1. What Happened?

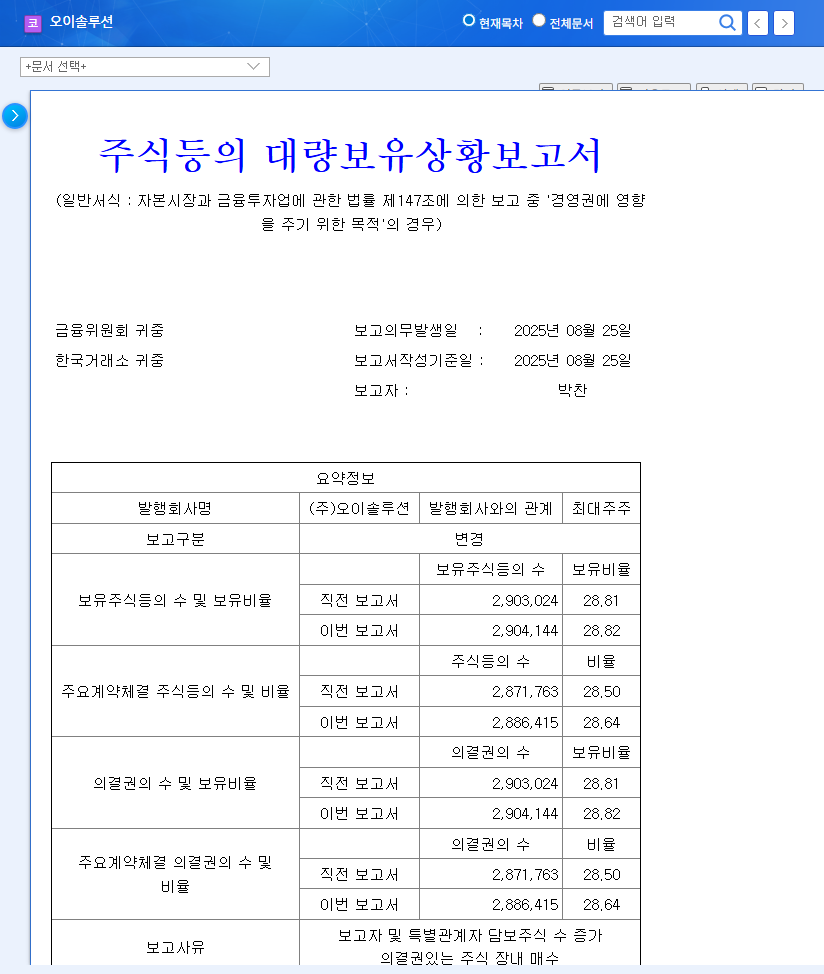

OI Solutions’ major shareholder and CEO, Park Chan, increased his stake from 28.81% to 28.82%, a 0.01%p increase, through an on-market purchase on August 18, 2025. The purpose of the acquisition is ‘general investment,’ and the reason for reporting is ‘increase in pledged shares and on-market purchase of voting shares.’

2. Why Does It Matter?

An increase in a major shareholder’s stake is generally interpreted as a positive signal for the company. In particular, an increase in the CEO’s stake can demonstrate a commitment to responsible management and positively influence investor sentiment. However, the small increase of 0.01%p may limit its impact.

3. What’s OI Solutions’ Current Situation?

OI Solutions continues its sales growth by entering various markets such as 5G and FTTH. However, profitability has deteriorated due to investments in new businesses. Financially, debt has increased, and operating cash flow is negative, requiring improvement. Expanding data center investments due to AI market growth is expected to be a future growth driver.

4. So, What Should I Do?

In the short term, Park Chan’s stake increase may positively affect the stock price, but the impact is expected to be limited. To assess the mid-to-long-term investment value, continuous monitoring of profitability improvement is crucial. Also, consider Park Chan’s further stake changes, optical communication industry trends, and macroeconomic variables.

5. Action Plan for Investors

- Check Profitability Indicators: Confirm whether OI Solutions’ profitability, such as operating profit and net income, has improved through future earnings announcements.

- Monitor Major Shareholder Trends: Keep track of Park Chan’s additional stake changes and other major shareholders’ activities.

- Watch Market Conditions: Understand the outlook for the optical communications industry, competitor trends, and macroeconomic variables to inform your investment decisions.

Will CEO Park Chan’s stake increase positively affect OI Solutions’ stock price?

It may have a positive impact in the short term, but considering the small increase of 0.01%p, the impact is expected to be limited. The long-term stock trend depends on the company’s fundamentals, especially profitability improvement.

Is it a good time to invest in OI Solutions?

Currently, OI Solutions’ profitability has deteriorated despite sales growth. Therefore, it’s important to check for profitability improvement through future earnings releases and comprehensively assess the market conditions before making investment decisions. Maintaining a ‘wait-and-see’ approach and proceeding cautiously is recommended.

What is the future outlook for OI Solutions?

OI Solutions has growth potential alongside the growth of the optical communication market. In particular, expanding data center investments driven by AI market growth can be a positive factor. However, sustainable growth will depend on resolving the challenge of improving profitability.