The recent announcement of the ASIA PAPER MANUFACTURING CO.,LTD stock cancellation has sent ripples through the investment community. The company (KOSPI: 002310) plans to cancel 8.6 billion KRW in treasury shares, a significant move that comes amidst a challenging period of declining revenue and profitability. For investors, the critical question is whether this is a genuine, strategic effort to bolster shareholder value or a defensive maneuver to manage a crisis. This comprehensive analysis will dissect the decision, examine the company’s underlying fundamentals, and provide clear insights to help you navigate your investment strategy concerning ASIA PAPER MANUFACTURING CO.,LTD.

While the cancellation of treasury shares is a positive signal for shareholder returns, it must be weighed against the company’s fundamental performance and the significant headwinds facing the paper industry.

The Core Details of the Stock Cancellation

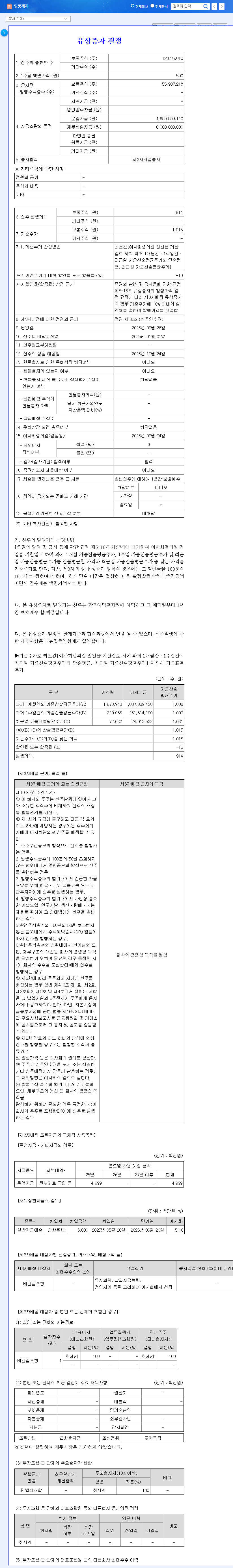

On November 14, 2025, ASIA PAPER MANUFACTURING CO.,LTD formally disclosed its decision to cancel 1,150,000 of its common shares. These are treasury shares—stock that the company had previously repurchased from the open market. The total value of this cancellation is approximately 8.6 billion KRW, which accounts for 2.76% of its market capitalization. The official cancellation is scheduled for December 3, 2025. By removing these shares from the total outstanding count, the company aims to increase the value of each remaining share. You can view the Official Disclosure on the DART system for complete details.

Analyzing the Financial Backdrop: Why Now?

This decision to enhance shareholder value was not made in a vacuum. The company’s recent financial performance reveals significant challenges that provide crucial context for this strategic move.

Worsening Profitability and Revenue Decline

The cumulative results for Q3 2025 painted a bleak picture. Year-over-year, revenue dropped by 4.44%, while operating profit and net income plummeted by 9.54% and 11.46%, respectively. The primary culprit was a significant sales decrease in the paper division, which constitutes over half of the company’s revenue. This downturn highlights structural issues within its core business segment.

Raw Material and Pricing Pressures

While stable pulp prices offer some relief, the company has struggled to pass rising raw material costs onto its customers through higher selling prices. This margin squeeze is a persistent threat to profitability. Furthermore, the volatility of waste paper prices, a key input, introduces additional risk. Investors should monitor commodity market trends closely, as detailed in reports from sources like Reuters Business.

Strained Financial Health

The company’s consolidated debt-to-equity ratio exceeds 100%, and short-term borrowings are on the rise. This indicates a need for careful financial management. A major upcoming capital expenditure is the new corrugated board factory in Cheongju. While this investment is a potential long-term growth driver targeting the booming e-commerce packaging market, it will place a considerable financial burden on the company in the short term.

Impact of the 002310 Treasury Shares Cancellation

Understanding the implications of this move is key for investors. While the immediate stock price impact may be limited, the long-term effects are more nuanced.

- •Enhanced Per-Share Metrics: By reducing the number of outstanding shares, key metrics like Earnings Per Share (EPS) and Book Value Per Share (BPS) automatically increase. This can make the stock appear more attractive on a valuation basis.

- •Positive Signal to the Market: The act of cancelling shares, especially during a downturn, signals management’s confidence in the company’s long-term prospects and its commitment to rewarding shareholders.

- •Tapping into Corrugated Board Growth: The cancellation may also serve to focus investor attention on future growth areas, such as the corrugated board market, which benefits from the sustained rise of e-commerce and demand for sustainable packaging.

Investment Thesis: Key Factors to Monitor

The ASIA PAPER MANUFACTURING CO.,LTD stock cancellation is a positive gesture, but it doesn’t erase the underlying business risks. A prudent investment approach requires careful monitoring of several factors.

Path to Performance Improvement

Ultimately, sustainable stock price growth will depend on fundamental business improvement. Watch for signs of stabilization in the paper division, improved pricing power, and a clear timeline for when the new Cheongju factory will begin contributing to the bottom line. Learning how to analyze industrial sector stocks can provide a valuable framework for this evaluation.

Macroeconomic Headwinds

External factors remain a major threat. A rising KRW/USD exchange rate can increase the cost of imported raw materials. Fluctuations in oil prices impact energy and logistics costs. A broader economic downturn could dampen demand across both the paper and corrugated board segments. Investors must remain vigilant about these macroeconomic indicators.

Conclusion: A Cautious Long-Term Play

In summary, ASIA PAPER MANUFACTURING CO.,LTD’s decision to cancel treasury shares is a commendable step towards enhancing shareholder value. However, it should be viewed as one piece of a much larger and more complex puzzle. Rather than expecting a short-term price jump, investors should adopt a medium-to-long-term perspective, focusing on whether the company can successfully navigate its current challenges, stabilize its financials, and capitalize on the growth opportunities in the corrugated board industry. The road ahead requires a significant operational turnaround, and success is far from guaranteed.