The recent INTERFLEX Vietnam subsidiary acquisition has sent ripples through the market, prompting investors to closely examine the future of INTERFLEX (KRX: 051370). On November 6, 2025, the company announced its definitive plan to acquire an 83.58% stake in its Vietnamese subsidiary, Korea Circuit Vina Co., LTD., for 18.8 billion KRW. This strategic move, while aiming to bolster global production and efficiency, comes at a time when the company faces significant performance headwinds. This comprehensive analysis will dissect the acquisition’s implications for INTERFLEX’s business strategy, its financial stability, and the outlook for the INTERFLEX stock price, providing investors with the critical insights needed for informed decision-making.

The Landmark Acquisition: A Strategic Overview

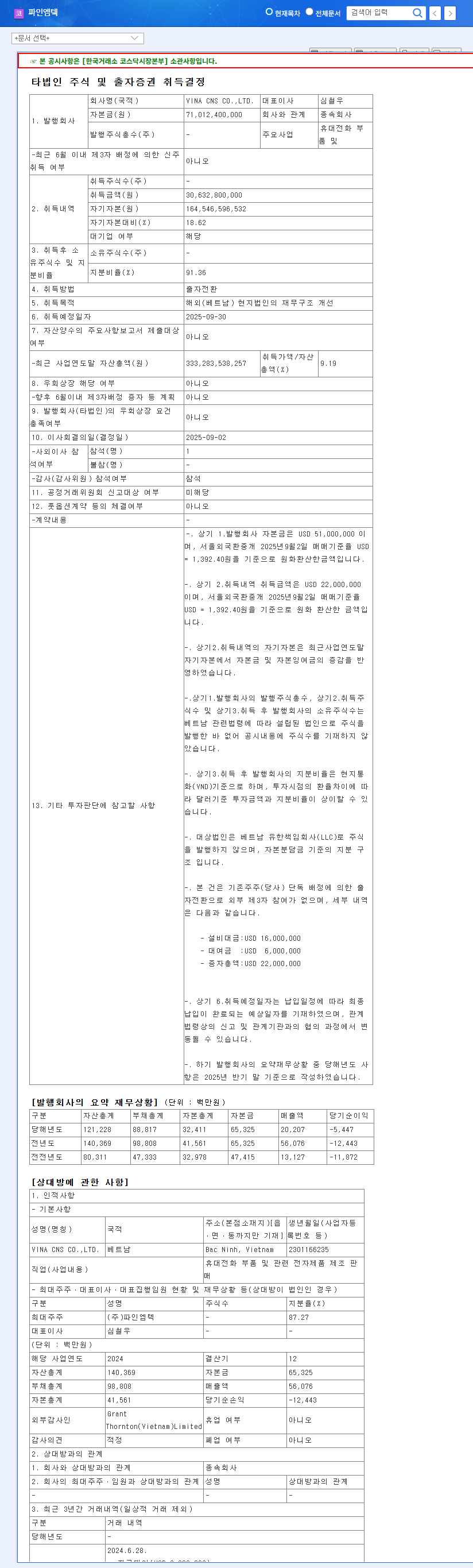

INTERFLEX has formally committed to purchasing an 83.58% controlling stake in Korea Circuit Vina Co., LTD. The transaction, valued at 18.8 billion KRW, represents 6.68% of INTERFLEX’s total capital and is slated for completion on November 14, 2025. This information was confirmed via an Official Disclosure on the DART system. The stated objective is clear: to fortify its overseas production capabilities, enhance operational efficiency, and ultimately strengthen its global market competitiveness. This move is a pivotal element of the company’s long-term INTERFLEX growth strategy, signaling a commitment to geographic diversification and cost optimization.

Analyzing INTERFLEX’s Financial Health

With limited analysis from securities firms, a direct examination of INTERFLEX’s fundamentals is essential. The 2025 semi-annual report paints a mixed picture, revealing both strategic strengths and pressing financial concerns that provide crucial context for the acquisition.

Positive Catalysts and Strengths

- •Strategic Diversification: Beyond its core FPCB business, INTERFLEX is actively expanding into automotive components and real estate leasing. The burgeoning automotive electronics sector, in particular, represents a significant growth vector for the FPCB industry.

- •R&D and IP Moat: Continuous investment in research and development has yielded numerous patents, securing a competitive edge in technology and product innovation for the future. You can learn more by reading our deep-dive into the FPCB market.

- •Solid Liquidity: With 100.7 billion KRW in cash and cash equivalents as of mid-2025, the company maintains a healthy liquidity position, capable of weathering short-term obligations.

Negative Headwinds and Risks

- •Declining Performance: Consolidated revenue for H1 2025 fell 21.8% year-over-year to 217.5 billion KRW, while operating profit plummeted by 70% to 10.3 billion KRW. This sharp decline is attributed to reduced demand from key customers and intense market competition.

- •High Debt Ratio: A significant proportion of total liabilities relative to equity poses a potential risk to the company’s long-term financial soundness.

- •Macroeconomic Exposure: The company is vulnerable to external pressures such as USD exchange rate volatility, rising interest rates on its variable-rate borrowings, and a potential global economic slowdown.

While the INTERFLEX Vietnam subsidiary acquisition is a forward-looking move, it must be weighed against the immediate reality of declining core business profitability and existing financial leverage.

Impact Analysis of the Vietnam Acquisition

The acquisition’s success will be judged by its impact across three key areas: business strategy, financial performance, and investor sentiment surrounding the INTERFLEX stock.

1. Strategic and Operational Impact

Securing a production base in Vietnam provides a strategic hedge against supply chain disruptions and offers significant cost advantages. This could enhance profit margins and production capacity over the long term. However, the immediate challenge lies in integrating the subsidiary’s operations and ensuring its performance contributes positively to INTERFLEX’s consolidated results, especially given the parent company’s recent struggles.

2. Financial Impact

The 18.8 billion KRW cash outflow represents about 18.7% of the company’s cash reserves. While not critically burdensome for short-term liquidity, it is a substantial investment for a company with a high debt ratio. The subsidiary’s performance will now be directly reflected in INTERFLEX’s consolidated financial statements. Any underperformance from Korea Circuit Vina could exacerbate existing financial pressures.

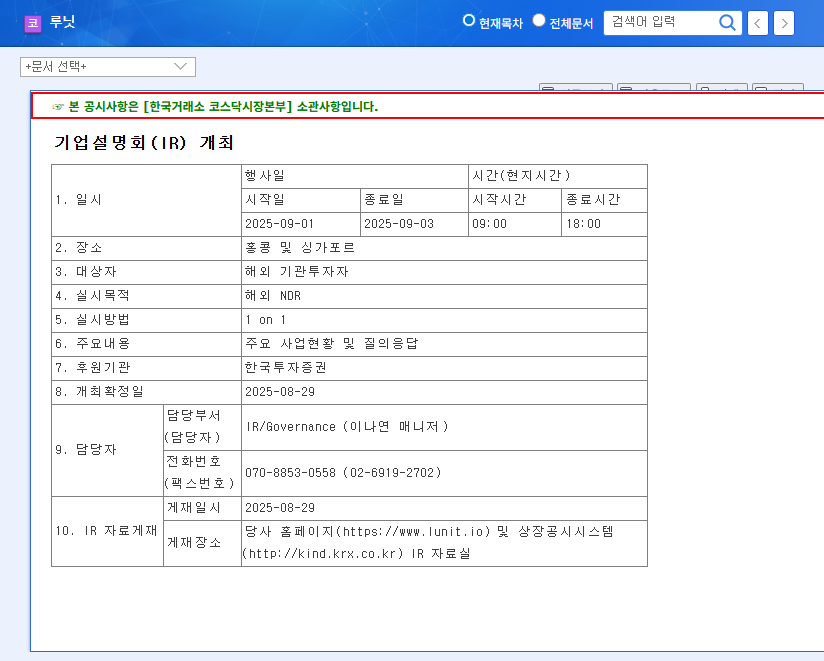

3. Investor and Stock Price Impact

The market may view this move positively as a proactive step towards long-term growth and competitiveness. Conversely, investors might react with caution, citing the immediate cash expenditure and the risk associated with a large-scale investment amidst declining profits. The uncertainty surrounding synergy realization and the subsidiary’s intrinsic value could lead to short-term volatility in the INTERFLEX stock price.

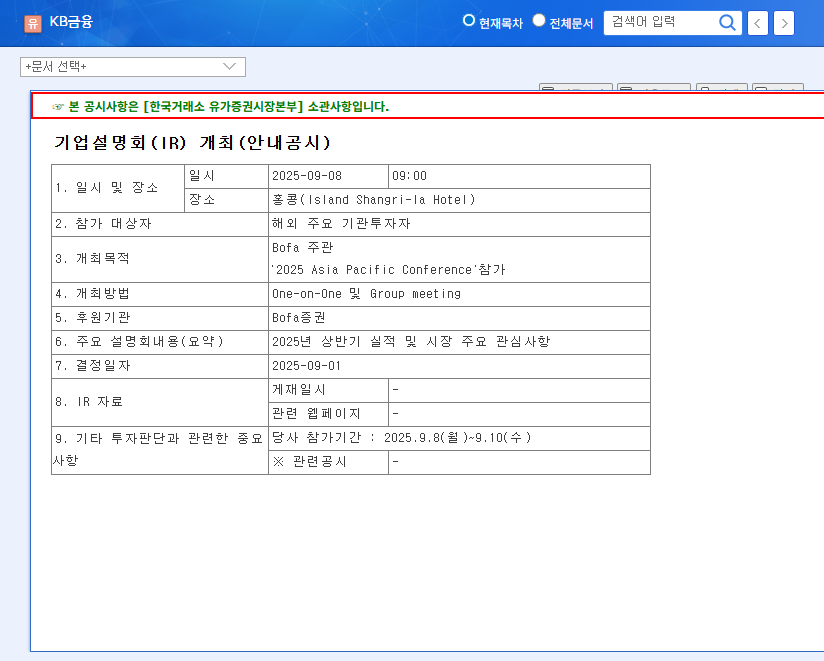

Future Outlook and Investor Action Plan

INTERFLEX’s decision on the Vietnam subsidiary acquisition is a calculated risk aimed at securing a more competitive future. The key to success will be execution. Investors should monitor the following key performance indicators:

- •Subsidiary Profitability: Scrutinize quarterly reports to assess the actual financial contribution of Korea Circuit Vina Co., LTD.

- •Core Business Turnaround: Watch for signs of recovery in the primary FPCB business, including new client wins or improved margins.

- •New Business Traction: Evaluate the revenue growth and profitability of new ventures, especially in the automotive electronics segment, which is expected to grow significantly according to market research reports.

- •Financial Health Management: Monitor changes in the company’s debt-to-equity ratio and its management of foreign exchange and interest rate risks.

Ultimately, overcoming short-term performance declines and leveraging the new subsidiary to create tangible synergies will be the defining challenges for INTERFLEX. The market will be watching closely to see if this bold strategic pivot can translate into sustainable value creation.