1. What’s Happening with Interojo’s Rights Offering?

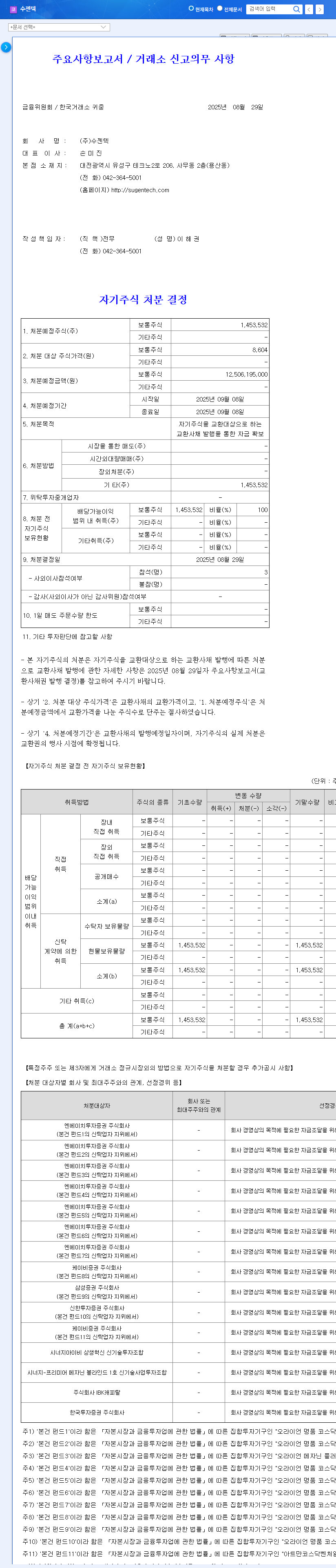

Interojo announced a rights offering on September 23, 2025. They will issue 1,493,428 new shares at ₩20,088 per share, representing a 12% increase. The main investor is Stick Prism Co., Ltd., and the payment date is October 1, 2025.

2. Why the Rights Offering?

Interojo plans to use the funds from this rights offering to expand production capacity, increase R&D investment, explore overseas markets, and secure future growth engines. They also anticipate improvements in their financial structure.

3. Rights Offering: Opportunity or Risk?

3.1 Positive Impacts

- Improved Financial Structure and Investment Resources

- Enhanced Growth Potential

- Increased Market Confidence

3.2 Negative Impacts (Short-term)

- Concerns about Share Dilution

- Burden of Participation for Existing Shareholders

- Uncertainty Regarding Fund Utilization Plans

4. What Investment Strategies Should Be Considered?

4.1 Short-term Investment Strategies

- Observation and Information Gathering

- Stock Price Impact Analysis

4.2 Mid- to Long-term Investment Strategies

- Monitoring the Execution of Growth Strategies

- Checking for Improvements in Financial Health

- Monitoring Fundamental Improvements and Market Environment Changes

FAQ

What is the purpose of Interojo’s rights offering?

To secure investment resources for expanding production capacity, increasing R&D investment, exploring overseas markets, and securing future growth engines, as well as improving the financial structure.

How will the rights offering affect the stock price?

In the short term, there is a possibility of share dilution due to the increase in the number of shares. However, in the long term, stock price increases can be expected depending on the company’s growth.

What should investors be aware of?

It is important to make investment decisions by comprehensively considering the company’s plans for utilizing the rights offering funds, market conditions, and the company’s fundamentals.