HLB Pep Co., Ltd. has made a significant move with its recent announcement of a KRW 4.2 billion tangible asset acquisition, a decision that has investors buzzing. This strategic investment in advanced production machinery raises a critical question: is this a calculated step towards dominating the peptide market, or does it introduce a worrying level of financial strain on a company already navigating challenges? This comprehensive HLB Pep investment analysis will dissect the details, explore the potential upside, and uncover the risks investors must watch closely.

We will delve into the company’s current financials, the strategic rationale behind the purchase, and provide a clear verdict on what this means for HLB Pep’s future trajectory and its stock value. By understanding both the opportunities and the hurdles, investors can make more informed decisions.

The Landmark Deal: What Exactly is the KRW 4.2 Billion Investment?

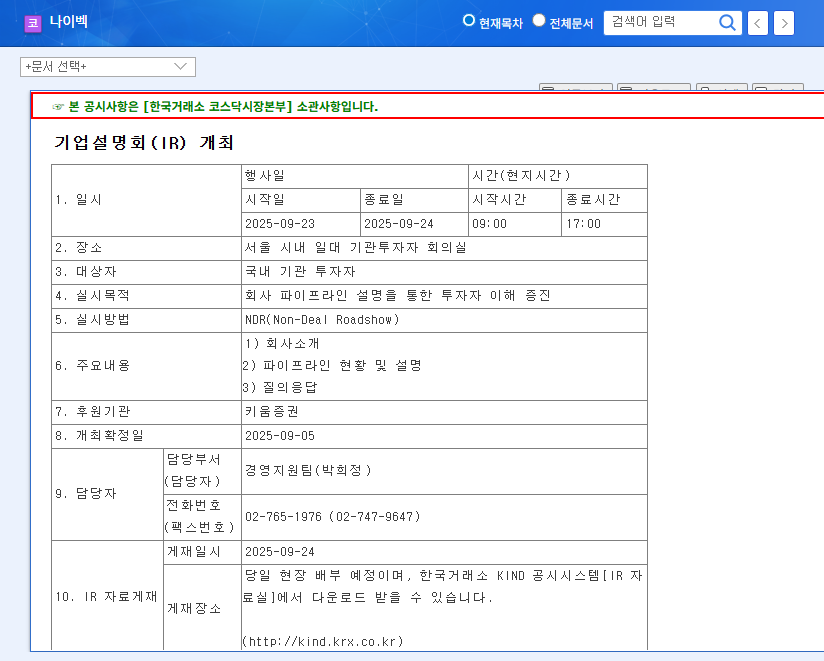

On November 7, 2025, HLB Pep Co., Ltd. formally disclosed its decision to acquire significant machinery from YMC Korea Co., Ltd. The cornerstone of this KRW 4.2 billion investment is a ‘Continuous Purification Liquid Chromatography System,’ a piece of cutting-edge technology designed to streamline and enhance the production of high-purity peptides. The official details can be reviewed in the company’s filing. (Source: Official Disclosure)

To put this figure into perspective:

- •The acquisition price represents 7.42% of the company’s total assets as of mid-2025.

- •It accounts for a substantial 25.12% when compared to the company’s asset base.

- •The payment is structured in cash installments, scheduled to be paid out between November 2025 and February 2027, which spreads the immediate financial impact.

The Strategic Vision: Boosting Peptide Production Capacity for Future Growth

The core motivation behind this HLB Pep asset acquisition is a proactive strategy to secure a dominant position in the high-growth peptide industry. By investing in its peptide production capacity, HLB Pep aims to achieve several key objectives that are critical for its long-term success. The peptide therapeutics market is expanding rapidly, and having state-of-the-art, in-house manufacturing is a significant competitive advantage. For more on this trend, see analysis on the growing global peptide market.

Positive Impacts of the Investment

- •Enhanced Production Scale & Efficiency: The new equipment is expected to dramatically increase the output of peptide materials, crucial for both its pharmaceutical and CDMO (Contract Development and Manufacturing Organization) business lines.

- •Superior Quality and Competitiveness: Advanced automation and precision manufacturing lead to higher purity and consistency in products, bolstering the company’s reputation and quality control.

- •Foundation for Long-Term Growth: This move signals a strong commitment to its high-potential new drug development pipeline and positions HLB Pep as a more attractive partner for CDMO contracts.

This isn’t just buying machinery; it’s an investment in the foundational infrastructure required to compete and win in the next decade of peptide-based therapeutics.

A Look Under the Hood: Analyzing HLB Pep’s Financials

While the strategic vision is compelling, a thorough HLB Pep investment analysis must confront the company’s current financial realities. As of the first half of 2025, the picture is mixed. The company has demonstrated an ability to raise capital but is facing profitability and cash flow pressures.

Key Financial Risks and Considerations

- •Short-Term Financial Burden: The KRW 4.2 billion outlay is significant. The company’s negative operating cash flow means it cannot fund this purchase from operations alone, making the management of the installment plan critical.

- •Pressure on Profitability: High R&D expenses (69.1% of sales) already weigh on the bottom line. The new equipment will add depreciation costs, which could delay the company’s return to operating profit in the near term.

- •Dependence on Pipeline Success: Ultimately, the return on this investment is heavily tied to the successful commercialization of HLB Pep’s drug candidates. Any clinical setbacks or delays would diminish the value of this expanded capacity. See our detailed analysis of HLB Pep’s new drug pipeline for more.

Investor Verdict and Action Plan

The HLB Pep asset acquisition is best viewed as a bold, long-term strategic play. It correctly identifies the need for robust production capabilities to unlock future growth in its core peptide and CDMO businesses. The move is fundamentally positive for the company’s long-term competitive positioning.

However, investors must balance this long-term optimism with the significant short-term financial hurdles. The company’s ability to manage its cash flow, service its debt, and continue funding its R&D pipeline while absorbing the costs of this expansion will be the key narrative to watch over the next 18-24 months.

Investment Opinion: Hold (Wait and See). The potential long-term rewards from this strategic investment are clear, but the immediate financial risks and profitability challenges warrant a cautious approach. Close monitoring is essential before committing new capital.

Investors should keep a close eye on pipeline progress, quarterly financial reports for signs of improved cash flow, and any announcements of new CDMO contracts that would begin to utilize this new capacity.