SBI Investment Divests Neurophet Shares – What Happened?

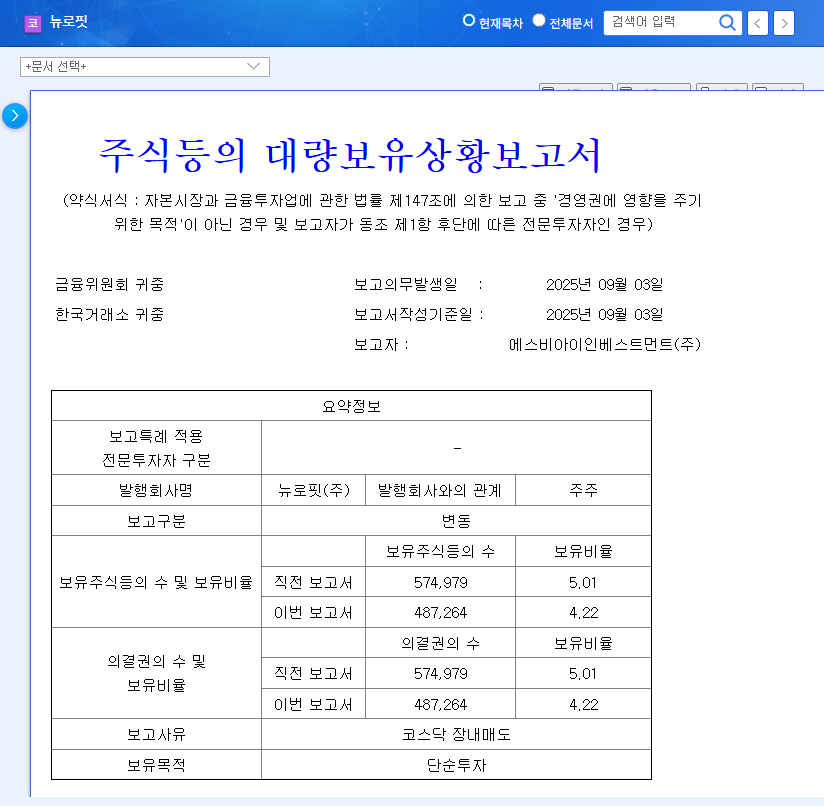

SBI Investment sold 93,715 shares of Neurophet on September 4, 2025, reducing its stake from 5.01% to 4.22%. The reason for the sale was stated as ‘KOSDAQ market sale,’ and it was carried out through the 2019 SBI Job Creation Fund, 2020 SBI Scale-up Fund, and SBI-KIS 2019 BIC Investment Association.

Why is the SBI Divestment Important? – Analyzing the Hidden Meaning

As a venture capital (VC) firm, SBI Investment’s primary goal is to recoup its investments. Therefore, this divestment is likely part of an investment recovery strategy rather than a negative assessment of Neurophet’s growth potential. However, the sale of shares by a major shareholder in the early stages of listing can negatively impact investor sentiment. Short-term downward pressure on the stock price seems inevitable.

So, What Happens to Neurophet? – Analyzing Fundamentals and Growth Potential

- Strengths: Neurophet has secured unique technology and a high market share in the brain image analysis software market. Notably, ‘Neurophet AQUA’ holds a monopoly in the domestic multiple sclerosis analysis market, and ‘Neurophet SCALE PET’ accounts for about 40% of the domestic PET image analysis software market.

- Opportunities: The medical AI market is expected to show high growth rates due to the aging population and the growth of the digital healthcare market. Neurophet is accelerating its entry into the global market in line with these market trends.

- Weaknesses: As of the first half of 2025, Neurophet recorded operating losses and net losses due to high R&D expenses. Improvement in financial structure is necessary.

- Threats: As a newly listed company, Neurophet’s stock price is highly volatile, and the SBI Investment’s divestment may cause a short-term drop in stock price.

What Should Investors Do? – Suggesting an Action Plan

- Short-term investors: Invest cautiously considering the possibility of a short-term stock price decline.

- Long-term investors: If you focus on Neurophet’s long-term growth potential, you can use the stock price drop as a buying opportunity. However, it is necessary to continuously monitor factors such as earnings improvement trends, new technology development, and global market entry performance.

Frequently Asked Questions (FAQ)

Is SBI’s divestment of Neurophet shares a negative sign for Neurophet’s future?

Since SBI’s main purpose as a venture capital firm is to recoup its investments, this sale is unlikely to be interpreted as a negative judgment on Neurophet’s future. It can be seen as a strategy to secure funds for the next stage of investment after recovering the initial investment.

Is it okay to invest in Neurophet?

Neurophet possesses excellent technology in the field of brain disease AI solutions and has high growth potential. However, since it is a newly listed company, investment involves risks, so sufficient analysis and information gathering are required before making investment decisions.

What is the outlook for Neurophet’s stock price?

In the short term, stock price volatility may increase due to SBI’s divestment, but in the long term, Neurophet’s growth is expected along with the growth of the brain disease AI solution market.