What Happened? FiberPro’s Stock Option Exercise

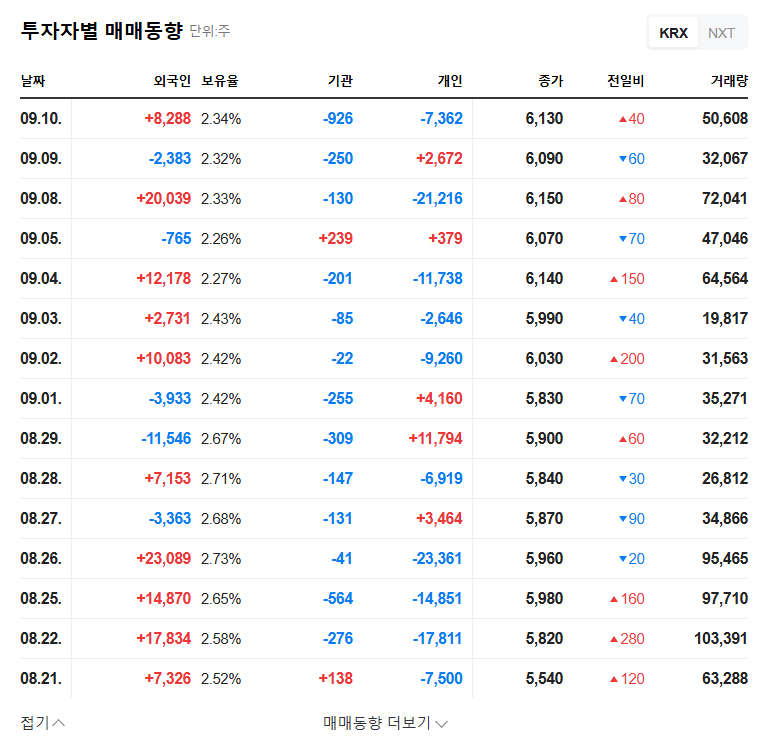

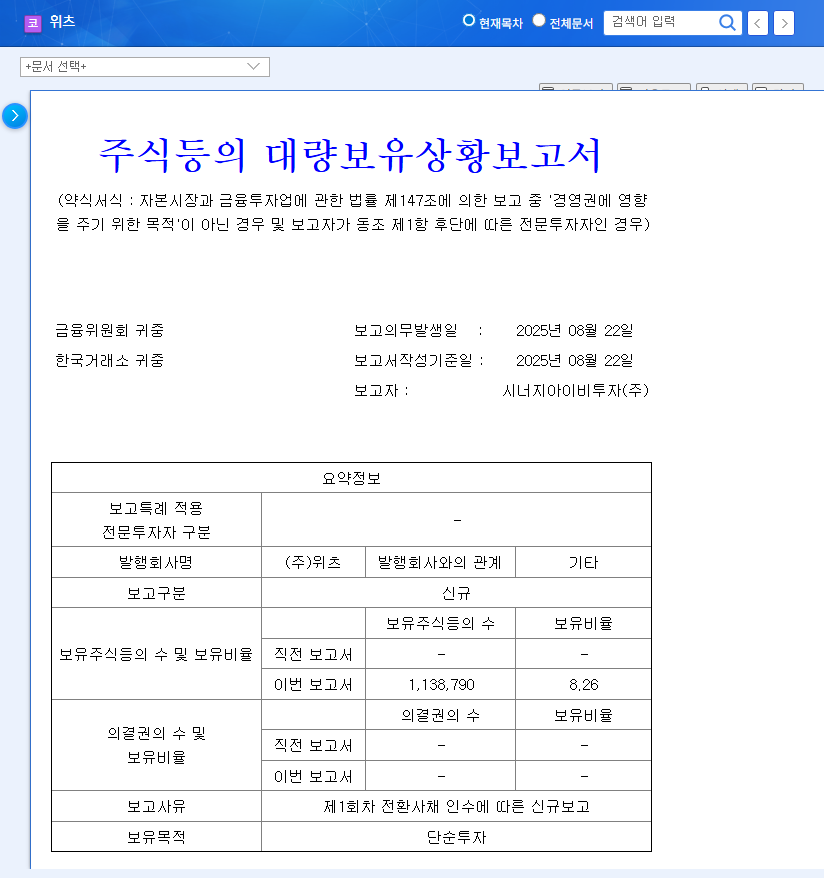

FiberPro announced on September 10, 2025, that 360,000 shares (1.1% of total outstanding shares) could enter the market through a stock option exercise.

Why Does it Matter? Negative News Amidst Poor Performance

FiberPro’s first-half 2025 results were disappointing. Revenue decreased by 46.9% year-over-year, and operating profit fell by 53.9%. The optical measuring instrument segment saw a particularly sharp decline in sales of 87.4%. The stock option exercise could negatively impact investor sentiment in this context.

What’s Next? Downward Pressure on Stock Price

- Overhang Concerns: The influx of shares from the stock option exercise could put downward pressure on the stock price.

- Worsening Market Sentiment: Combined with poor financial performance, this could amplify investor anxiety.

- Stock Dilution Effect: The increased number of outstanding shares could dilute earnings per share (EPS).

What Should Investors Do? Proceed with Caution

Investors should exercise caution with FiberPro. It’s crucial to closely monitor the selling trend of the exercised stock options, future earnings announcements, and make informed investment decisions. Pay particular attention to the performance recovery of the optical measuring instrument segment and the growth potential of the integrated navigation system segment. Macroeconomic conditions are also important factors in investment decisions.

Frequently Asked Questions

Why is the stock option exercise negative for the stock price?

When shares are released into the market through a stock option exercise, it increases the supply of shares, which can lead to downward pressure on the stock price. This effect can be more pronounced for companies with poor financial performance.

What is the outlook for FiberPro?

The recovery of the optical measuring instruments segment is crucial. The growth potential of the integrated navigation systems segment and changes in the macroeconomic environment can also affect the stock price.

What should investors pay attention to?

Investors should carefully monitor the actual selling timing and volume of the exercised stock options, future earnings announcements, and competitor trends. It is important to avoid hasty investment decisions and proceed with caution.