1. DuChemBio IR: What Was Discussed?

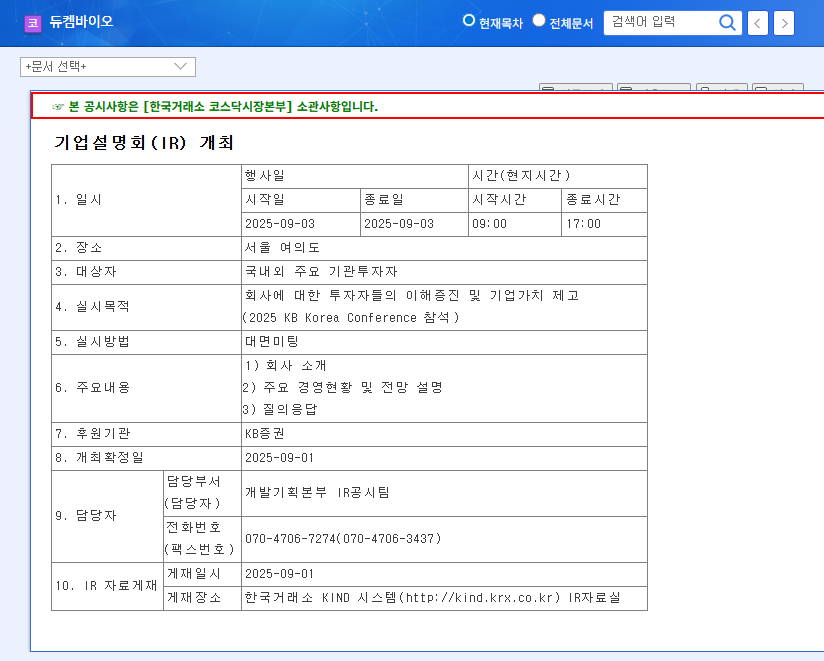

On September 3, 2025, DuChemBio presented its company overview, current management status, and future outlook at the KB Korea Conference. They emphasized their high market share in the domestic PET-CT radiopharmaceutical market with key products like FDG, FP-CIT, and Amyloid PET, and explained their portfolio expansion strategy through new product launches (e.g., FES). Overseas technology transfer, open innovation, and the acquisition of RadioDNS Labs to strengthen R&D capabilities were also highlighted. The solid financial performance for the first half of 2025 (revenue of KRW 17.96 billion and operating profit of KRW 2.55 billion) was also announced.

2. Why Invest in DuChemBio?

DuChemBio has high growth potential alongside the growth of the radiopharmaceutical market. Its key competitive advantages include high market share, strong technological capabilities, and active R&D investments. This IR provided investors with a clear understanding of the company’s vision and growth strategy. Furthermore, participation in the KB Korea Conference is expected to increase brand awareness and attract potential investors.

3. Post-IR Stock Forecast: What to Expect?

The IR is expected to have positive impacts, such as enhancing investor confidence and brand awareness, building a positive corporate image, and expanding future funding and partnership opportunities. However, potential risk factors, including the content of the IR and Q&A session, macroeconomic volatility, and intensifying competition, must also be considered. While a positive stock trend is expected overall, continuous monitoring of market conditions and the competitive landscape is necessary.

4. Investor Action Plan

- Closely monitor the IR presentation content and market reaction.

- Analyze the impact of macroeconomic variables (interest rates, exchange rates, oil prices, etc.).

- Continuously observe the progress of the R&D pipeline and new market development efforts.

What is DuChemBio’s main business?

DuChemBio’s main business is the development, manufacturing, and sale of radiopharmaceuticals for the diagnosis and treatment of cancer and brain diseases.

What are DuChemBio’s competitive advantages?

DuChemBio holds a high market share in the domestic PET-CT radiopharmaceutical market and strengthens its technological competitiveness through continuous R&D investment.

What is DuChemBio’s future growth strategy?

DuChemBio secures growth drivers through new product launches, overseas technology transfer, open innovation, and strategic acquisitions.