The latest HYUNDAI WIA Q3 2025 earnings report presents a complex and contradictory picture for investors. While the company delivered impressive top-line growth, with both revenue and operating profit handily beating market expectations, a significant and unexpected plunge into a net income loss has sent shockwaves through the investment community. This stark contrast between operational strength and bottom-line weakness demands a thorough investigation.

What caused this financial paradox? Are the underlying fundamentals of Hyundai WIA strong, or does the net loss signal deeper, more systemic risks? This comprehensive Hyundai WIA earnings analysis will break down the Q3 2025 results, explore the contributing factors, and provide a strategic outlook for investors navigating this uncertainty.

Deconstructing the HYUNDAI WIA Q3 2025 Earnings Report

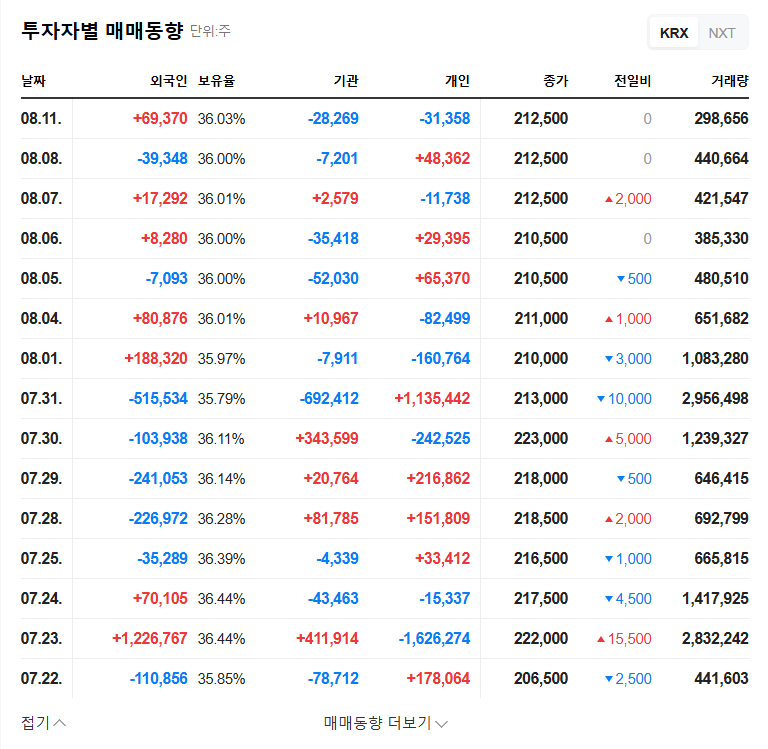

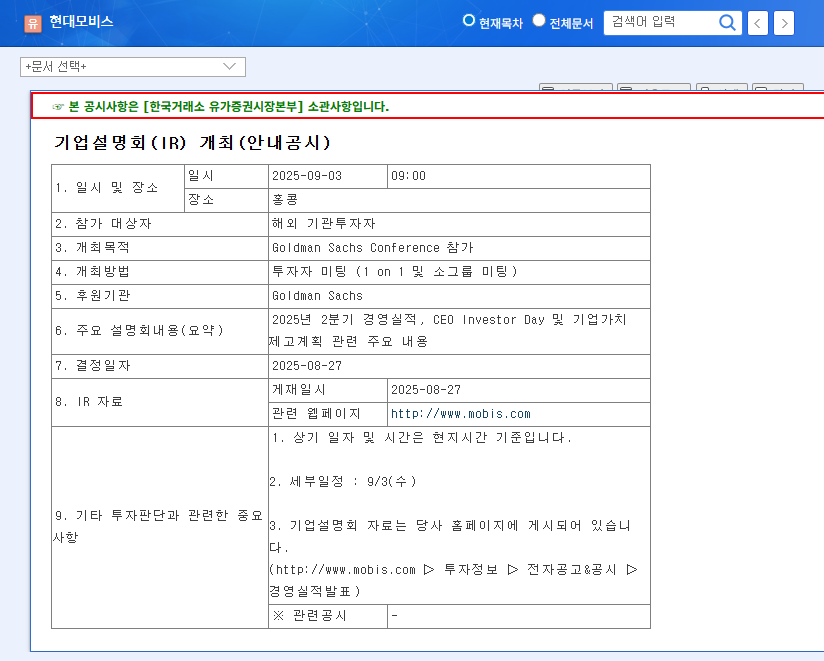

On the surface, Hyundai WIA demonstrated robust business activity. The official consolidated financial statements, which can be viewed in the company’s Official Disclosure, revealed figures that initially appeared positive. Let’s examine the key metrics against market consensus:

- •Revenue: KRW 2,151.9 billion, a solid 3.87% above analyst estimates.

- •Operating Profit: KRW 51.8 billion, a remarkable 25.42% above estimates, signaling strong operational efficiency.

- •Net Income: KRW -16.3 billion, a shocking reversal from an expected profit of KRW 86.2 billion, resulting in a -118.91% miss and a transition to loss.

The core challenge of the HYUNDAI WIA Q3 2025 earnings is deciphering how a company with surging revenue and excellent operational control could end up with a substantial net loss. The answer lies beyond the core business operations.

Analyzing the Discrepancy: The Good, The Bad, and The Ugly

The Good: Factors Driving Revenue & Operating Profit

The positive performance was not accidental. It was fueled by strong execution in key divisions. The Mobility segment, which includes core automotive components, performed well. More notably, the Special Business segment, heavily focused on defense products, saw a significant boost from increased global defense spending and successful export contracts. This diversification helped drive Hyundai WIA revenue beyond forecasts. Furthermore, the impressive operating profit margin suggests that the company’s internal cost management and efficiency initiatives are paying off, allowing it to translate higher sales into greater operational earnings.

The Bad: Pinpointing the Net Income Loss

The Hyundai WIA net income loss is the central mystery. Since operating profit was strong, the cause must be found in non-operating items—expenses and losses that occur outside the primary business activities. The most likely culprits include:

- •One-Off Costs: The company may have incurred significant, non-recurring charges such as asset write-downs, restructuring costs, or legal settlements.

- •Financial Expenses: Higher interest rates or losses from foreign currency exchange fluctuations could have heavily impacted the bottom line.

- •Losses from Subsidiaries: Poor performance or impairment charges related to affiliated companies, particularly the ongoing uncertainty in Russian operations, could have led to significant equity-method losses.

Future Outlook & Investor Strategy

The Hyundai WIA stock outlook is now at a crossroads. The market’s reaction will depend heavily on the company’s ability to clarify the nature of the net loss. If it is truly a one-time event, the strong underlying business performance could pave the way for a recovery. However, if it signals persistent issues, investor confidence may erode.

Long-Term Growth Drivers Remain Intact

Despite the quarterly setback, Hyundai WIA’s long-term strategy is focused on high-growth areas. The company is making significant investments in the future of mobility. Key initiatives include:

- •Electrification Components: Development and mass production of integrated coolant modules and e-axles for electric vehicles (EVs). The EV market continues to expand globally, as noted by industry experts at leading market research firms.

- •Advanced Manufacturing: Entering the market for EV component manufacturing equipment, positioning itself as a key supplier in the electrification supply chain.

- •Urban Air Mobility (UAM): Expanding into the nascent but potentially lucrative air mobility sector, showcasing a forward-thinking approach to transportation. More on this can be found in our article on Investing in Future Mobility Trends.

Key Considerations for Investors

Moving forward, investors should demand clarity. The company must transparently explain the specific causes of the Q3 net loss and outline concrete measures to prevent recurrence. A clear roadmap for improving profitability in the core mobility segment and managing geopolitical risks associated with its Russian operations is essential. While the long-term vision is promising, consistent execution and profitability in the present are non-negotiable for rebuilding market trust. The full HYUNDAI WIA Q3 2025 earnings report, though jarring, serves as a critical reminder that operational success must always be validated by a healthy bottom line.