The initial GS Global Corp. Q3 2025 earnings report has sent a complex but intriguing signal to the market. In a climate of global economic headwinds and geopolitical tension, the company has managed a notable turnaround to profitability, even as its top-line revenue experienced a significant decline. This paradoxical result raises critical questions: What strategic maneuvers fueled this financial shift? And what does this performance indicate for the company’s long-term stability and value for investors? This comprehensive analysis will dissect the official figures, explore the underlying factors, and provide a clear outlook on what lies ahead for GS Global Corp.

GS Global’s Q3 2025 performance highlights a critical transition: prioritizing operational efficiency and profitability over sheer revenue growth in a challenging macroeconomic environment.

Unpacking the Q3 2025 Financials

GS Global Corp. unveiled its preliminary key indicators for the third quarter of 2025, confirming a successful return to positive operating profit and net income. While this is a positive sign of a sustained profitability drive, the absolute figures, when compared year-over-year, tell a more nuanced story. The data, sourced from the official disclosure (Source: DART), reveals a steeper decline in profit than in revenue, underscoring the ongoing need for rigorous cost management.

Key Performance Indicators (KPIs)

- •Revenue: KRW 945.8 billion (down 10.4% YoY, 12.0% QoQ)

- •Operating Profit: KRW 6.5 billion (down 73.6% YoY, 67.2% QoQ)

- •Net Income: KRW 1.0 billion (down 94.1% YoY, 92.0% QoQ)

- •Operating Profit Margin: 0.69% (a decrease of 1.64%p YoY)

In-depth Corporate Financial Analysis

The contrast between falling revenue and rising profitability isn’t magic; it’s the result of deliberate strategic choices and varying performance across the company’s diverse portfolio. This corporate financial analysis points to a business in a state of calculated transition.

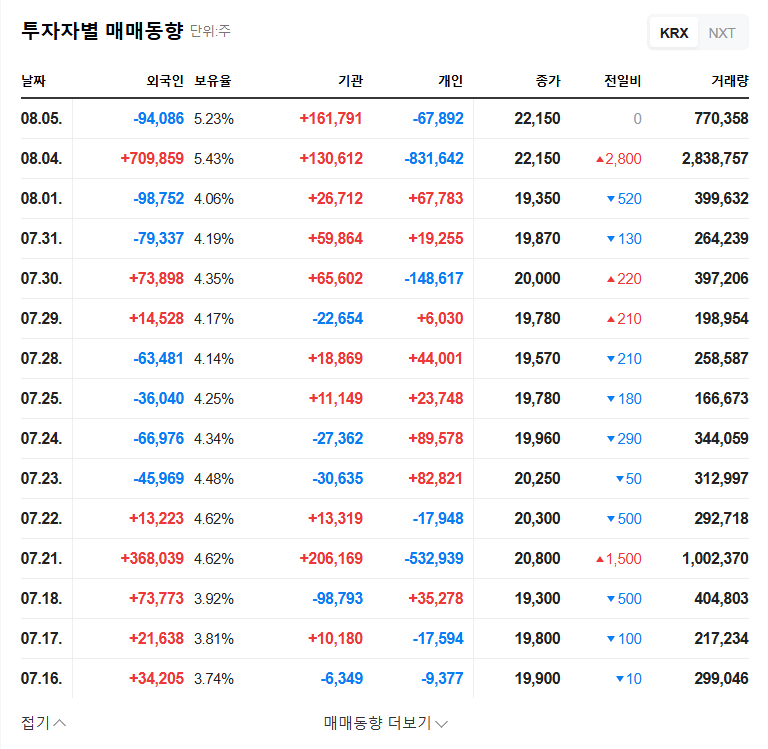

1. A Story of Two Business Segments

The overall numbers are heavily influenced by a divergence in segmental performance. The legacy trade and distribution arm, which constitutes the bulk of revenue, is feeling the direct impact of the global economic slowdown. Weakened demand for core commodities like steel and petrochemicals has predictably squeezed sales. Conversely, the company’s strategic pivot toward new growth engines—such as offshore wind power substructures and EV import/distribution—is likely beginning to bear fruit, contributing higher-margin profits that, while not enough to lift total revenue, have significantly bolstered the bottom line.

2. Financial Discipline and External Pressures

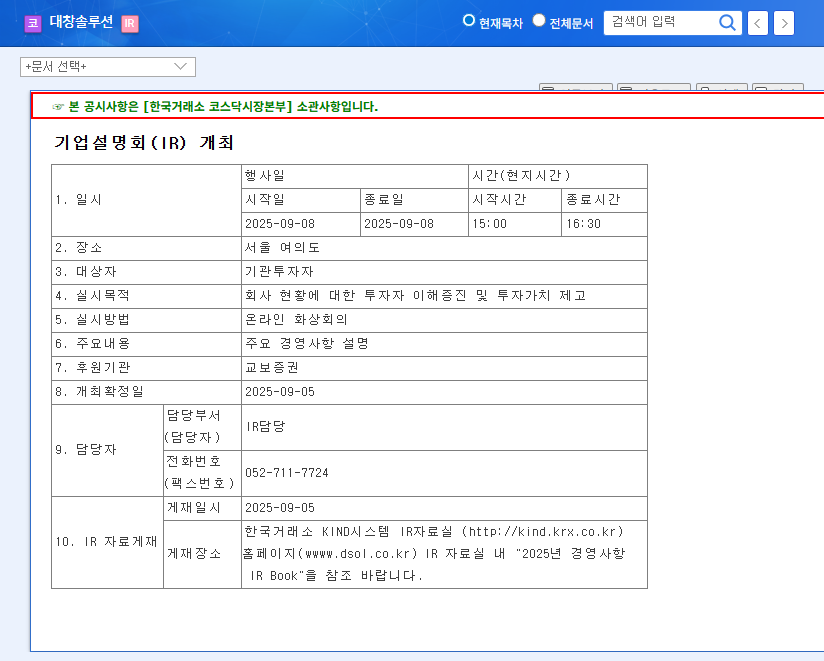

A proactive approach to financial management is evident. The company’s debt ratio improved to 116.97% by the end of H1 2025, a positive indicator of strengthening fiscal health. However, external variables remain a potent force. The high volatility of the KRW/USD exchange rate can create significant swings in foreign currency-related gains and losses, a critical factor for a global trading company. On a brighter note, the stabilization of interest rates by major central banks offers a reprieve, potentially lowering the financial burden associated with corporate debt.

Market Outlook and Investor Action Plan

Looking forward, the investment outlook for GS Global depends on its ability to navigate a complex market while capitalizing on emerging trends. Investors should monitor several key areas outlined in the GS Global Corp. Q3 2025 earnings data and beyond.

- •New Business Monetization: The most crucial indicator for future growth will be the tangible revenue contribution and profitability margins from the new energy and EV ventures. Look for these to be broken out in future reports.

- •Core Business Resilience: While new businesses grow, the core trade/distribution segment must stabilize. Investors should evaluate strategies for market share recovery and efficiency improvements in this area. You can learn more by reading our analysis of the global shipping industry.

- •Foreign Exchange Risk Management: Given the KRW/USD volatility, the company’s hedging strategies and their effectiveness will be paramount. A well-managed forex strategy can protect profits from unpredictable market swings.

- •Continued Financial Prudence: Monitoring the debt ratio and cash flow statements is essential. Sustained financial discipline is key to weathering economic uncertainty and funding new growth initiatives.

Conclusion

The GS Global Corp. Q3 2025 earnings report paints a picture of a company at a strategic crossroads. It is successfully navigating a downturn by focusing on operational efficiency and the cultivation of new, high-potential business lines. While the decline in revenue and significant YoY drop in profit figures warrant caution, the return to profitability demonstrates resilience. The future investment value of GS Global Corp. will be determined by its success in transforming its new ventures from promising initiatives into powerful, revenue-generating engines of growth.

Disclaimer: This analysis is based on preliminary data. Investment decisions should be made after careful consideration and consultation with a financial advisor. The final responsibility for all investment decisions rests with the investor.