1. What Happened? : Hyundai Steel Q2 2025 Earnings Breakdown

Hyundai Steel reported a net loss of KRW 16.9 billion in Q2 2025, compared to a profit in the same period last year. Revenue decreased by 50.5% year-over-year to KRW 11.5 trillion, while operating profit also fell by 48.3% to KRW 82.7 billion. Rising raw material prices and a weak global steel market were cited as primary factors.

2. Why Did This Happen? : Factors Behind the Poor Performance

- Global economic slowdown and decreased steel demand

- Increased cost burden due to rising raw material prices (iron ore, coking coal) and logistics costs

- Reduced export profitability due to unfavorable exchange rates

3. What’s Next? : Hyundai Steel’s Future Strategy and Outlook

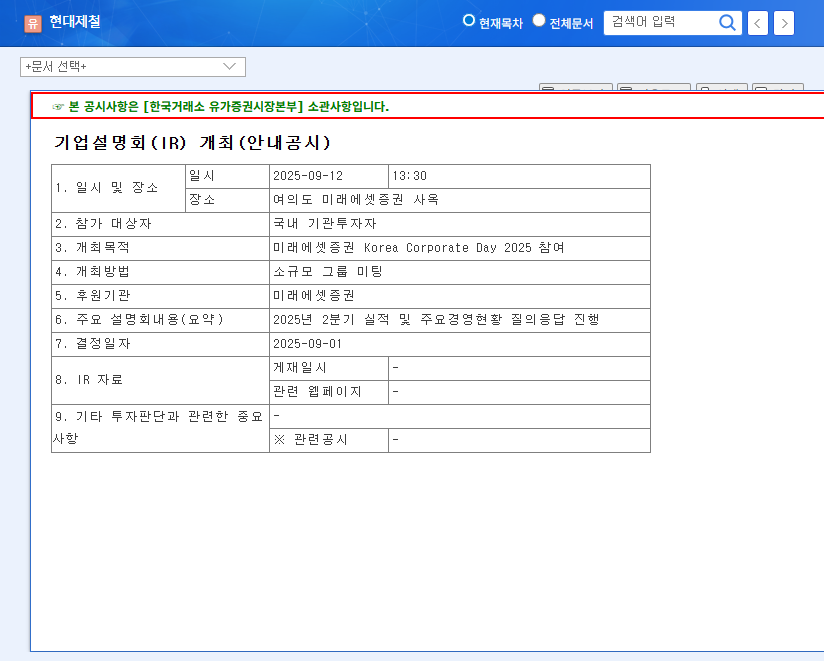

Hyundai Steel outlined its future growth strategy during the earnings call, focusing on the construction of an electric arc furnace in the US, development of low-carbon process technology, diversification of its business portfolio, and strengthening ESG management. If these efforts yield tangible results, long-term growth is expected.

4. What Should Investors Do? : Investment Strategy

The current investment recommendation for Hyundai Steel is ‘Neutral’. Investors should carefully observe the concrete implementation of the plans presented in the earnings call, the recovery of the global steel market, and fluctuations in raw material prices. Caution is advised in the short term due to potential stock price volatility. Long-term investors should monitor the company’s business restructuring efforts and its progress in securing future growth engines.

Frequently Asked Questions (FAQ)

What were Hyundai Steel’s Q2 2025 earnings results?

Hyundai Steel reported a net loss of KRW 16.9 billion, a 50.5% decrease in revenue to KRW 11.5 trillion, and a 48.3% decrease in operating profit to KRW 82.7 billion in Q2 2025.

What were the main reasons for the poor performance?

The main factors contributing to the poor performance were the global economic slowdown, rising raw material prices, and unfavorable exchange rates.

What is the outlook for Hyundai Steel?

Hyundai Steel is focusing on securing future growth engines through investments in an electric arc furnace in the US, low-carbon technologies, and business portfolio diversification. While long-term growth potential exists, the short-term outlook requires careful monitoring of market conditions.