature of the CDMO business, the stability of large-scale supply contracts is crucial. This amendment is interpreted as an attempt to bolster investor confidence by addressing key concerns regarding contract stability and transparency.

3. What’s the Impact? – Positive Signal, Strengthening Mid-to-Long-Term Growth Potential

While the amendment doesn’t directly alter the company’s fundamentals, it’s seen as a positive signal, enhancing contract stability and predictability, thereby boosting investor trust. Short-term stock price fluctuations might be limited, but it’s expected to strengthen mid-to-long-term growth potential.

- Positive Impacts: Increased trust, confirmation of stable business foundation, highlighted risk management capabilities

- Neutral Impacts: No direct changes to financial status or business expansion

4. What Should Investors Do? – Continuous Monitoring is Key

It’s crucial for investors to continuously monitor Samsung Biologics’ business performance, new contract signings, the competitive landscape of the CDMO market, and macroeconomic indicator fluctuations when making investment decisions.

Frequently Asked Questions

Will this business report amendment have an immediate impact on the stock price?

The impact on short-term stock price fluctuations is expected to be limited. However, it can act as a positive factor in the long run.

What is the outlook for Samsung Biologics’ CDMO business?

By strengthening contract stability, the company is expected to secure its core competitiveness in the CDMO business and enhance its mid-to-long-term growth potential.

What precautions should investors take?

It’s important to continuously monitor future business performance, new contract signings, market competition, and macroeconomic indicator fluctuations.