Raontec Selected for 4K LEDoS National Project: What Does it Mean?

Raontec has been selected to lead the national project for ‘4K High-Resolution LEDoS Panel Development’ by the Ministry of Trade, Industry and Energy. They will receive 4.04 billion won in government funding for the 42-month research project, collaborating with prestigious institutions like Hanyang University. This recognition validates Raontec’s technological prowess.

Why is 4K LEDoS Important?

The key to immersive XR experiences lies in high-resolution displays. 4K LEDoS offers superior clarity and brightness compared to existing technologies, positioning it as a crucial catalyst for the mass adoption of next-generation XR devices like AR glasses.

National Project Selection: What’s Next for Raontec?

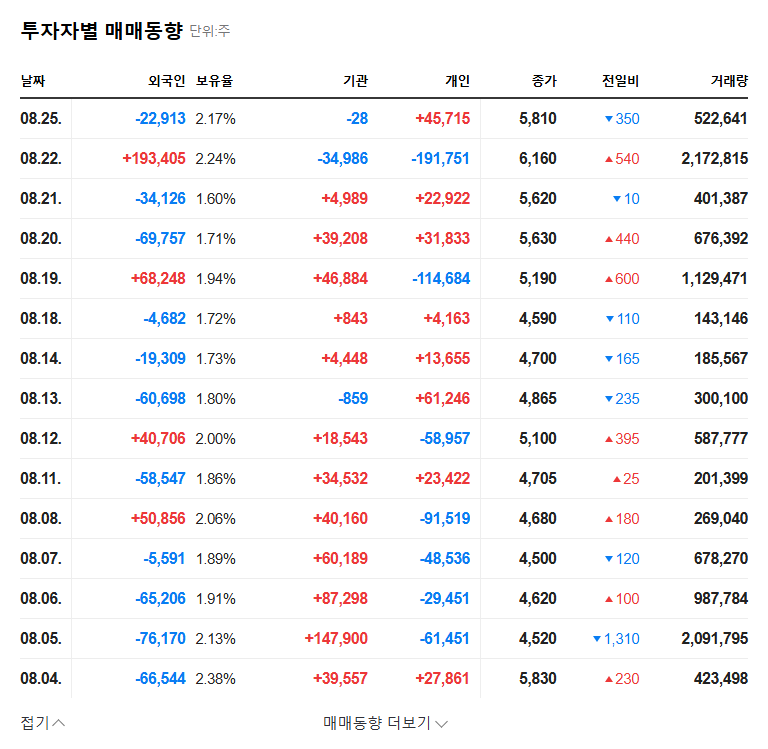

- Short-term: The project selection can act as a momentum for stock price increase. Securing R&D funding also alleviates financial burdens and accelerates development.

- Long-term: Acquiring 4K LEDoS technology strengthens competitiveness in the XR market and opens doors to new business ventures. Contributing to the AR device ecosystem can ultimately lead to increased sales and profitability.

Action Plan for Investors

- Positive aspects: XR market growth, enhanced technological competitiveness

- Points of caution: Uncertainties in technology development, financial risks

- Key checkpoints: Progress of technology development, changes in the competitive landscape

Frequently Asked Questions

What is LEDoS?

LEDoS (LED on Silicon) is a technology that integrates micro LEDs onto a silicon wafer. It offers higher brightness, resolution, and energy efficiency compared to existing displays, making it a promising next-generation display technology.

What does this national project selection mean for Raontec?

By securing the 4K high-resolution LEDoS panel development technology, Raontec can strengthen its competitiveness in the XR market and secure future growth engines. Government funding is also expected to alleviate financial burdens and accelerate technology development.

What are the key points to consider when investing?

Investors should consider risk factors such as uncertainties in technology development, the long development period, and intensifying market competition. It’s crucial to make investment decisions based on a comprehensive assessment of the company’s financial status and the XR market outlook.