The Park Systems stock (KOSDAQ: 140860) is drawing significant attention as the company prepares for a pivotal Investor Relations (IR) event. As a global leader in Atomic Force Microscopes (AFM), a critical tool for the world’s most advanced industries, Park Systems stands at the intersection of several high-growth sectors. This analysis will provide a deep dive into the company’s fundamentals, market position, and the key factors that could influence its stock price, offering profound insights for savvy investors.

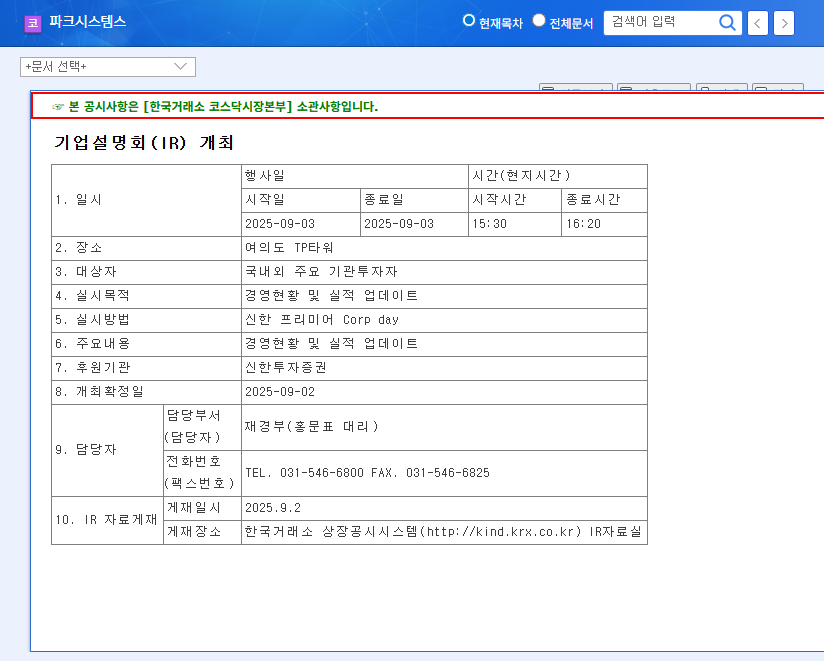

The upcoming IR event, scheduled for September 30, 2025, at 2 PM (KST), is more than a standard corporate presentation. It is a crucial opportunity for the management to outline future growth strategies and provide clarity on recent performance, potentially serving as a major catalyst for the stock. For official details, investors can refer to the Official Disclosure (DART).

Deconstructing Park Systems’ Financial Health and Market Position

Robust Fundamentals Driven by Advanced Industries

A thorough Park Systems stock analysis begins with its core business segments. The company’s financial performance in the first half of 2025 highlights its strong market penetration:

- •Industrial Equipment: This segment is the primary revenue driver, contributing KRW 63,241 million (75.51% of total sales). This growth is directly tied to expanding capital expenditures in the semiconductor and electronics industries.

- •Research Equipment: Accounting for KRW 18,631 million (22.24% of sales), this segment shows significant future potential, boosted by the new FX series and expansion into the high-growth bio-research market.

While total revenue showed a significant year-over-year increase, a temporary decrease in operating profit was noted. This is attributed to strategic investments in R&D and new business expansion—costs that are essential for long-term technological leadership. Despite this, the company maintains an impressive operating profit margin of 24.3%, signaling excellent core profitability and a stable financial footing.

Unparalleled Competitive Edge in the AFM Market

Park Systems’ unique market position is built on three decades of specialized know-how. The demand for their high-precision Atomic Force Microscopes is surging, driven by the relentless innovation in AI semiconductors, High Bandwidth Memory (HBM), and advanced packaging. According to industry reports, the semiconductor metrology and inspection market is on a steep growth trajectory. The recent acquisition of Lyncee Tec SA adds Digital Holographic Microscopy (DHM) to its technology stack, creating a more comprehensive metrology solution for clients and unlocking new avenues for growth.

For investors, the core question is whether Park Systems’ technological dominance and strategic investments can outweigh short-term margin pressures and macroeconomic uncertainties, justifying a higher valuation for the stock.

Key Factors Influencing Park Systems Stock Price

Any sound Park Systems investment thesis must carefully weigh the positive catalysts against potential risks. Here’s a balanced view of the factors at play.

Positive Catalysts (The Bull Case)

- •AI & Semiconductor Boom: The exponential growth in AI, HBM, and advanced packaging directly fuels demand for Park Systems’ core products.

- •Synergistic Acquisitions: The integration of Lyncee Tec SA enhances the company’s product portfolio and expands its market reach.

- •Bio-Market Expansion: The application of Scanning Ion Conductance Microscopy (SICM) technology opens up lucrative new opportunities in biological and medical research.

Potential Risks & Considerations (The Bear Case)

- •Short-Term Margin Pressure: Increased spending on R&D and new ventures, while crucial for growth, can temporarily impact profitability.

- •Currency Volatility: With a high percentage of overseas sales, profitability is sensitive to fluctuations in the USD and EUR exchange rates.

- •Competitive Landscape: As a technology leader, Park Systems must continuously innovate to stay ahead of potential competitors. Investors should learn about evaluating tech company moats for better context.

Conclusion: Investor Action Plan

Our overall outlook for the Park Systems stock is Neutral to Positive. The company’s strong technological foundation and alignment with high-growth industries present a compelling long-term narrative. The upcoming IR event will be a critical data point, offering insights into how management plans to navigate short-term challenges while capitalizing on long-term opportunities.

Investors should closely monitor the IR presentation for details on new business progress, cost management strategies, and the forward-looking sales pipeline. While the long-term potential is evident, prudent investors should remain prepared for short-term volatility and make decisions based on a thorough analysis of the information revealed at the event and subsequent market reactions.