What Happened?

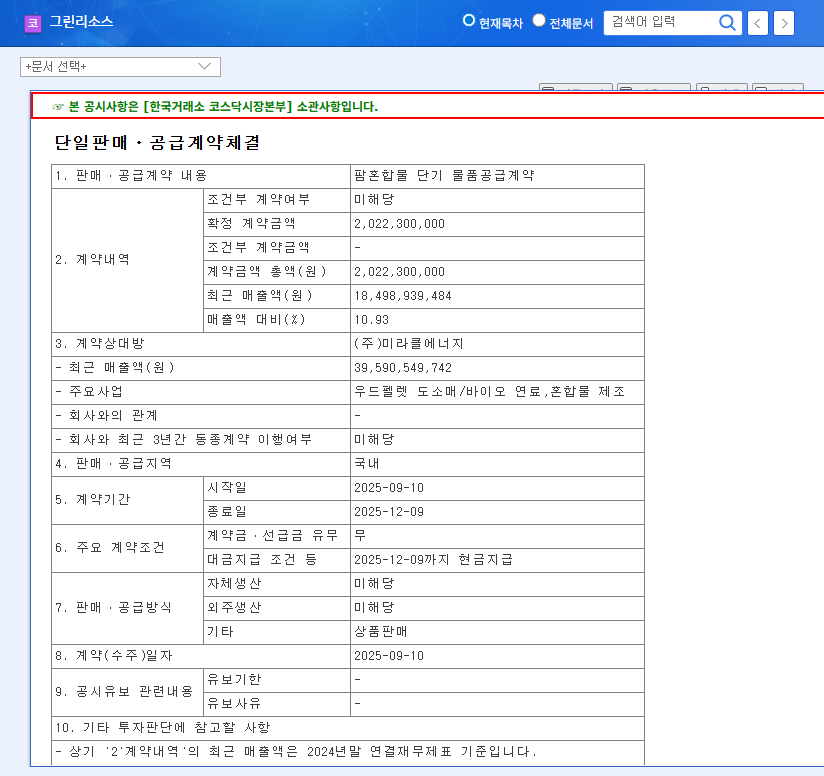

Green Resources signed a ₩2 billion short-term (3-month) supply contract with Miracle Energy on September 10, 2025, for palm mixture. This represents a significant 10.93% of Green Resources’ recent quarterly revenue.

Why Does This Matter?

This contract is positive for potential short-term revenue growth. However, its short duration and focus on a specific product (palm mixture) raise questions about its long-term impact. The apparent lack of connection to Green Resources’ core businesses (semiconductor coating materials and superconducting wire equipment) is also a consideration.

What’s Next?

- Revenue and Profitability: Short-term revenue increase is expected, but sustainability is uncertain. Profitability depends on the contract’s margin.

- Financial Structure: ₩2 billion in revenue is positive, but insufficient to resolve existing financial challenges.

- Business Expansion: Palm mixture could be a new growth driver, but more information is needed.

- Market Environment: The competitive landscape and growth potential of the palm mixture market are unclear.

- Stock Price Impact: A significant short-term surge is unlikely; existing business performance and financial health improvements are key.

What Should Investors Do?

- Monitor Contract Implementation and Performance: Track actual delivery rates, profitability, etc.

- Assess Business Diversification: Determine the sustainability of the palm mixture venture and its synergy with existing businesses.

- Focus on Existing Business Performance and Financial Health: Monitor performance in semiconductor coatings and superconducting wire equipment, and improvements in financial structure.

Frequently Asked Questions (FAQ)

Will this contract positively impact Green Resources’ stock price?

While it could provide a short-term positive momentum, given the contract size and duration, a significant price surge is unlikely. Existing business performance and financial health improvements are expected to have a greater impact.

Can the palm mixture business become a new growth driver for Green Resources?

More information is needed regarding how the palm mixture business fits into Green Resources’ future growth strategy, or whether it’s a one-off deal. Currently, it’s difficult to assess its sustainability and synergy with existing businesses.

What should investors pay attention to?

Investors should monitor contract implementation, the sustainability of the palm mixture business, and improvements in existing business performance and financial health.