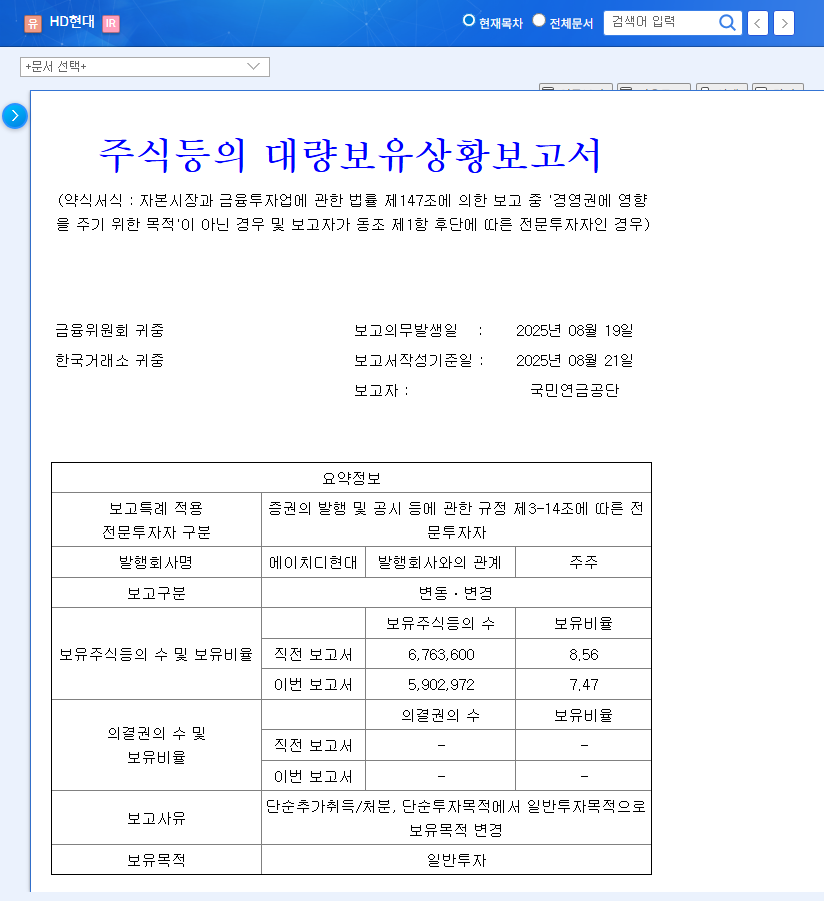

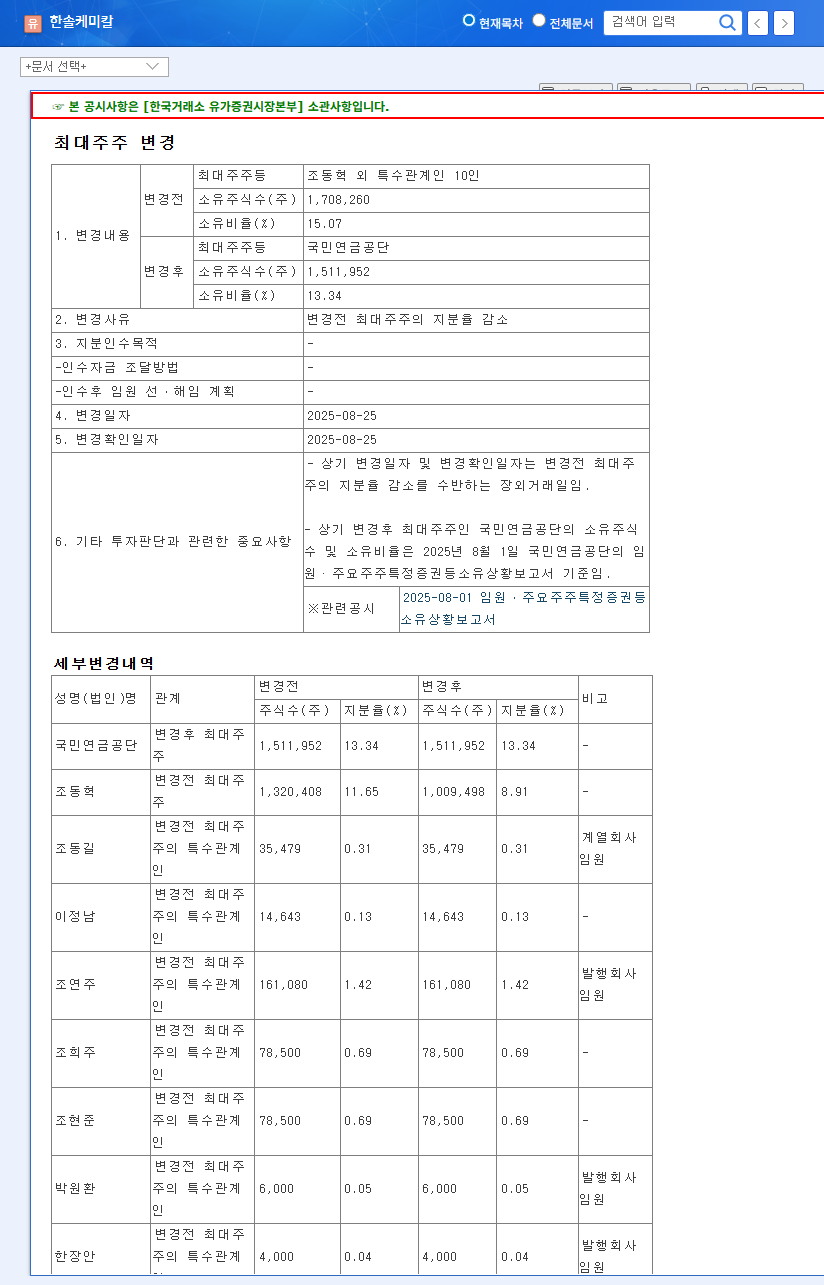

A significant market event has captured the attention of investors: the Eugenetech investment by South Korea’s largest institutional player, the National Pension Service (NPS). According to an Official Disclosure, the NPS has acquired a new 5.01% stake in the semiconductor equipment manufacturer. When a financial titan like the NPS makes a move, it’s more than just a transaction; it’s a powerful signal about a company’s perceived value and future trajectory. This deep-dive analysis will unpack the fundamentals behind the National Pension Service Eugenetech acquisition, explore the potential impacts on Eugenetech’s stock, and outline a prudent strategy for investors looking to understand this pivotal development in the semiconductor equipment sector.

The NPS’s ‘simple investment’ purpose signals strong confidence in Eugenetech’s intrinsic value and long-term growth potential, independent of any desire to influence management.

Deconstructing the NPS’s Eugenetech Investment Thesis

The decision by the National Pension Service to invest heavily in Eugenetech is not arbitrary. It’s a calculated move based on a rigorous evaluation of the company’s financial health, technological edge, and market position. Let’s examine the core pillars that likely support this major Eugenetech investment.

1. Explosive Financial Performance

Eugenetech’s recent earnings report paints a picture of robust health. For the first half of 2025, the company posted sales of KRW 188.078 billion, a 28.6% increase year-over-year. Even more impressive, its operating profit surged by 108.6% to KRW 28.943 billion. This isn’t just growth; it’s a testament to operational efficiency and strong demand within the global semiconductor market, a sector currently being supercharged by advancements in AI and high-performance computing. For more on market trends, industry analysis from authoritative sources like Gartner’s semiconductor reports can provide valuable context.

2. A Fortress-Like Balance Sheet

Beyond stellar profits, Eugenetech boasts a remarkably stable financial structure. With a debt-to-equity ratio of just 17.8%, the company operates with very low financial risk. This stability provides a crucial buffer against industry volatility and empowers the company to pursue aggressive R&D and strategic capital expenditures without being over-leveraged.

3. Commitment to Technological Leadership

Perhaps the most compelling factor is Eugenetech’s forward-looking strategy. The company dedicates a massive 24.1% of its sales to Research & Development. This investment is focused on critical next-generation technologies, including deposition equipment for sub-10nm processes and advanced Atomic Layer Deposition (ALD) systems. ALD is essential for creating the ultra-thin, uniform layers required in modern 3D NAND and DRAM chips, positioning Eugenetech at the heart of future semiconductor manufacturing.

Market Impact and Strategic Outlook

The NPS’s seal of approval is expected to create ripple effects for Eugenetech stock both in the short and long term. In the immediate future, the news serves as a powerful catalyst for positive investor sentiment, potentially driving stock momentum and increasing trading volume as retail and other institutional investors take notice.

Over the mid-to-long term, the benefits become more structural. Having a stable, long-term investor like the NPS enhances corporate credibility, which can attract other funds and even improve terms for future capital raising. This stability allows Eugenetech’s management to focus on its long-term R&D roadmap without being pressured by short-term market noise. For investors interested in this sector, understanding the nuances of evaluating semiconductor equipment stocks is crucial for making informed decisions.

Key Risk Factors to Monitor

Despite the overwhelmingly positive outlook, a prudent investment strategy requires acknowledging potential risks. The following factors should be carefully monitored:

- •Industry Cyclicality: The semiconductor industry is famously cyclical. A global economic downturn could curb demand for electronics, directly impacting equipment orders for Eugenetech.

- •Supply Chain & Raw Materials: As a build-to-order manufacturer, Eugenetech’s profitability can be squeezed by volatility in raw material prices or disruptions in the supply chain.

- •Currency Fluctuations: With over 45% of its sales coming from exports, the company is exposed to foreign exchange risk. A significant appreciation of the Korean Won could negatively impact reported earnings.

Frequently Asked Questions (FAQ)

Why did the National Pension Service (NPS) purchase Eugenetech shares?

The NPS executed this Eugenetech investment based on the company’s strong fundamentals, including high earnings growth, a solid financial structure, significant R&D spending, and a growing international presence. The stake was acquired for ‘simple investment’ purposes, reflecting confidence in its future growth potential.

How might this acquisition affect Eugenetech’s stock price?

In the short term, this news is likely to boost investor sentiment and create positive stock momentum. In the long term, the stable backing of the NPS can enhance corporate credibility and support sustained R&D, contributing to a fundamental increase in corporate value.

What is the long-term investment outlook for Eugenetech?

The long-term outlook is positive, heavily reliant on the company’s ability to execute its R&D roadmap and lead in next-generation technologies. The NPS investment provides a stable foundation for these efforts. Investors should maintain a mid-to-long-term perspective, continually assessing R&D milestones, industry trends, and macroeconomic conditions.