Why Did KB Securities Sell Newkizon Stock? (Event Analysis)

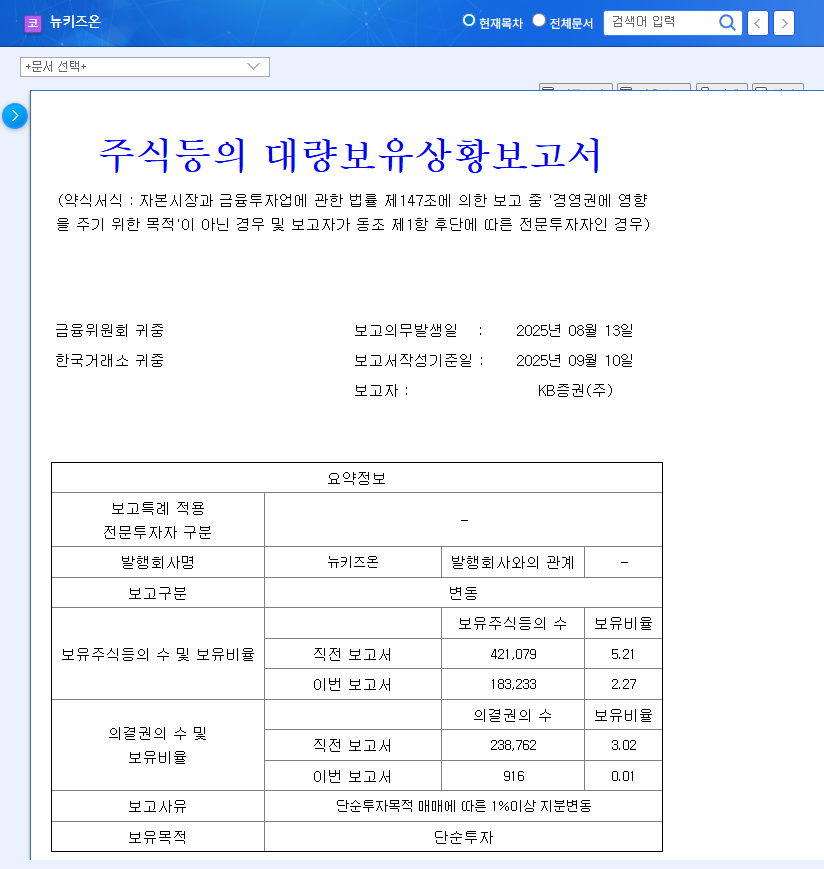

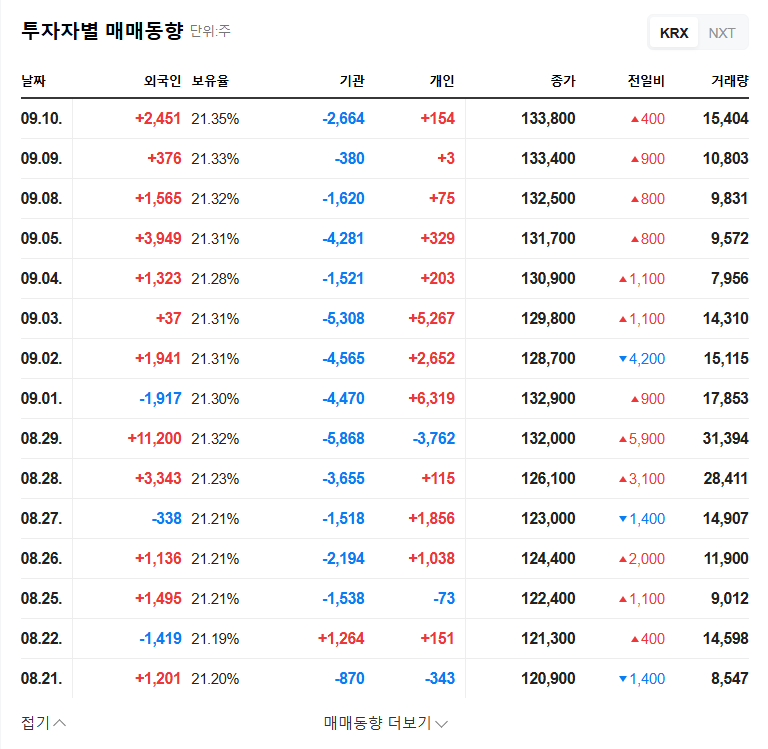

KB Securities reduced its stake in Newkizon from 5.21% to 2.27%, a decrease of 3.04%, due to ‘simple investment purposes.’ The selloff occurred through on-market trades between August 13th and 18th, 2025, with a significant portion, over 180,000 shares, sold on August 13th. This could lead to short-term downward pressure on the stock price.

Is Newkizon’s Financial Health Sound? (Company Analysis)

Newkizon has growth potential, thanks to its diversified brand portfolio and a strong online sales network. While showing steady revenue growth, the company recorded a net loss in the first half of 2025 due to merger costs and increased marketing investments. However, its KOSDAQ listing has eased funding access, and with plans for international expansion, the long-term growth outlook remains positive.

What’s the Outlook for Newkizon’s Stock Price? (Stock Forecast)

In the short term, KB Securities’ selloff and the company’s weak first-half performance could increase stock price volatility. However, in the long term, improvements in fundamentals and success in international expansion could drive stock price appreciation. The current low valuation, with a P/E ratio around 3, might present an attractive investment opportunity.

What Should Investors Do? (Investment Strategy)

- Short-term investors: Proceed with caution, considering the possibility of further price declines.

- Long-term investors: Monitor second-half earnings improvements and international expansion progress, looking for opportunities to buy at a lower price.

Key Points to Watch

- Absorption of KB Securities’ sold shares

- Improvement in second-half 2025 earnings

- Success of international expansion

Frequently Asked Questions (FAQ)

Will KB Securities’ sale of Newkizon shares negatively impact the stock price?

It may create downward pressure in the short term, but it’s not expected to significantly impact long-term fundamentals.

When is a good time to invest in Newkizon?

Short-term investors should proceed with caution, while long-term investors could consider buying at a lower price after observing second-half earnings and international expansion progress.

What is the outlook for Newkizon’s future growth?

Positive growth is expected, considering the company’s diverse brand portfolio, online channel competitiveness, and international expansion plans.