1. What Happened? : Amendment to TaeYoung Construction’s Business Report

TaeYoung Construction updated its financial status and project progress since its workout application in late 2023 through an amendment to its 52nd business report. The key changes include the restatement of the 51st consolidated financial statements (workout related) and updates on the progress of construction contracts from 2016-2024.

2. Why Does it Matter? : Risks Remain with Workout, PF Contingent Liabilities

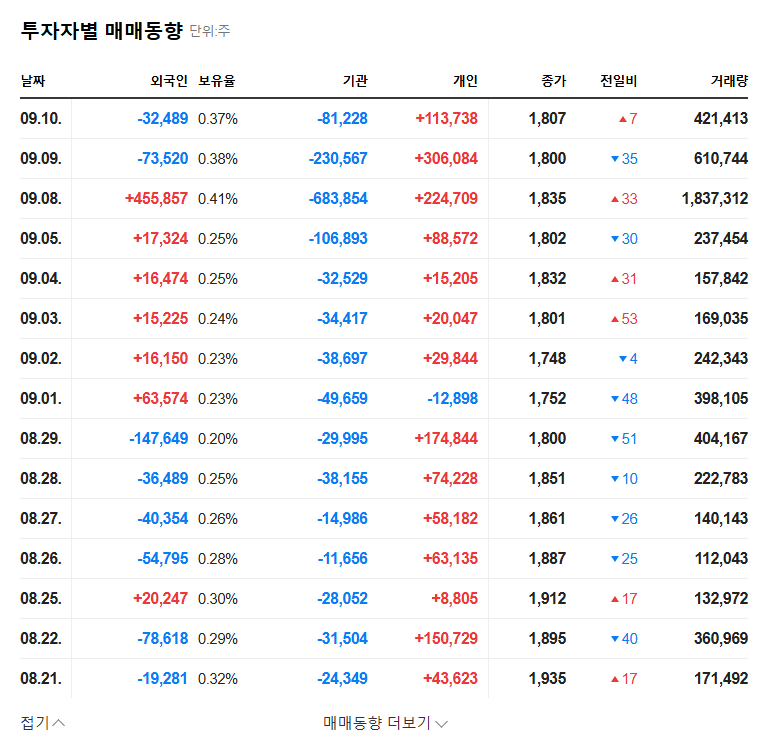

The positive aspects include the resolution of capital impairment and the return to operating profit. However, risks persist, including KRW 7.5 trillion in PF contingent liabilities, delays/non-commencement of several projects, and outstanding receivables. Credit rating downgrades and the construction market downturn also pose challenges.

3. What’s Next? : Analyzing Fundamental Impact and Market Relevance

While the workout may negatively impact stock prices in the short term, it can be a process of long-term recovery. The current high interest rates and construction market downturn pose a direct burden on TaeYoung Construction, increasing the likelihood of PF risks materializing.

4. What Should Investors Do? : Considerations for Investment Decisions

- Workout Implementation: Verify cooperation with creditors and the implementation of the corporate improvement plan.

- PF Risk Management: Assess the progress of each PF project and the potential loss.

- New Orders and Business Diversification: Examine the company’s ability to secure orders in both public and private sectors and develop new businesses.

- Financial Soundness: Monitor the improvement trend of indicators such as debt ratio and interest coverage ratio.

- Macroeconomic and Construction Market Trends: Analyze external factors such as interest rates and real estate policies.

5. Conclusion: A Cautious Investment Approach is Necessary

Despite TaeYoung Construction’s efforts to improve its finances, uncertainties remain high due to the workout, PF contingent liabilities, and market downturn. Investors should carefully consider the factors mentioned above and make prudent investment decisions.

Frequently Asked Questions (FAQ)

What is TaeYoung Construction’s workout?

A workout is a system in which a company, facing difficulties in repaying its debts, negotiates with creditors for debt restructuring, management normalization, etc., to seek recovery.

Why are PF contingent liabilities risky?

If a PF project becomes insolvent, TaeYoung Construction, as the contractor, may have to bear the financial burden of supplementing funds, which can significantly impact its finances.

What precautions should be taken when investing in TaeYoung Construction?

Carefully consider the workout’s progress, solutions for PF contingent liabilities, and the construction market outlook before making investment decisions.