1. DN Automotive IR: What Happened?

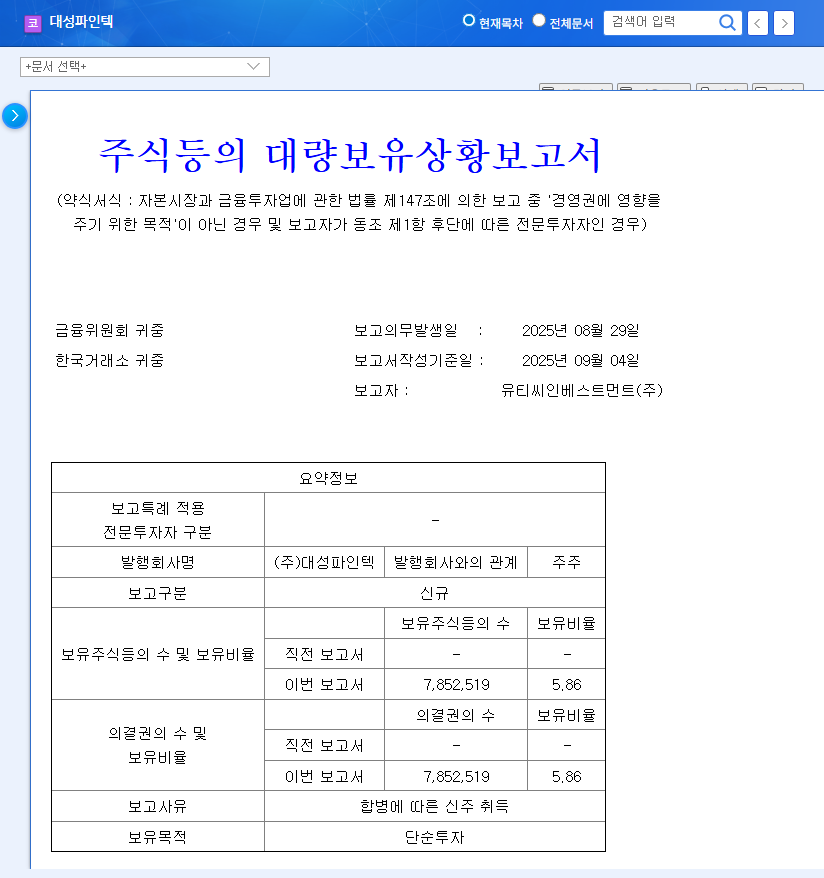

DN Automotive announced its H1 2025 earnings and future business strategies at its IR meeting on September 15, 2025. The key focus was on the restructuring results following the merger with Dong-A Tire and the transition to a holding company structure, as well as future growth drivers.

2. Why Does It Matter?

This IR serves as a crucial indicator for assessing DN Automotive’s mid- to long-term growth potential. Investors paid particular attention to the following key aspects:

- Merger Synergies: Actual improvements in business efficiency after the merger with Dong-A Tire

- Post-Restructuring Strategy: Specific business portfolio and growth strategies following the transition to a holding company structure

- Machine Tool Growth Potential: Future growth potential of the globally competitive machine tool division

- Global Market Expansion: Current status and future plans for global market entry

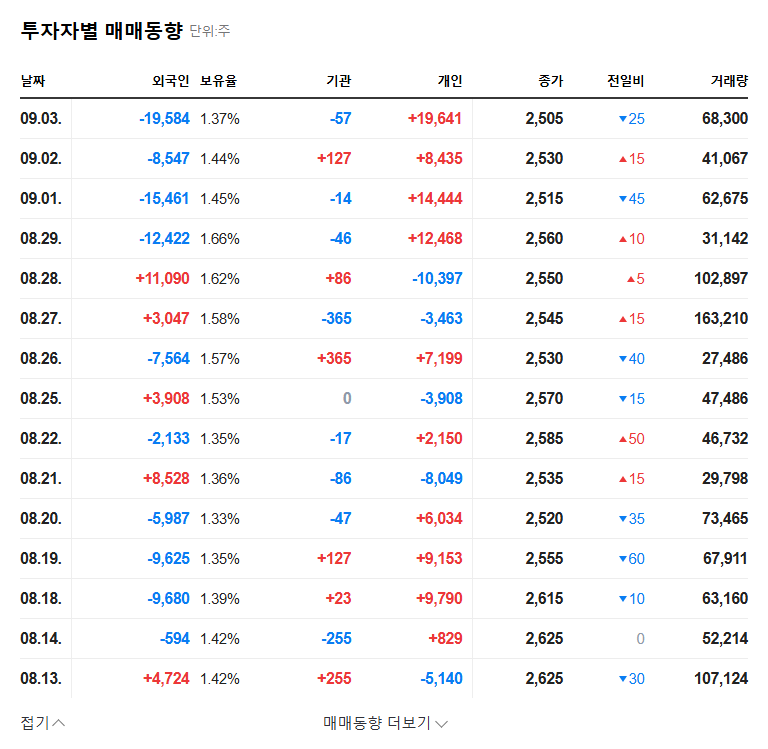

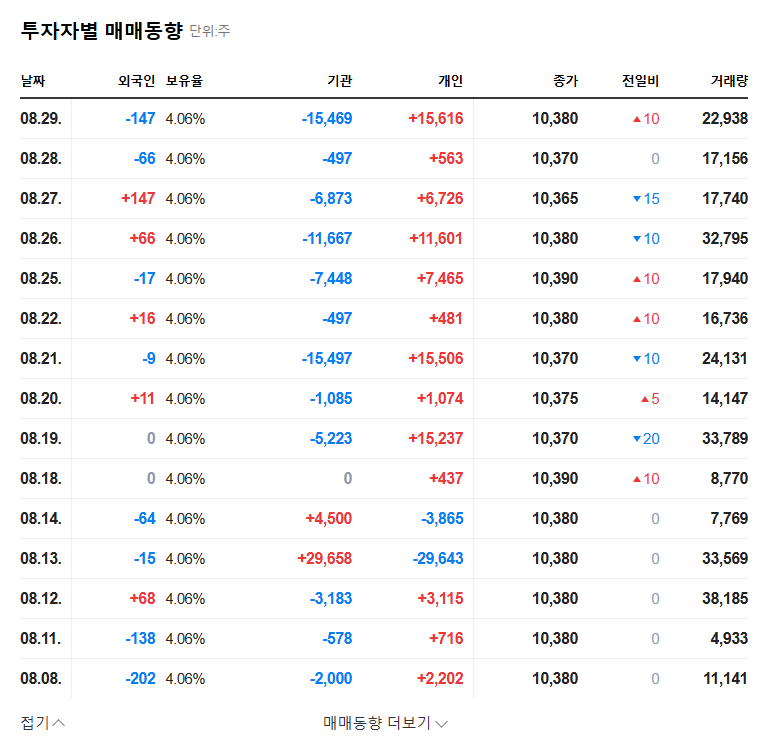

3. So What? – Investment Outlook

The stock price is expected to be significantly influenced by the content of the IR presentation. Positive results and growth strategies exceeding market expectations could act as a catalyst for stock price appreciation. Conversely, sluggish performance or increased uncertainty could lead to a decline in stock price. It’s important to note that macroeconomic factors, such as fluctuations in raw material prices, interest rates, and exchange rates, can also impact the stock price.

4. Investor Action Plan

Investors should thoroughly analyze the IR materials and make investment decisions by comprehensively considering the management’s responses and market reactions. It is crucial to assess the long-term growth potential and risk factors in a balanced manner, rather than being swayed by short-term stock price fluctuations. Focusing on the growth potential of the machine tool division and the global market expansion strategy will be key to identifying investment opportunities. Prudent investment decisions should be made by referring to market analysis and expert opinions after the IR meeting.

FAQ

What are DN Automotive’s main businesses?

DN Automotive manufactures auto parts, machine tools, and inner tubes for tires. They are particularly competitive globally in the machine tool sector.

What were the key takeaways from this IR?

The key takeaways were the announcement of the H1 2025 earnings, and the company’s performance and future growth strategies following the merger with Dong-A Tire and the transition to a holding company.

What should investors be aware of?

Investors should consider macroeconomic factors such as raw material price and exchange rate fluctuations, the potential for a global economic slowdown, the company’s performance relative to market expectations, and the feasibility of their future strategies.